Question: should brawn accept or reject this project at an adjusted wacc of 6.00%, 8.00%, or 10.00%? solve for all thank you Apply WACC in NPV.

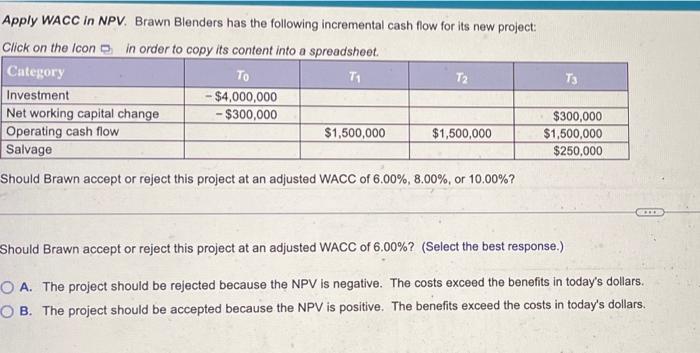

Apply WACC in NPV. Brawn Blenders has the following incremental cash flow for its new project: Click on the Icon in order to copy its content into a spreadsheet. Category To T T T3 Investment -$4,000,000 Net working capital change -$300,000 $300,000 Operating cash flow $1,500,000 $1,500,000 $1,500,000 Salvage $250,000 Should Brawn accept or reject this project at an adjusted WACC of 6.00%, 8.00%, or 10.00%? Should Brawn accept or reject this project at an adjusted WACC of 6.00%? (Select the best response.) OA. The project should be rejected because the NPV is negative. The costs exceed the benefits in today's dollars. OB. The project should be accepted because the NPV is positive. The benefits exceed the costs in today's dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts