Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Should Picture Perfect Ltd continue using their existing printer, or should they invest in a new one? Perform a separate net present value (NPV) calculation

Should Picture Perfect Ltd continue using their existing printer, or should they invest in a new one? Perform a separate net present value (NPV) calculation for each of the existing and new printer to substantiate your answer.

Should Picture Perfect Ltd continue using their existing printer, or should they invest in a new one? Perform a separate net present value (NPV) calculation for each of the existing and new printer to substantiate your answer.Show detailed calculations for the NPV calculations of both the existing and the new printer. Round off factors to three decimal places and other calculations to the nearest rand.

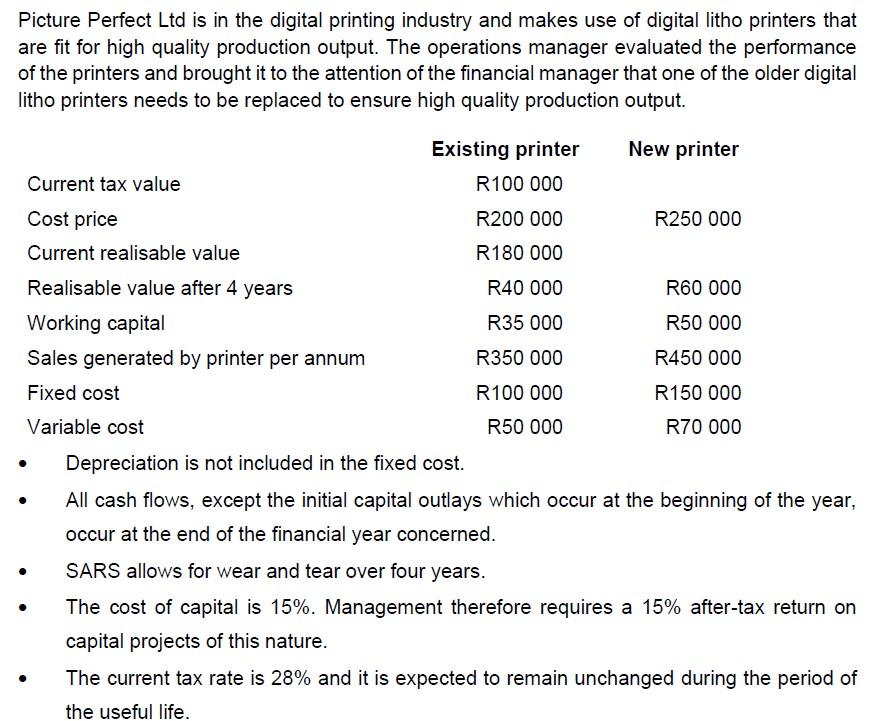

Picture Perfect Ltd is in the digital printing industry and makes use of digital litho printers that are fit for high quality production output. The operations manager evaluated the performance of the printers and brought it to the attention of the financial manager that one of the older digital litho printers needs to be replaced to ensure high quality production output. New printer Current tax value Cost price Current realisable value Realisable value after 4 years Working capital Sales generated by printer per annum Fixed cost Variable cost Existing printer R100 000 R200 000 R180 000 R40 000 R35 000 R350 000 R100 000 R50 000 R250 000 R60 000 R50 000 R450 000 R150 000 R70 000 Depreciation is not included in the fixe All cash flows, except the initial capital outlays which occur at the beginning of the year, occur at the end of the financial year concerned. SARS allows for wear and tear over four years. The cost of capital is 15%. Management therefore requires a 15% after-tax return on capital projects of this nature. The current tax rate is 28% and it is expected to remain unchanged during the period of the useful life. Picture Perfect Ltd is in the digital printing industry and makes use of digital litho printers that are fit for high quality production output. The operations manager evaluated the performance of the printers and brought it to the attention of the financial manager that one of the older digital litho printers needs to be replaced to ensure high quality production output. New printer Current tax value Cost price Current realisable value Realisable value after 4 years Working capital Sales generated by printer per annum Fixed cost Variable cost Existing printer R100 000 R200 000 R180 000 R40 000 R35 000 R350 000 R100 000 R50 000 R250 000 R60 000 R50 000 R450 000 R150 000 R70 000 Depreciation is not included in the fixe All cash flows, except the initial capital outlays which occur at the beginning of the year, occur at the end of the financial year concerned. SARS allows for wear and tear over four years. The cost of capital is 15%. Management therefore requires a 15% after-tax return on capital projects of this nature. The current tax rate is 28% and it is expected to remain unchanged during the period of the useful life. Picture Perfect Ltd is in the digital printing industry and makes use of digital litho printers that are fit for high quality production output. The operations manager evaluated the performance of the printers and brought it to the attention of the financial manager that one of the older digital litho printers needs to be replaced to ensure high quality production output. New printer Current tax value Cost price Current realisable value Realisable value after 4 years Working capital Sales generated by printer per annum Fixed cost Variable cost Existing printer R100 000 R200 000 R180 000 R40 000 R35 000 R350 000 R100 000 R50 000 R250 000 R60 000 R50 000 R450 000 R150 000 R70 000 Depreciation is not included in the fixe All cash flows, except the initial capital outlays which occur at the beginning of the year, occur at the end of the financial year concerned. SARS allows for wear and tear over four years. The cost of capital is 15%. Management therefore requires a 15% after-tax return on capital projects of this nature. The current tax rate is 28% and it is expected to remain unchanged during the period of the useful life.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether Picture Perfect Ltd should continue using their existing printer or invest in a new one we need to calculate the net present value NPV for each option NPV is a financial metric th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started