Answered step by step

Verified Expert Solution

Question

1 Approved Answer

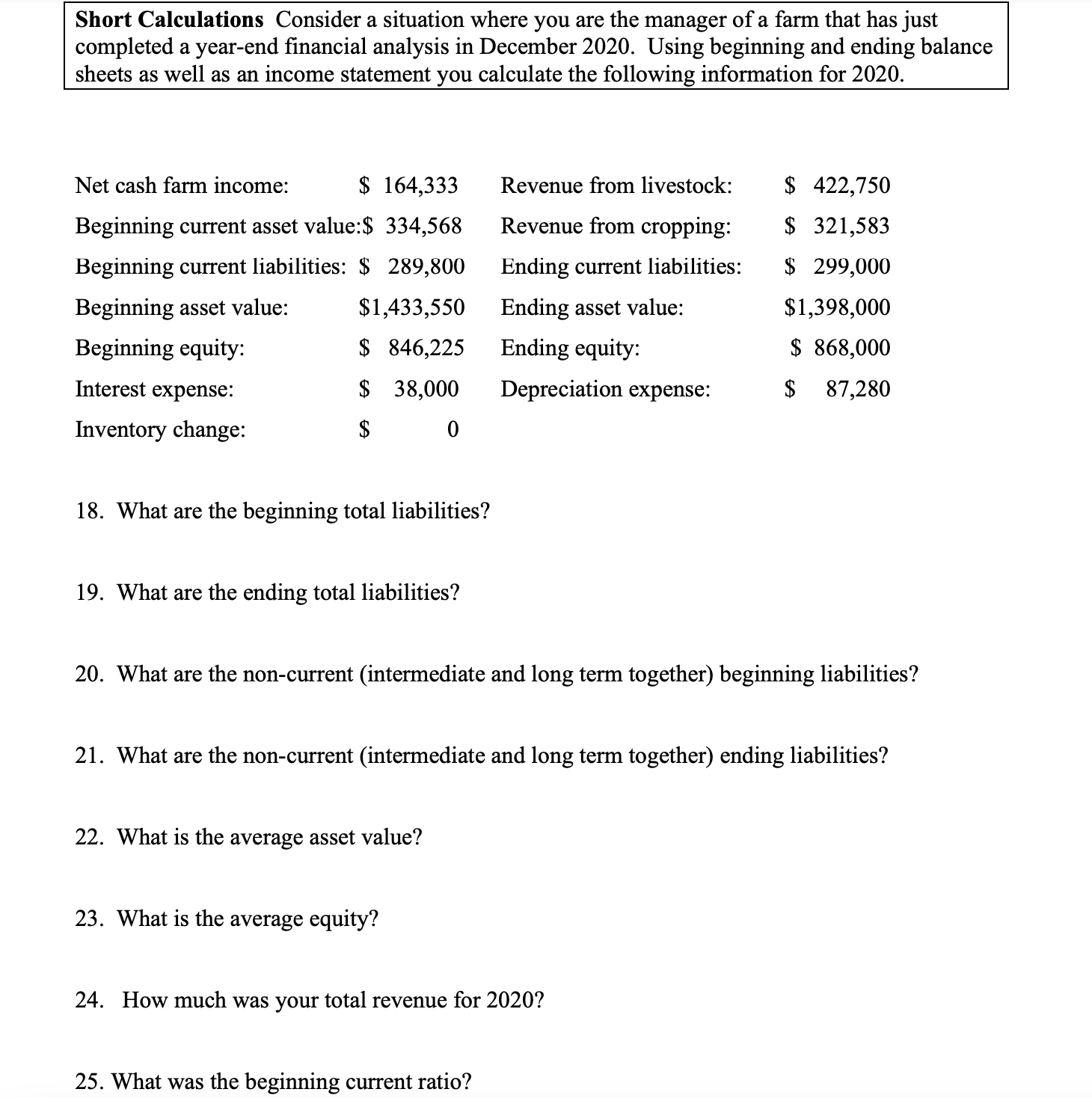

Short Calculations Consider a situation where you are the manager of a farm that has just completed a year-end financial analysis in December 2020.

Short Calculations Consider a situation where you are the manager of a farm that has just completed a year-end financial analysis in December 2020. Using beginning and ending balance sheets as well as an income statement you calculate the following information for 2020. Net cash farm income: $ 164,333 Beginning current asset value:$ 334,568 Revenue from livestock: $ 422,750 Beginning current liabilities: $ 289,800 Revenue from cropping: Ending current liabilities: $ 321,583 $ 299,000 Beginning asset value: $1,433,550 Ending asset value: $1,398,000 Beginning equity: $ 846,225 Ending equity: $ 868,000 Interest expense: $ 38,000 Depreciation expense: $ 87,280 Inventory change: $ 0 18. What are the beginning total liabilities? 19. What are the ending total liabilities? 20. What are the non-current (intermediate and long term together) beginning liabilities? 21. What are the non-current (intermediate and long term together) ending liabilities? 22. What is the average asset value? 23. What is the average equity? 24. How much was your total revenue for 2020? 25. What was the beginning current ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Beginning total liabilities Beginning current liabilities 289800 Endi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started