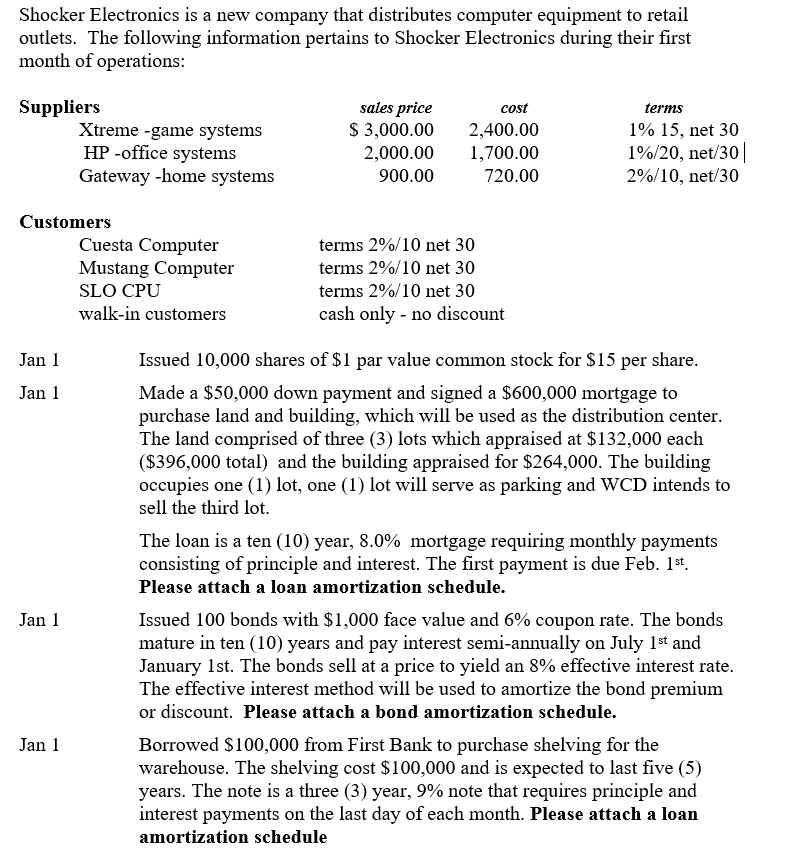

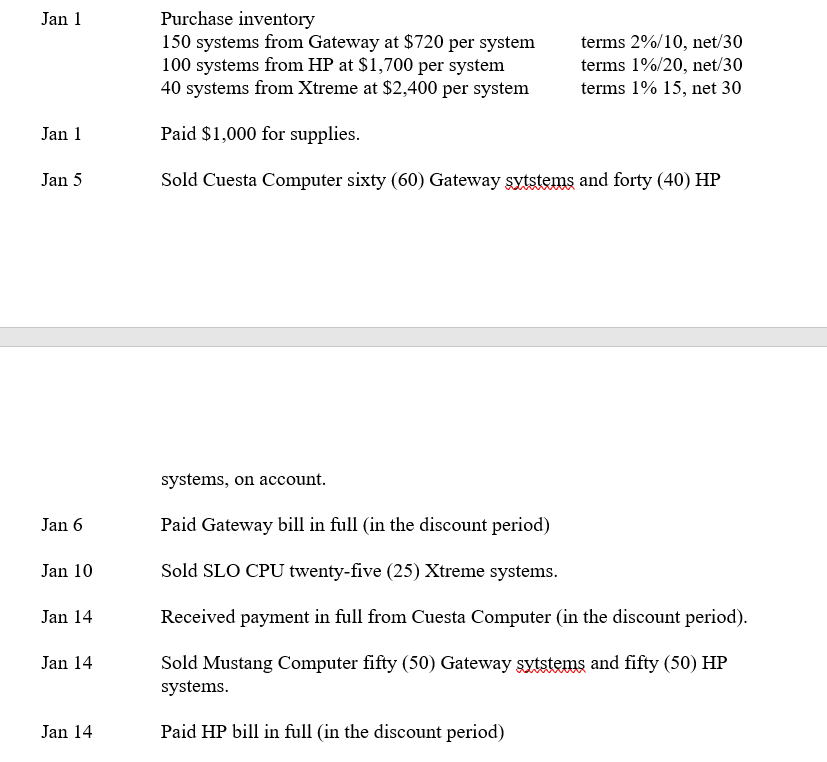

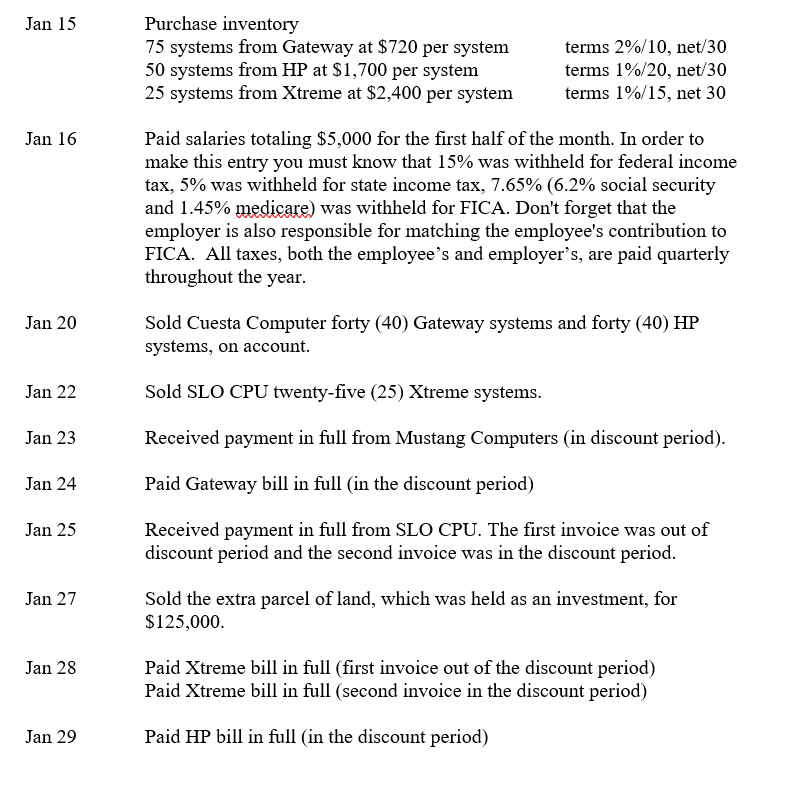

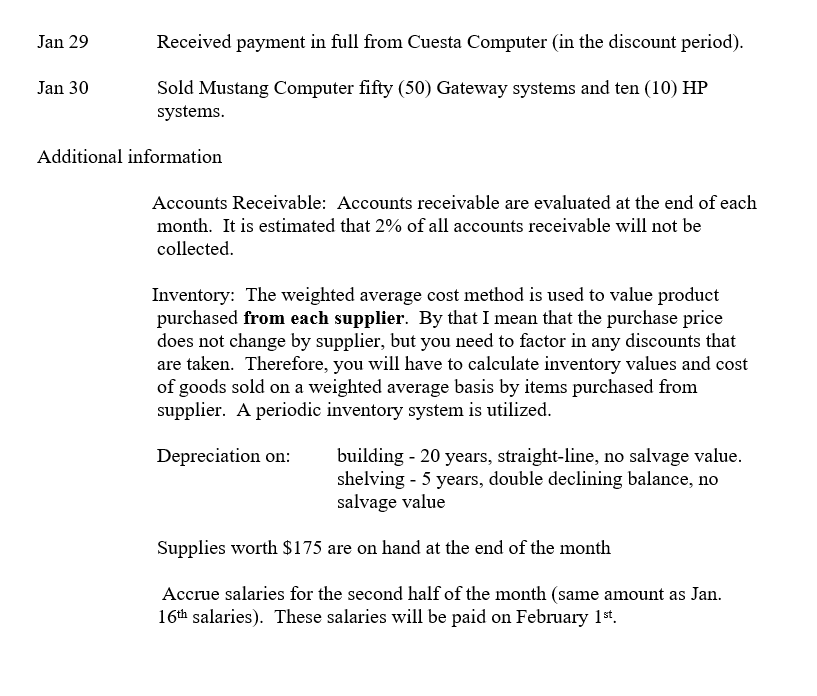

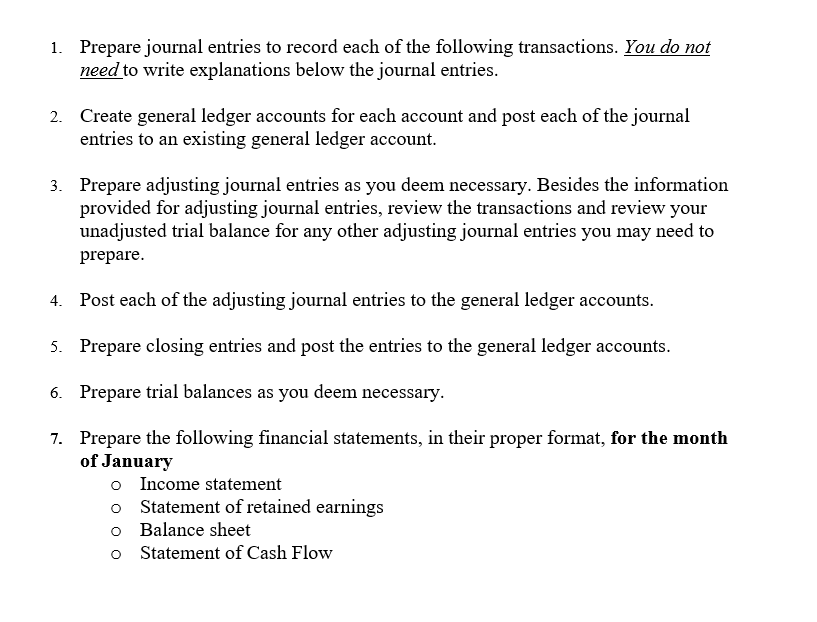

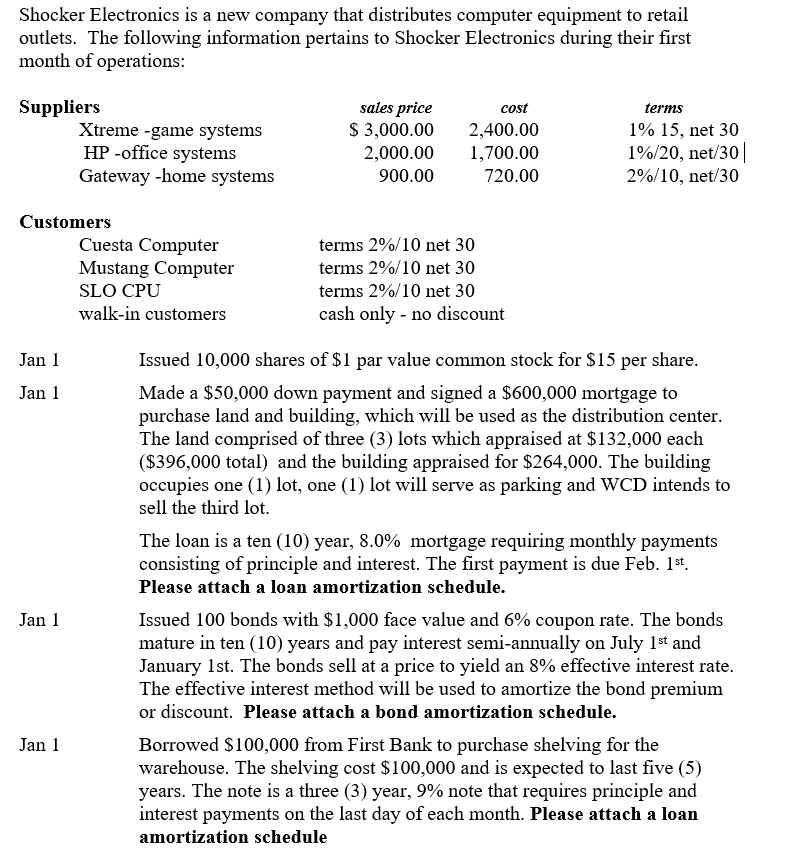

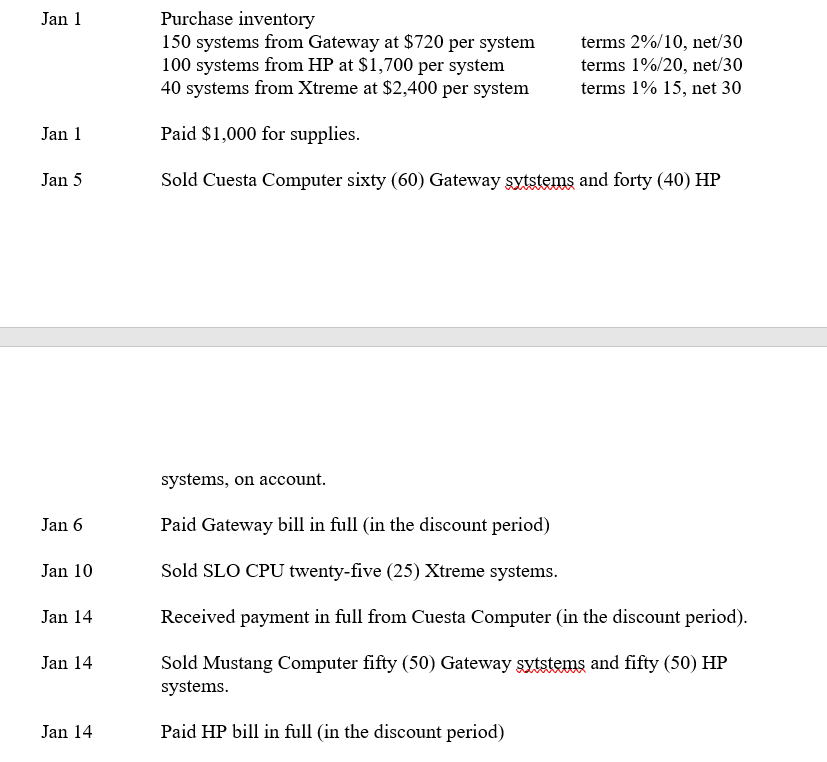

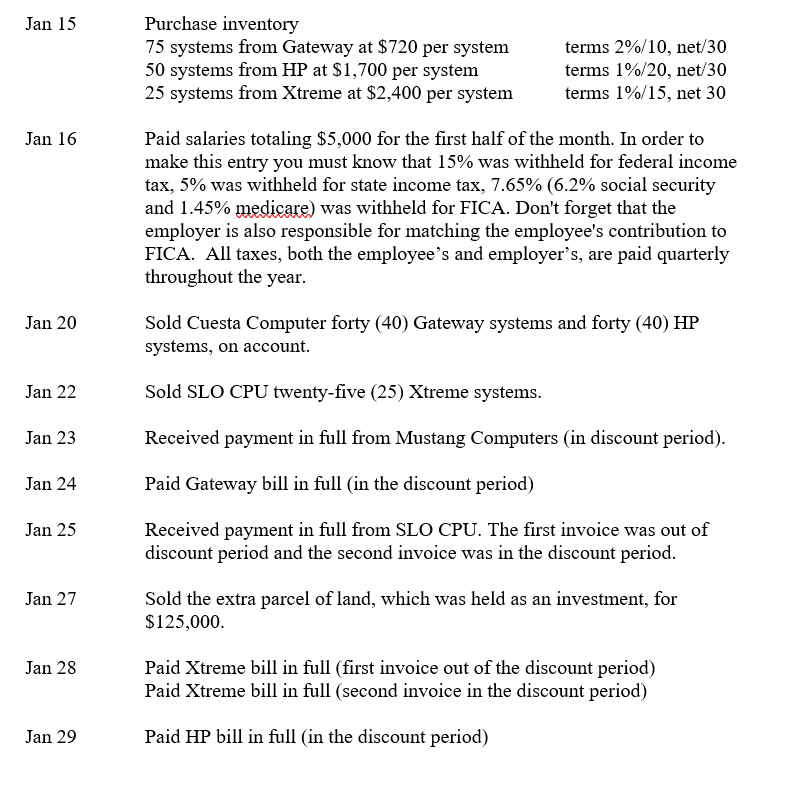

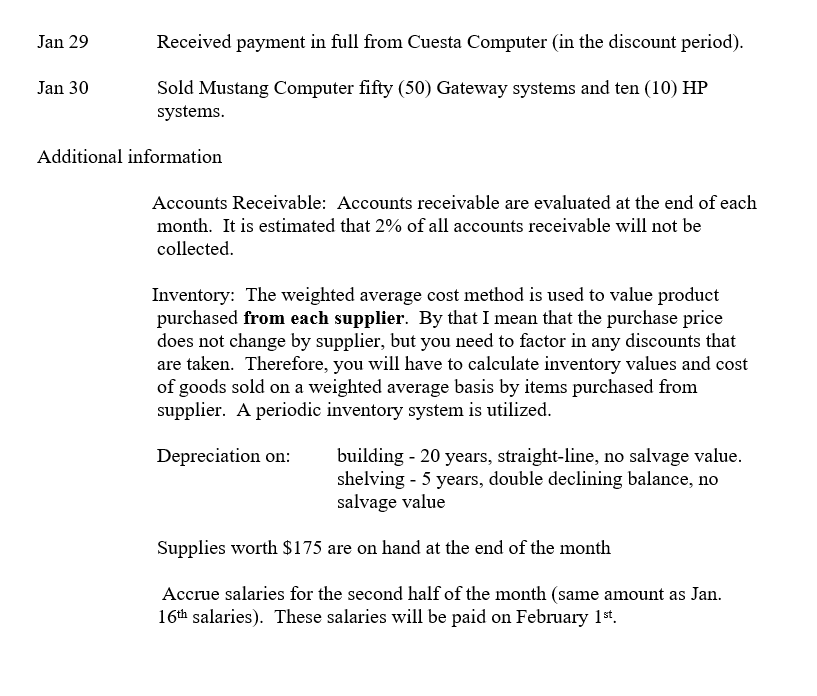

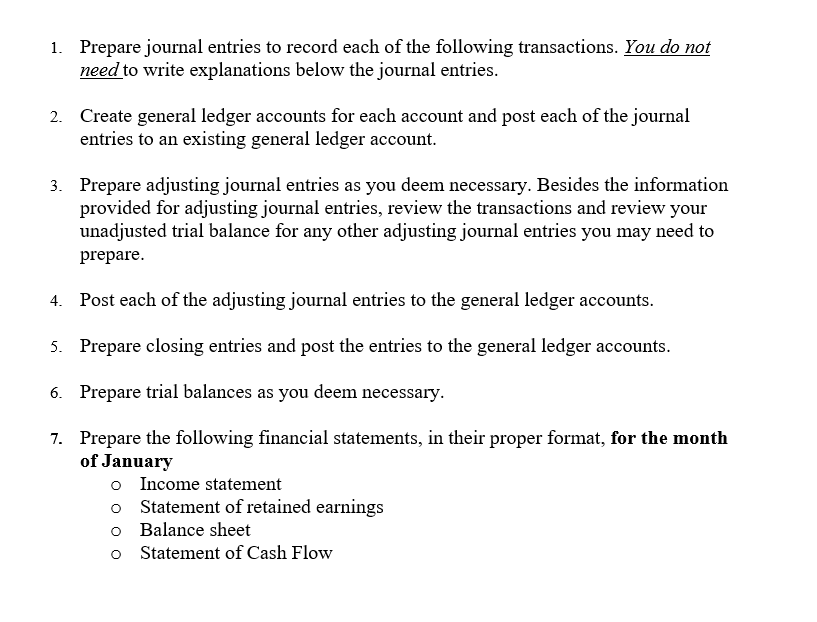

Shocker Electronics is a new company that distributes computer equipment to retail outlets. The following information pertains to Shocker Electronics during their first month of operations: Jan 1 Issued 10,000 shares of $1 par value common stock for $15 per share. Jan 1 Made a $50,000 down payment and signed a $600,000 mortgage to purchase land and building, which will be used as the distribution center. The land comprised of three (3) lots which appraised at $132,000 each ( $396,000 total) and the building appraised for $264,000. The building occupies one (1) lot, one (1) lot will serve as parking and WCD intends to sell the third lot. The loan is a ten (10) year, 8.0% mortgage requiring monthly payments consisting of principle and interest. The first payment is due Feb. 1st.. Please attach a loan amortization schedule. Jan 1 Issued 100 bonds with $1,000 face value and 6% coupon rate. The bonds mature in ten (10) years and pay interest semi-annually on July 1st and January 1st. The bonds sell at a price to yield an 8% effective interest rate. The effective interest method will be used to amortize the bond premium or discount. Please attach a bond amortization schedule. Jan 1 Borrowed $100,000 from First Bank to purchase shelving for the warehouse. The shelving cost $100,000 and is expected to last five (5) years. The note is a three (3) year, 9% note that requires principle and interest payments on the last day of each month. Please attach a loan amortization schedule systems, on account. Jan 6 Paid Gateway bill in full (in the discount period) Jan 10 Sold SLO CPU twenty-five (25) Xtreme systems. Jan 14 Received payment in full from Cuesta Computer (in the discount period). Jan 14 Sold Mustang Computer fifty (50) Gateway sytstems and fifty (50) HP systems. Jan 14 Paid HP bill in full (in the discount period) ] Paid salaries totaling $5,000 for the first half of the month. In order to make this entry you must know that 15% was withheld for federal income tax, 5% was withheld for state income tax, 7.65%(6.2% social security and 1.45% medicare) was withheld for FICA. Don't forget that the employer is also responsible for matching the employee's contribution to FICA. All taxes, both the employee's and employer's, are paid quarterly throughout the year. Sold Cuesta Computer forty (40) Gateway systems and forty (40) HP systems, on account. Sold SLO CPU twenty-five (25) Xtreme systems. Received payment in full from Mustang Computers (in discount period). Paid Gateway bill in full (in the discount period) Received payment in full from SLO CPU. The first invoice was out of discount period and the second invoice was in the discount period. Sold the extra parcel of land, which was held as an investment, for $125,000. Paid Xtreme bill in full (first invoice out of the discount period) Paid Xtreme bill in full (second invoice in the discount period) Paid HP bill in full (in the discount period) Jan 29 Received payment in full from Cuesta Computer (in the discount period). Jan 30 Sold Mustang Computer fifty (50) Gateway systems and ten (10) HP systems. Additional information Accounts Receivable: Accounts receivable are evaluated at the end of each month. It is estimated that 2% of all accounts receivable will not be collected. Inventory: The weighted average cost method is used to value product purchased from each supplier. By that I mean that the purchase price does not change by supplier, but you need to factor in any discounts that are taken. Therefore, you will have to calculate inventory values and cost of goods sold on a weighted average basis by items purchased from supplier. A periodic inventory system is utilized. Depreciation on: building - 20 years, straight-line, no salvage value. shelving - 5 years, double declining balance, no salvage value Supplies worth $175 are on hand at the end of the month Accrue salaries for the second half of the month (same amount as Jan. 16th salaries). These salaries will be paid on February 1st. 1. Prepare journal entries to record each of the following transactions. You do not need to write explanations below the journal entries. 2. Create general ledger accounts for each account and post each of the journal entries to an existing general ledger account. 3. Prepare adjusting journal entries as you deem necessary. Besides the information provided for adjusting journal entries, review the transactions and review your unadjusted trial balance for any other adjusting journal entries you may need to prepare. 4. Post each of the adjusting journal entries to the general ledger accounts. 5. Prepare closing entries and post the entries to the general ledger accounts. 6. Prepare trial balances as you deem necessary. 7. Prepare the following financial statements, in their proper format, for the month of January Income statement Statement of retained earnings Balance sheet Statement of Cash Flow