Question

Should the company proceed with its plan? Explain your answer. What other factors the company need to take into consideration. The total value of the

Should the company proceed with its plan? Explain your answer. What other factors the company need to take into consideration.

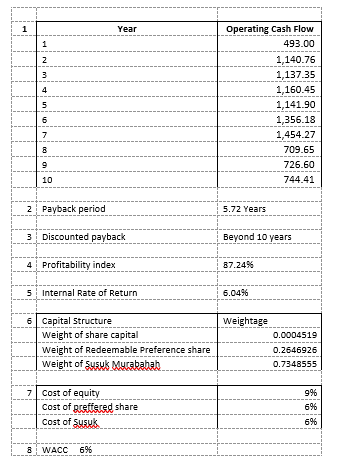

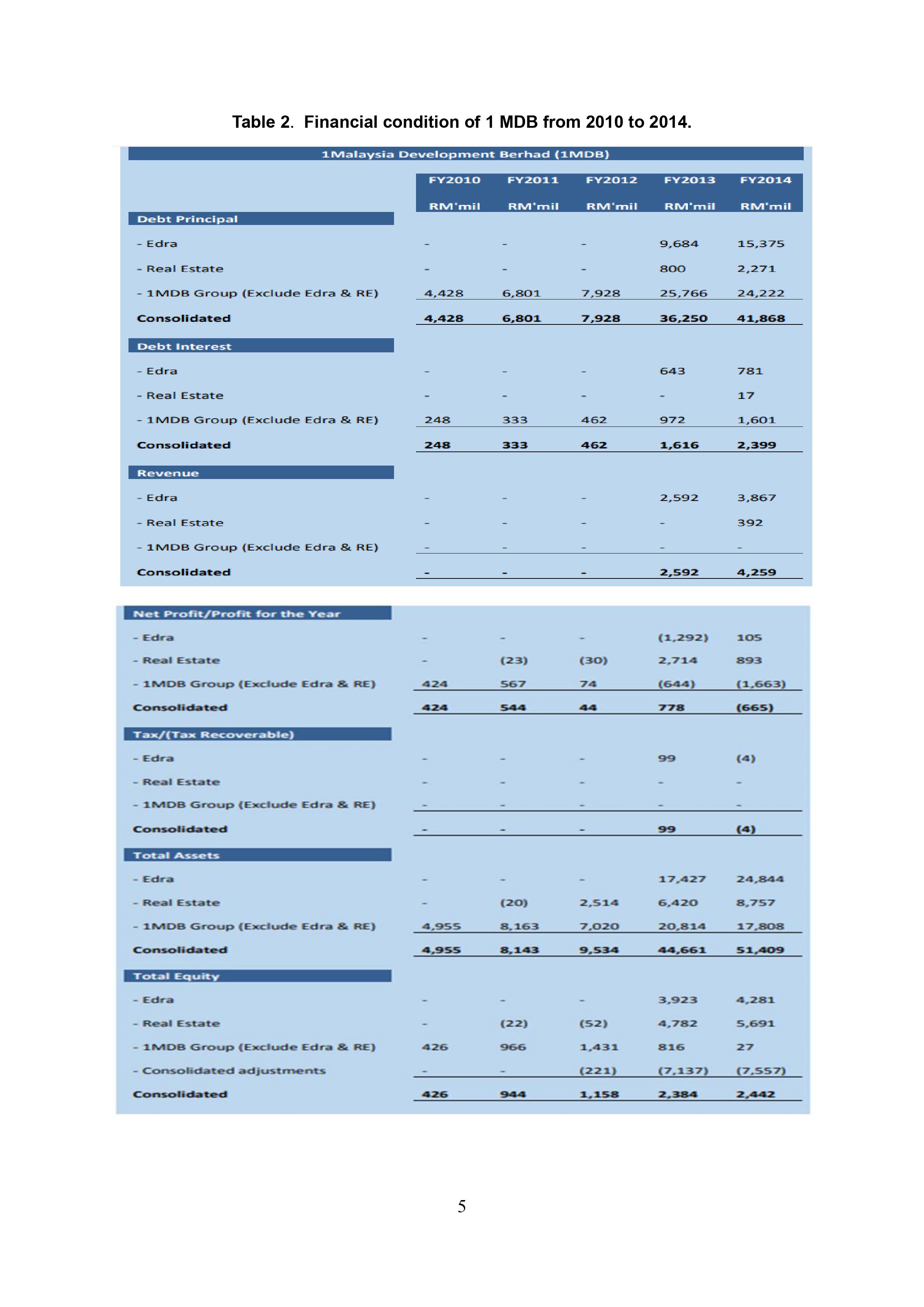

The total value of the assets owned by 1MDB Group as of 31 Mar 2014 was RM51,409.43 million which included the investments in energy related assets, the assets in portfolio investment and SPC, the assets in real estate investments and other assets. While the liabilities is reported to be RM42 billion (see Figure 1). Table 2 above display financial condition of 1 MDB from 2010 to 2014.

The raising concern of the financial issue raised by people is being highlighted in the report by Bernama in 2014

1Malaysia Development Bhd (1MDB) has given an assurance that all its investments were prudent and professionally managed. Some of the loans are long-term in nature but we believe this financial commitment can be met. We are also in the process of adding and unlocking value to the assets that we have acquired, 1MDB chairman Tan Sri Lodin Wok Kamaruddin told reporters today. Dispelling misconceptions about 1MDB s ability to repay loans, he said 1MDB was looking at restructuring its loans to address the mismatching longterm investment projects and short-term loans. He said its ventures in the Tun Razak Exchange (TRX) and Bandar Malaysia projects as well as in the energy sector were long-term in nature with long-term gestation periods

Kindly explain the statement above. Please elaborate on the total asset and the equity mentioned above and also relate it with the statement below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started