Answered step by step

Verified Expert Solution

Question

1 Approved Answer

should include the diagram, the excel sheet, and a verbal summary of your findings for questions 3 and 4. THE BIG RIG TRUCK RENTAL COMPANY

should include the diagram, the excel sheet, and a verbal summary of your findings for questions 3 and 4.

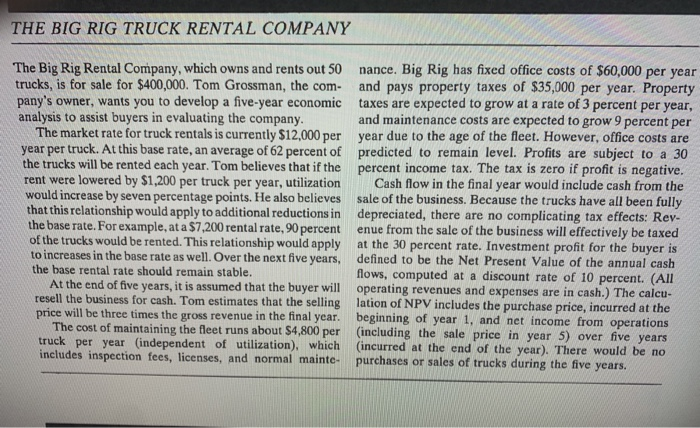

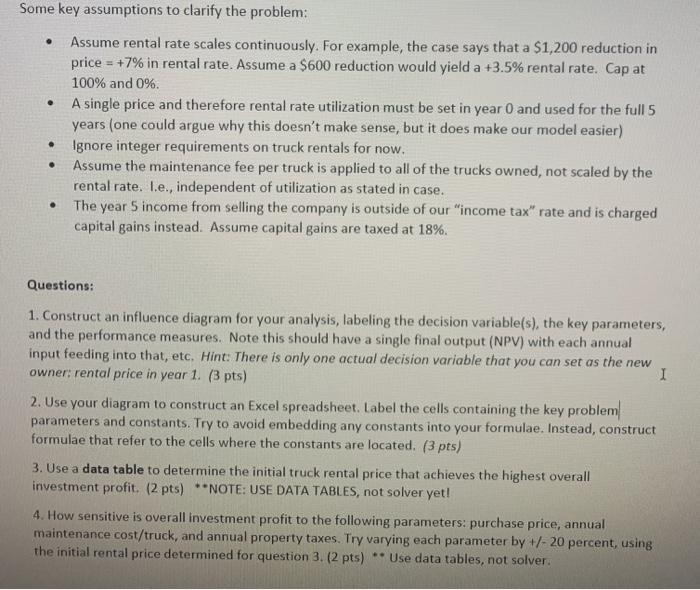

THE BIG RIG TRUCK RENTAL COMPANY The Big Rig Rental Company, which owns and rents out 50 nance. Big Rig has fixed office costs of $60,000 per year trucks, is for sale for $400,000. Tom Grossman, the com and pays property taxes of $35,000 per year. Property pany's owner, wants you to develop a five-year economic taxes are expected to grow at a rate of 3 percent per year, analysis to assist buyers in evaluating the company. and maintenance costs are expected to grow 9 percent per The market rate for truck rentals is currently $12,000 per year due to the age of the fleet. However, office costs are year per truck. At this base rate, an average of 62 percent of predicted to remain level. Profits are subject to a 30 the trucks will be rented each year. Tom believes that if the percent income tax. The tax is zero if profit is negative. rent were lowered by $1,200 per truck per year, utilization Cash flow in the final year would include cash from the would increase by seven percentage points. He also believes sale of the business. Because the trucks have all been fully that this relationship would apply to additional reductions in depreciated, there are no complicating tax effects: Rev- the base rate. For example, at a $7,200 rental rate, 90 percent enue from the sale of the business will effectively be taxed of the trucks would be rented. This relationship would apply at the 30 percent rate. Investment profit for the buyer is to increases in the base rate as well. Over the next five years, defined to be the Net Present Value of the annual cash the base rental rate should remain stable. flows, computed at a discount rate of 10 percent. (All At the end of five years, it is assumed that the buyer will operating revenues and expenses are in cash.) The calcu- resell the business for cash. Tom estimates that the selling lation of NPV includes the purchase price, incurred at the price will be three times the gross revenue in the final year. beginning of year 1, and net income from operations The cost of maintaining the fleet runs about $4,800 per (including the sale price in year 5) over five years truck per year (independent of utilization), which incurred at the end of the year). There would be no includes inspection fees, licenses, and normal mainte- purchases or sales of trucks during the five years. . Some key assumptions to clarify the problem: Assume rental rate scales continuously. For example, the case says that a $1,200 reduction in price = +7% in rental rate. Assume a $600 reduction would yield a +3.5% rental rate. Cap at 100% and 0%. A single price and therefore rental rate utilization must be set in year 0 and used for the full 5 years (one could argue why this doesn't make sense, but it does make our model easier) Ignore integer requirements on truck rentals for now. Assume the maintenance fee per truck is applied to all of the trucks owned, not scaled by the rental rate. I.e., independent of utilization as stated in case. The year 5 income from selling the company is outside of our "income tax rate and is charged capital gains instead. Assume capital gains are taxed at 18%. . . Questions: I 1. Construct an influence diagram for your analysis, labeling the decision variable(s), the key parameters, and the performance measures. Note this should have a single final output (NPV) with each annual input feeding into that, etc. Hint: There is only one actual decision variable that you can set as the new owner: rental price in year 1. (3 pts) 2. Use your diagram to construct an Excel spreadsheet. Label the cells containing the key problem parameters and constants. Try to avoid embedding any constants into your formulae. Instead, construct formulae that refer to the cells where the constants are located. (3 pts) 3. Use a data table to determine the initial truck rental price that achieves the highest overall investment profit. (2 pts) **NOTE: USE DATA TABLES, not solver yet! 4. How sensitive is overall investment profit to the following parameters: purchase price, annual maintenance cost/truck, and annual property taxes. Try varying each parameter by +/- 20 percent, using the initial rental price determined for question 3. (2 pts) ** Use data tables, not solver. THE BIG RIG TRUCK RENTAL COMPANY The Big Rig Rental Company, which owns and rents out 50 nance. Big Rig has fixed office costs of $60,000 per year trucks, is for sale for $400,000. Tom Grossman, the com and pays property taxes of $35,000 per year. Property pany's owner, wants you to develop a five-year economic taxes are expected to grow at a rate of 3 percent per year, analysis to assist buyers in evaluating the company. and maintenance costs are expected to grow 9 percent per The market rate for truck rentals is currently $12,000 per year due to the age of the fleet. However, office costs are year per truck. At this base rate, an average of 62 percent of predicted to remain level. Profits are subject to a 30 the trucks will be rented each year. Tom believes that if the percent income tax. The tax is zero if profit is negative. rent were lowered by $1,200 per truck per year, utilization Cash flow in the final year would include cash from the would increase by seven percentage points. He also believes sale of the business. Because the trucks have all been fully that this relationship would apply to additional reductions in depreciated, there are no complicating tax effects: Rev- the base rate. For example, at a $7,200 rental rate, 90 percent enue from the sale of the business will effectively be taxed of the trucks would be rented. This relationship would apply at the 30 percent rate. Investment profit for the buyer is to increases in the base rate as well. Over the next five years, defined to be the Net Present Value of the annual cash the base rental rate should remain stable. flows, computed at a discount rate of 10 percent. (All At the end of five years, it is assumed that the buyer will operating revenues and expenses are in cash.) The calcu- resell the business for cash. Tom estimates that the selling lation of NPV includes the purchase price, incurred at the price will be three times the gross revenue in the final year. beginning of year 1, and net income from operations The cost of maintaining the fleet runs about $4,800 per (including the sale price in year 5) over five years truck per year (independent of utilization), which incurred at the end of the year). There would be no includes inspection fees, licenses, and normal mainte- purchases or sales of trucks during the five years. . Some key assumptions to clarify the problem: Assume rental rate scales continuously. For example, the case says that a $1,200 reduction in price = +7% in rental rate. Assume a $600 reduction would yield a +3.5% rental rate. Cap at 100% and 0%. A single price and therefore rental rate utilization must be set in year 0 and used for the full 5 years (one could argue why this doesn't make sense, but it does make our model easier) Ignore integer requirements on truck rentals for now. Assume the maintenance fee per truck is applied to all of the trucks owned, not scaled by the rental rate. I.e., independent of utilization as stated in case. The year 5 income from selling the company is outside of our "income tax rate and is charged capital gains instead. Assume capital gains are taxed at 18%. . . Questions: I 1. Construct an influence diagram for your analysis, labeling the decision variable(s), the key parameters, and the performance measures. Note this should have a single final output (NPV) with each annual input feeding into that, etc. Hint: There is only one actual decision variable that you can set as the new owner: rental price in year 1. (3 pts) 2. Use your diagram to construct an Excel spreadsheet. Label the cells containing the key problem parameters and constants. Try to avoid embedding any constants into your formulae. Instead, construct formulae that refer to the cells where the constants are located. (3 pts) 3. Use a data table to determine the initial truck rental price that achieves the highest overall investment profit. (2 pts) **NOTE: USE DATA TABLES, not solver yet! 4. How sensitive is overall investment profit to the following parameters: purchase price, annual maintenance cost/truck, and annual property taxes. Try varying each parameter by +/- 20 percent, using the initial rental price determined for question 3. (2 pts) ** Use data tables, not solverStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started