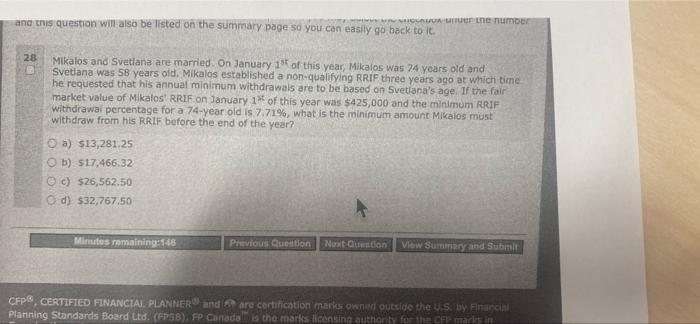

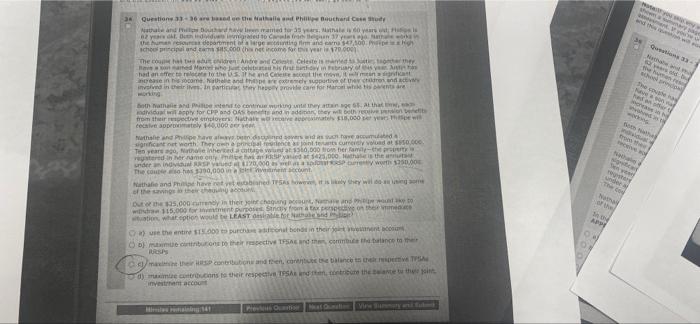

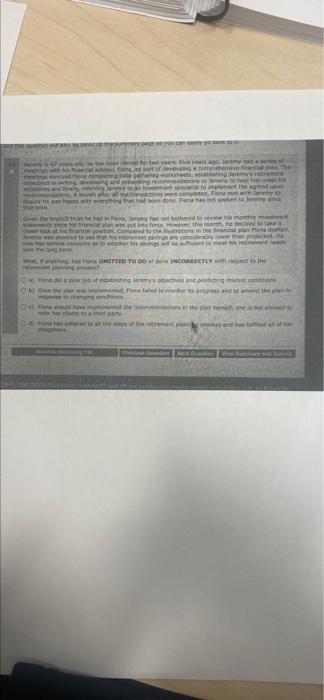

SHOCAUUA under the number and this question will also be listed on the summary page so you can easily go back to it. 28 Mikalos and Svetlana are married. On January 15 of this year, Mikalos was 74 years old and Svetlana was 58 years old. Mikalos established a non-qualifying RRIF three years ago at which time he requested that his annual minimum withdrawals are to be based on Svetlana's age. If the fair market value of Mikalos RRIF on January 1st of this year was $425,000 and the minimum RRIF withdrawal percentage for a 74-year old is 7.71%, what is the minimum amount Mikalos must withdraw from his RRIF before the end of the year? a) $13,281.25 Ob) $17,466.32 c) $26,562.50 Od) $32,767.50 Minutes remaining:148 Previous Question Next Question View Summary and Submit CFP, CERTIFIED FINANCIAL PLANNER and are certification marks owned outside the U.S. by Financial Planning Standards Board Ltd. (FPS8), FP Canada is the marks licensing authority for the CFP marks in Questions 33-36 are based on the Nathalle and Phillipe Bouchard Case Study Nathale and Philips Bouchard have live wamed for 35 years, Nathale is 60 years to s 82 years d individue inmigrated to Canade from Belgiun 37 years ago the human resources department of counting firm and $47,100. Pipe in High school principal and cams $15.000 (his net income for this year 170,000) the workin The coup has two edut idren Andre and Cell Celeste Bave Marcel who just celebrate his first they iting ton Febrisary of the year had an offer e relocate to the US. It he and Celeste accept the move, it mean increase in his socame, Nathalie and thope are extremely supportive of the children involved in their lives. In particuas they heppily provide care for Maron while his parents are Both Nathalie and Philipe intend to continue working until they attain age 65. At that time, e individual will apply for CPP and OAS benefits and in addition, they will both receive persone from their respective sinplovers: Nathale w receive approximately $18,000 per year he wil cecaive approximately $40,000 Nathalie and Philipe have always been displined sovers wid as such have accumulated i significant net worth. They own vestered in her name only mite has an under an individual SP cipal reorience as joint tenants currently valued at $950,000. Ten years ago, Nathalie inherited a cottage wurd $380,000 from her family-the propert yased $425,000 Nath 170,000 as well as a solo currently worth $250,000 The couple also hes $390,000 in avement account. Nathalie and Philipe have ret vet estabaned TPSAS however, it is likely they will do as using some of the savings their chauung accu LOU $25,000 currently in their joint chaquing account, Namare and Philipe would ake to spective wdra 115,000 for vestment purposes, Strictly from tuation, whiteption would be LEAST desirable for Nathabend their c Cause the entire $15,000 to purchase addicional bonds in their joint vestment accoun b) maxime contributions to their respective TFSA and then, commbute the balance to their BRSPS maxiine their contribution and then, contribute the balance to their respective T d) maximize contributions to their respective TPSA and then, tontribute the balance to the joint investment account Miss Pemaining 141 Previous Quation to View Summary and fubord Not you swy shown a and this wi mary page Questions 33 Nthabe and a 2 years old b the human res school pr The couste ay Nave hed an offer to crease in he working ved in foth athe individual to the p ve o Nathalo sigstcar en weer under a shers Nathai APPE ON The feed for bed years Five years ago, Jeremy nada senes antial as one part of devel comprehensive francial pan. The heeg worksheets, tablet Jeremy tto ampiament maleted, fene whe cons thappy with everything that had been done. Fena trust he han Pena, Jeremy has not bothered to review his monthly ided to take ustrations in the financial plas Plane drahe, position whether his savings will be sufficient to meet he retirer Wh, if anything has one OMITTED TO Do ar don INCORRECTLY with the ng pro aan die a pear 300 of establishing Jeremy's objectives and predicting market conditions On Our Forfatter i agress and then Os should respendations in the perse, the on has ach the trement pags and a bed of ser BORD i HAAPARE SHOCAUUA under the number and this question will also be listed on the summary page so you can easily go back to it. 28 Mikalos and Svetlana are married. On January 15 of this year, Mikalos was 74 years old and Svetlana was 58 years old. Mikalos established a non-qualifying RRIF three years ago at which time he requested that his annual minimum withdrawals are to be based on Svetlana's age. If the fair market value of Mikalos RRIF on January 1st of this year was $425,000 and the minimum RRIF withdrawal percentage for a 74-year old is 7.71%, what is the minimum amount Mikalos must withdraw from his RRIF before the end of the year? a) $13,281.25 Ob) $17,466.32 c) $26,562.50 Od) $32,767.50 Minutes remaining:148 Previous Question Next Question View Summary and Submit CFP, CERTIFIED FINANCIAL PLANNER and are certification marks owned outside the U.S. by Financial Planning Standards Board Ltd. (FPS8), FP Canada is the marks licensing authority for the CFP marks in Questions 33-36 are based on the Nathalle and Phillipe Bouchard Case Study Nathale and Philips Bouchard have live wamed for 35 years, Nathale is 60 years to s 82 years d individue inmigrated to Canade from Belgiun 37 years ago the human resources department of counting firm and $47,100. Pipe in High school principal and cams $15.000 (his net income for this year 170,000) the workin The coup has two edut idren Andre and Cell Celeste Bave Marcel who just celebrate his first they iting ton Febrisary of the year had an offer e relocate to the US. It he and Celeste accept the move, it mean increase in his socame, Nathalie and thope are extremely supportive of the children involved in their lives. In particuas they heppily provide care for Maron while his parents are Both Nathalie and Philipe intend to continue working until they attain age 65. At that time, e individual will apply for CPP and OAS benefits and in addition, they will both receive persone from their respective sinplovers: Nathale w receive approximately $18,000 per year he wil cecaive approximately $40,000 Nathalie and Philipe have always been displined sovers wid as such have accumulated i significant net worth. They own vestered in her name only mite has an under an individual SP cipal reorience as joint tenants currently valued at $950,000. Ten years ago, Nathalie inherited a cottage wurd $380,000 from her family-the propert yased $425,000 Nath 170,000 as well as a solo currently worth $250,000 The couple also hes $390,000 in avement account. Nathalie and Philipe have ret vet estabaned TPSAS however, it is likely they will do as using some of the savings their chauung accu LOU $25,000 currently in their joint chaquing account, Namare and Philipe would ake to spective wdra 115,000 for vestment purposes, Strictly from tuation, whiteption would be LEAST desirable for Nathabend their c Cause the entire $15,000 to purchase addicional bonds in their joint vestment accoun b) maxime contributions to their respective TFSA and then, commbute the balance to their BRSPS maxiine their contribution and then, contribute the balance to their respective T d) maximize contributions to their respective TPSA and then, tontribute the balance to the joint investment account Miss Pemaining 141 Previous Quation to View Summary and fubord Not you swy shown a and this wi mary page Questions 33 Nthabe and a 2 years old b the human res school pr The couste ay Nave hed an offer to crease in he working ved in foth athe individual to the p ve o Nathalo sigstcar en weer under a shers Nathai APPE ON The feed for bed years Five years ago, Jeremy nada senes antial as one part of devel comprehensive francial pan. The heeg worksheets, tablet Jeremy tto ampiament maleted, fene whe cons thappy with everything that had been done. Fena trust he han Pena, Jeremy has not bothered to review his monthly ided to take ustrations in the financial plas Plane drahe, position whether his savings will be sufficient to meet he retirer Wh, if anything has one OMITTED TO Do ar don INCORRECTLY with the ng pro aan die a pear 300 of establishing Jeremy's objectives and predicting market conditions On Our Forfatter i agress and then Os should respendations in the perse, the on has ach the trement pags and a bed of ser BORD i HAAPARE