Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SHOW ALL CALCULATIONS : It WILL BE AWARDED IF I CAN FOLLOW YOUR REASONING/COMPREHENSION/ UNDERSTANDING A9-13 Decommissioning Obligation: Bruce Networks Ltd. (BNL) has a 10-year

SHOW ALL CALCULATIONS: It WILL BE AWARDED IF I CAN FOLLOW YOUR REASONING/COMPREHENSION/ UNDERSTANDING

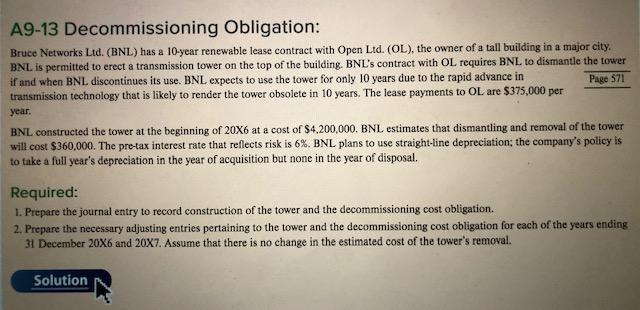

A9-13 Decommissioning Obligation: Bruce Networks Ltd. (BNL) has a 10-year renewable lease contract with Open Ltd. (OL), the owner of a tall building in a major city. BNL is permitted to crect a transmission tower on the top of the building. BNL's contract with OL requires BNL to dismantle the lower if and when BNL discontinues its use. BNL expects to use the tower for only 10 years due to the rapid advance in Page 571 transmission technology that is likely to render the tower obsolete in 10 years. The lease payments to OL are $375,000 per year. BNL constructed the tower at the beginning of 20x6 at a cost of $4,200,000. BNL estimates that dismantling and removal of the tower will cost $360,000. The pre-tax interest rate that reflects risk is 6%. BNL plans to use straight-line depreciation, the company's policy is to take a full year's depreciation in the year of acquisition but none in the year of disposal. Required: 1. Prepare the journal entry to record construction of the tower and the decommissioning cost obligation. 2. Prepare the necessary adjusting entries pertaining to the tower and the decommissioning cost obligation for each of the years ending 31 December 20X6 and 20x7. Assume that there is no change in the estimated cost of the tower's removal. SolutionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started