Question

Short Island Company has projected current sales (all on credit) of 50,000 units at a selling price of $30 per unit. Selling expenses are

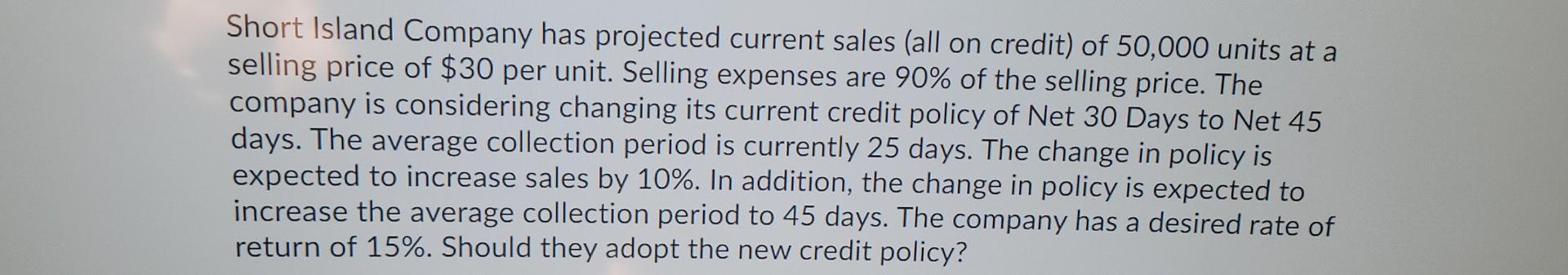

Short Island Company has projected current sales (all on credit) of 50,000 units at a selling price of $30 per unit. Selling expenses are 90% of the selling price. The company is considering changing its current credit policy of Net 30 Days to Net 45 days. The average collection period is currently 25 days. The change in policy is expected to increase sales by 10%. In addition, the change in policy is expected to increase the average collection period to 45 days. The company has a desired rate of return of 15%. Should they adopt the new credit policy?

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Anjwer Stakement showing ulhich policy need to be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

16th edition

0077664078, 978-0077664077, 78111048, 978-0078111044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App