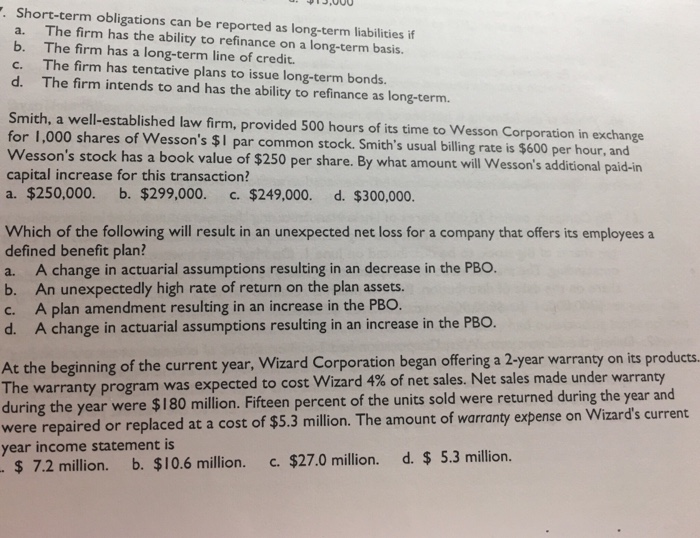

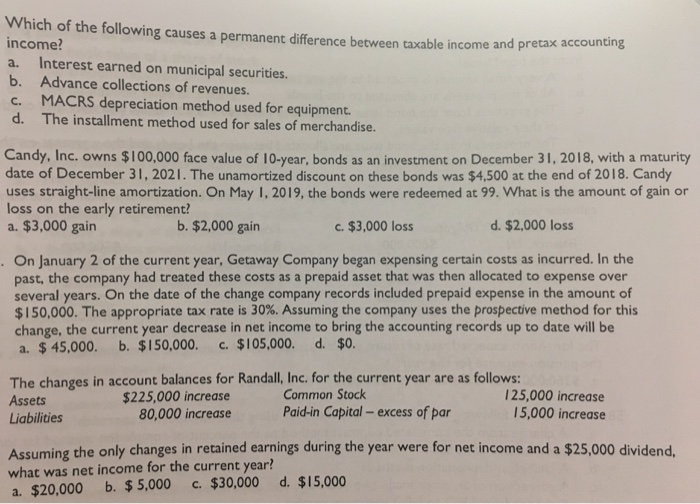

Short-term obligations can be reported as long-term liabilities if The firm has the ability to refinance on a long-term basis. The firm has a long-term line of credit. The firm has tentative plans to issue long-term bonds. The firm intends to and has the ability to refinance as long-term. a. b. c. d. Smith, a well-established law firm, provided 500 hours of its time to Wesson Corporation in exchange for 1,000 shares of Wesson's $1 par common stock. Smith's usual billing rate i Wesson's stock has a book value of $250 per share. By what amount will Wesson's additional paid-in capital increase for this transaction? a. $250,000. b. $299,000. c. $249,000. d. $300,000 s $600 per hour, and Which of the following will result in an unexpected net loss for a company that offers its employees a defined benefit plan? a. A change in actuarial assumptions resulting in an decrease in the PBO. b. An unexpectedly high rate of return on the plan assets. c. A plan amendment resulting in an increase in the PBO. d. A change in actuarial assumptions resulting in an increase in the PBO. At the beginning of the current year, Wizard Corporation began offering a 2-year warranty on its products. The warranty program was expected to cost Wizard during the year were $180 million. Fifteen percent of the units sold were returned during the year and were repaired or replaced at a cost of $5.3 million. The amount of year income statement is 4% of net sales. Net sales made under warranty warranty expense on Wizard's current s 72 milion. b. $10.6 million. c. $27.0 million. d. $ 5.3 million. Which of the following causes a permanent difference between taxable income and pretax a income? a. Interest earned on municipal securities. b. Advance collections of revenues. c. MACRS depreciation method used for equipment d. The installment method used for sales of merchandise ccounting Candy, Inc. owns $100,000 face value of 10-year, bonds as an investment on December 31, 2018, with a maturity date of December 31, 2021. The unamortized discount on these bonds was $4,500 at the end of 2018. Candy uses straight-line amortization. On May I, 2019, the bonds were redeemed at 99. What is the amount of gain or oss on the early retirement? a. $3,000 gair b. $2,000 gain d. $2,000 loss c. $3,000 loss . On January 2 of the current year, Getaway Company began expensing certain costs as incurred. In the past, the company had treated these costs as a prepaid asset that was then allocated to expense over several years. On the date of the change company records included prepaid expense in the amount of $150,000. The appropriate tax rate is 30%. Assuming the company uses the prospective method for this change, the current year decrease in net income to bring the accounting records up to date will be a. $45,000. b. $150,000. c. $105,000. d. $0. The changes in account balances for Randall, Inc. for the current year are as follows: Assets Liabilities 25,000 increase 15,000 increase $225,000 increase 80,000 increase Common Stock Paid-in Capital-excess of par Assuming the only changes in retained earnings during the year were for net income and a $25,000 dividend what was net income for the current year? 300 12 3.00 Short-term obligations can be reported as long-term liabilities if The firm has the ability to refinance on a long-term basis. The firm has a long-term line of credit. The firm has tentative plans to issue long-term bonds. The firm intends to and has the ability to refinance as long-term. a. b. c. d. Smith, a well-established law firm, provided 500 hours of its time to Wesson Corporation in exchange for 1,000 shares of Wesson's $1 par common stock. Smith's usual billing rate i Wesson's stock has a book value of $250 per share. By what amount will Wesson's additional paid-in capital increase for this transaction? a. $250,000. b. $299,000. c. $249,000. d. $300,000 s $600 per hour, and Which of the following will result in an unexpected net loss for a company that offers its employees a defined benefit plan? a. A change in actuarial assumptions resulting in an decrease in the PBO. b. An unexpectedly high rate of return on the plan assets. c. A plan amendment resulting in an increase in the PBO. d. A change in actuarial assumptions resulting in an increase in the PBO. At the beginning of the current year, Wizard Corporation began offering a 2-year warranty on its products. The warranty program was expected to cost Wizard during the year were $180 million. Fifteen percent of the units sold were returned during the year and were repaired or replaced at a cost of $5.3 million. The amount of year income statement is 4% of net sales. Net sales made under warranty warranty expense on Wizard's current s 72 milion. b. $10.6 million. c. $27.0 million. d. $ 5.3 million. Which of the following causes a permanent difference between taxable income and pretax a income? a. Interest earned on municipal securities. b. Advance collections of revenues. c. MACRS depreciation method used for equipment d. The installment method used for sales of merchandise ccounting Candy, Inc. owns $100,000 face value of 10-year, bonds as an investment on December 31, 2018, with a maturity date of December 31, 2021. The unamortized discount on these bonds was $4,500 at the end of 2018. Candy uses straight-line amortization. On May I, 2019, the bonds were redeemed at 99. What is the amount of gain or oss on the early retirement? a. $3,000 gair b. $2,000 gain d. $2,000 loss c. $3,000 loss . On January 2 of the current year, Getaway Company began expensing certain costs as incurred. In the past, the company had treated these costs as a prepaid asset that was then allocated to expense over several years. On the date of the change company records included prepaid expense in the amount of $150,000. The appropriate tax rate is 30%. Assuming the company uses the prospective method for this change, the current year decrease in net income to bring the accounting records up to date will be a. $45,000. b. $150,000. c. $105,000. d. $0. The changes in account balances for Randall, Inc. for the current year are as follows: Assets Liabilities 25,000 increase 15,000 increase $225,000 increase 80,000 increase Common Stock Paid-in Capital-excess of par Assuming the only changes in retained earnings during the year were for net income and a $25,000 dividend what was net income for the current year? 300 12 3.00