Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A city of population 1M, with 3% unemployment, has decided to pay a locally owned construction firm to build a new half mile long

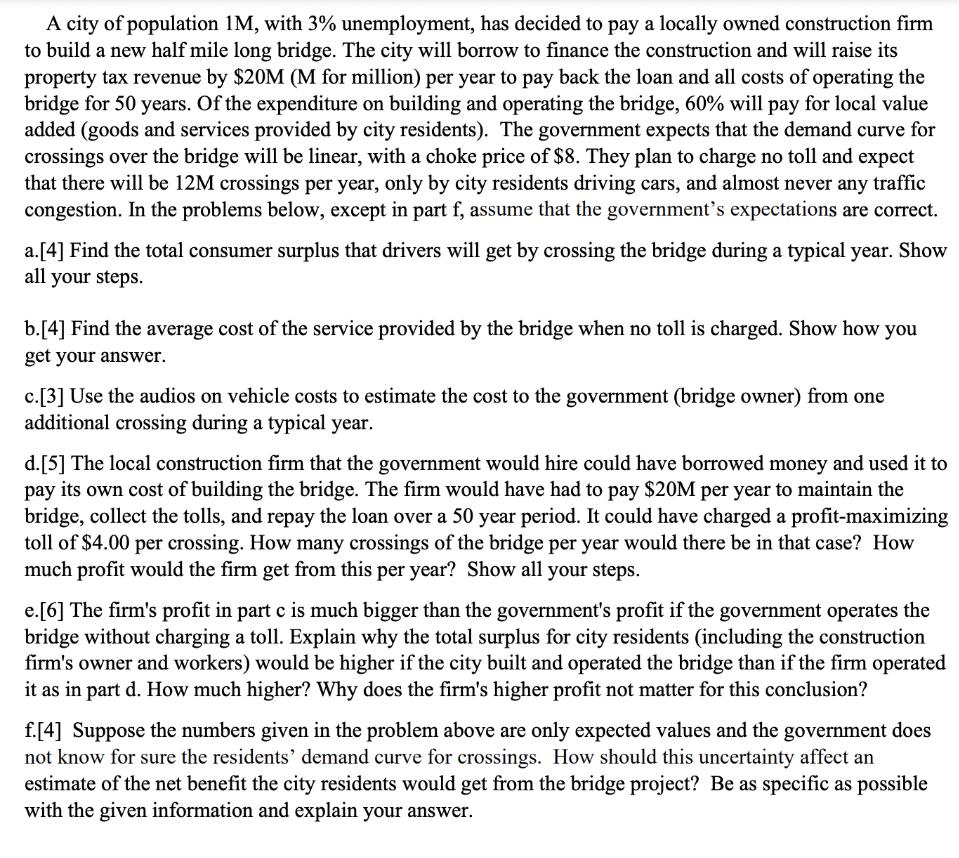

A city of population 1M, with 3% unemployment, has decided to pay a locally owned construction firm to build a new half mile long bridge. The city will borrow to finance the construction and will raise its property tax revenue by $20M (M for million) per year to pay back the loan and all costs of operating the bridge for 50 years. Of the expenditure on building and operating the bridge, 60% will pay for local value added (goods and services provided by city residents). The government expects that the demand curve for crossings over the bridge will be linear, with a choke price of $8. They plan to charge no toll and expect that there will be 12M crossings per year, only by city residents driving cars, and almost never any traffic congestion. In the problems below, except in part f, assume that the government's expectations are correct. a.[4] Find the total consumer surplus that drivers will get by crossing the bridge during a typical year. Show all your steps. b.[4] Find the average cost of the service provided by the bridge when no toll is charged. Show how you get your answer. c. [3] Use the audios on vehicle costs to estimate the cost to the government (bridge owner) from one additional crossing during a typical year. d.[5] The local construction firm that the government would hire could have borrowed money and used it to pay its own cost of building the bridge. The firm would have had to pay $20M per year to maintain the bridge, collect the tolls, and repay the loan over a 50 year period. It could have charged a profit-maximizing toll of $4.00 per crossing. How many crossings of the bridge per year would there be in that case? How much profit would the firm get from this per year? Show all your steps. e.[6] The firm's profit in part c is much bigger than the government's profit if the government operates the bridge without charging a toll. Explain why the total surplus for city residents (including the construction firm's owner and workers) would be higher if the city built and operated the bridge than if the firm operated it as in part d. How much higher? Why does the firm's higher profit not matter for this conclusion? f.[4] Suppose the numbers given in the problem above are only expected values and the government does not know for sure the residents' demand curve for crossings. How should this uncertainty affect an estimate of the net benefit the city residents would get from the bridge project? Be as specific as possible with the given information and explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The total consumer surplus that drivers will get by crossing the br...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635da8bf161cf_177743.pdf

180 KBs PDF File

635da8bf161cf_177743.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started