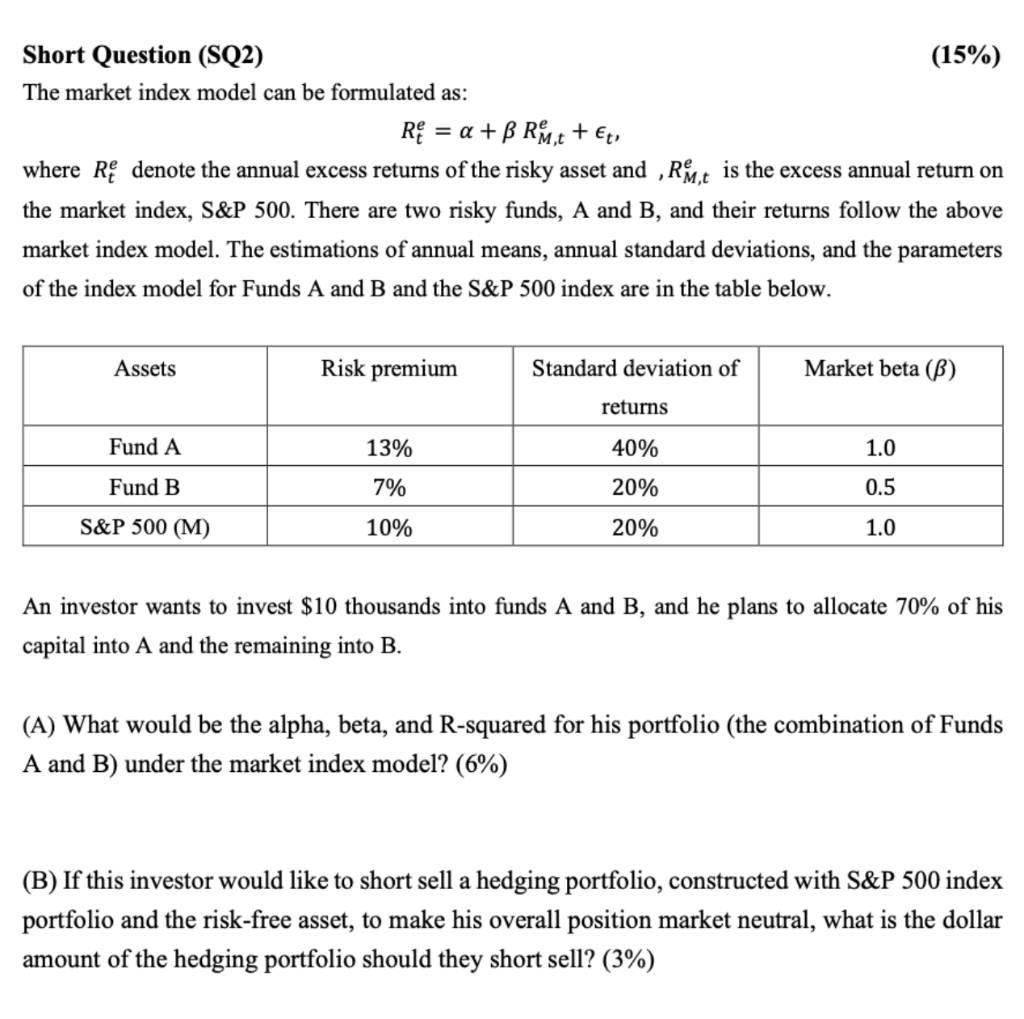

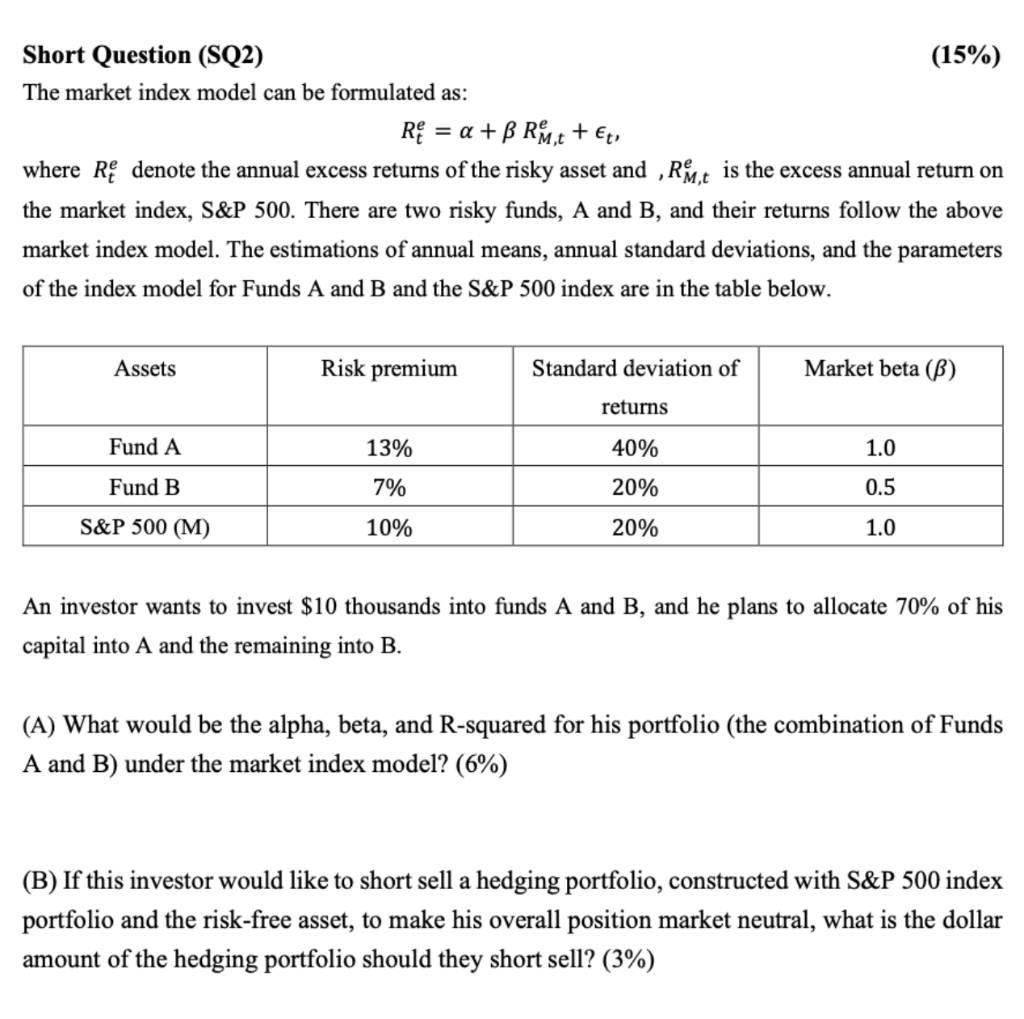

= Short Question (SQ2) (15%) The market index model can be formulated as: Rp = a + B RM,t + Et, where R denote the annual excess returns of the risky asset and , R ,t is the excess annual return on the market index, S&P 500. There are two risky funds, A and B, and their returns follow the above market index model. The estimations of annual means, annual standard deviations, and the parameters of the index model for Funds A and B and the S&P 500 index are in the table below. Assets Risk premium Standard deviation of Market beta (B) returns Fund A 13% 40% 1.0 Fund B 7% 20% 0.5 S&P 500 (M) 10% 20% 1.0 An investor wants to invest $10 thousands into funds A and B, and he plans to allocate 70% of his capital into A and the remaining into B. (A) What would be the alpha, beta, and R-squared for his portfolio (the combination of Funds A and B) under the market index model? (6%) (B) If this investor would like to short sell a hedging portfolio, constructed with S&P 500 index portfolio and the risk-free asset, to make his overall position market neutral, what is the dollar amount of the hedging portfolio should they short sell? (3%) = Short Question (SQ2) (15%) The market index model can be formulated as: Rp = a + B RM,t + Et, where R denote the annual excess returns of the risky asset and , R ,t is the excess annual return on the market index, S&P 500. There are two risky funds, A and B, and their returns follow the above market index model. The estimations of annual means, annual standard deviations, and the parameters of the index model for Funds A and B and the S&P 500 index are in the table below. Assets Risk premium Standard deviation of Market beta (B) returns Fund A 13% 40% 1.0 Fund B 7% 20% 0.5 S&P 500 (M) 10% 20% 1.0 An investor wants to invest $10 thousands into funds A and B, and he plans to allocate 70% of his capital into A and the remaining into B. (A) What would be the alpha, beta, and R-squared for his portfolio (the combination of Funds A and B) under the market index model? (6%) (B) If this investor would like to short sell a hedging portfolio, constructed with S&P 500 index portfolio and the risk-free asset, to make his overall position market neutral, what is the dollar amount of the hedging portfolio should they short sell? (3%)