Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show all necessary work for each problem; your work is part of the grading criteria. Precise usage of language and symbols/notations is part of

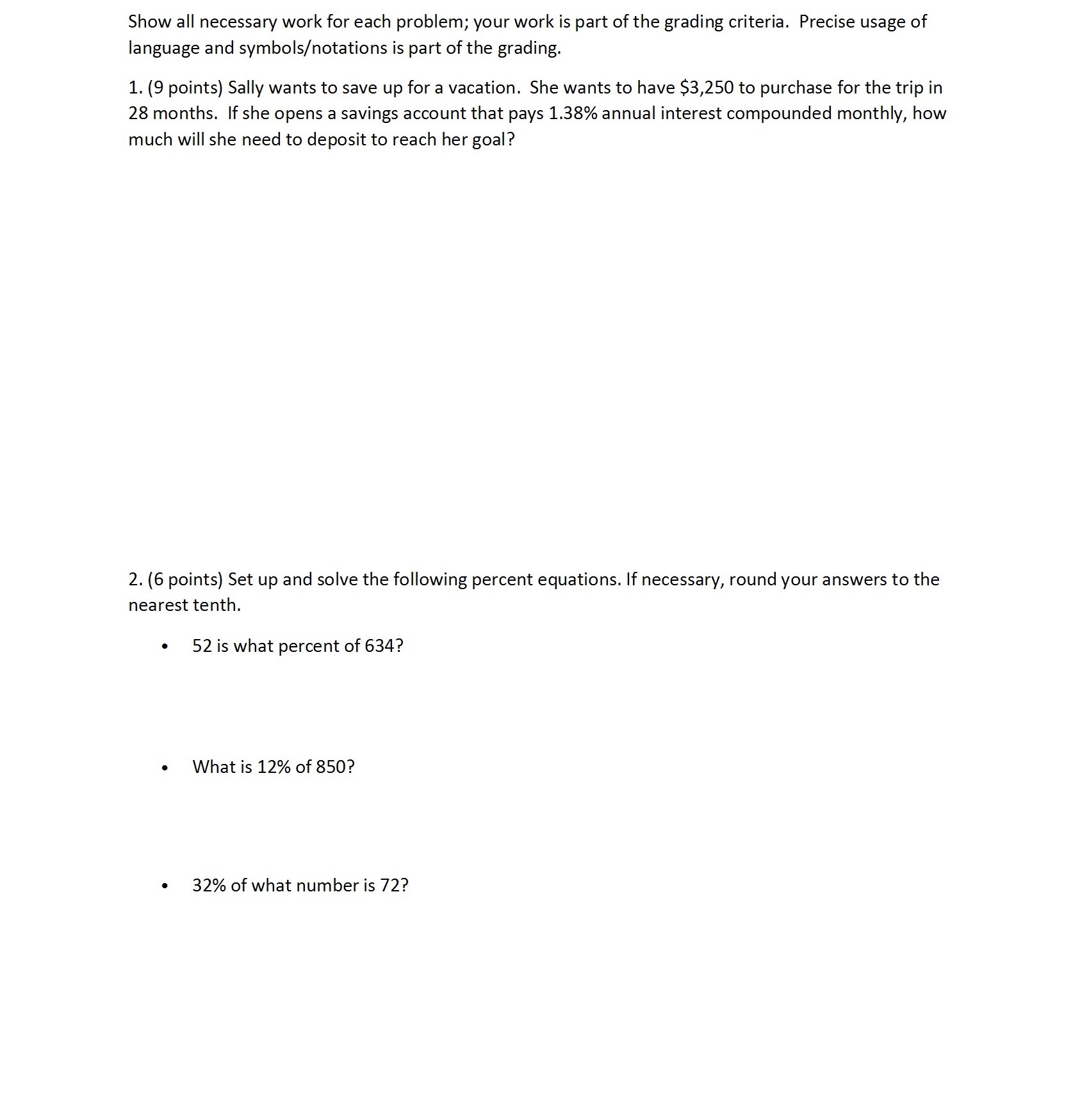

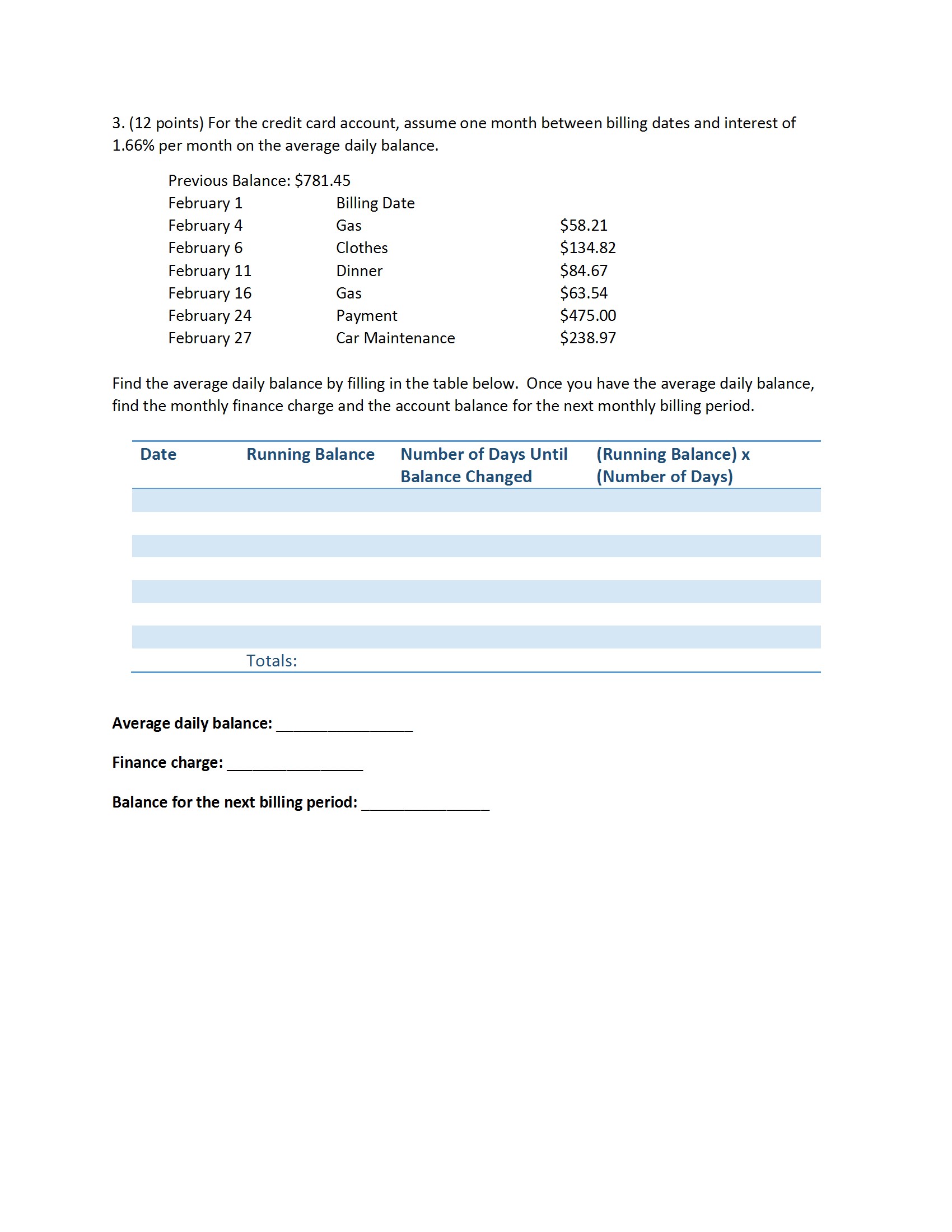

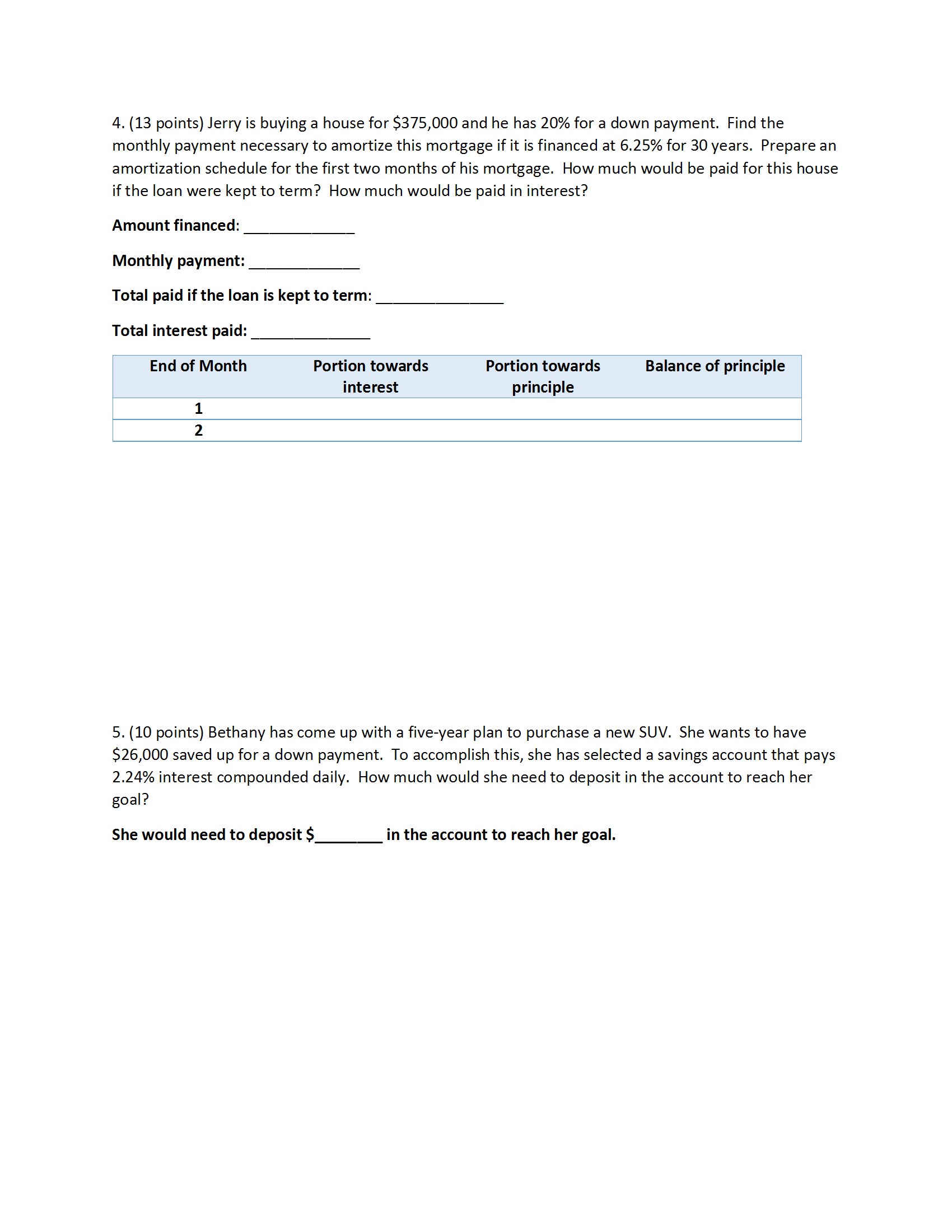

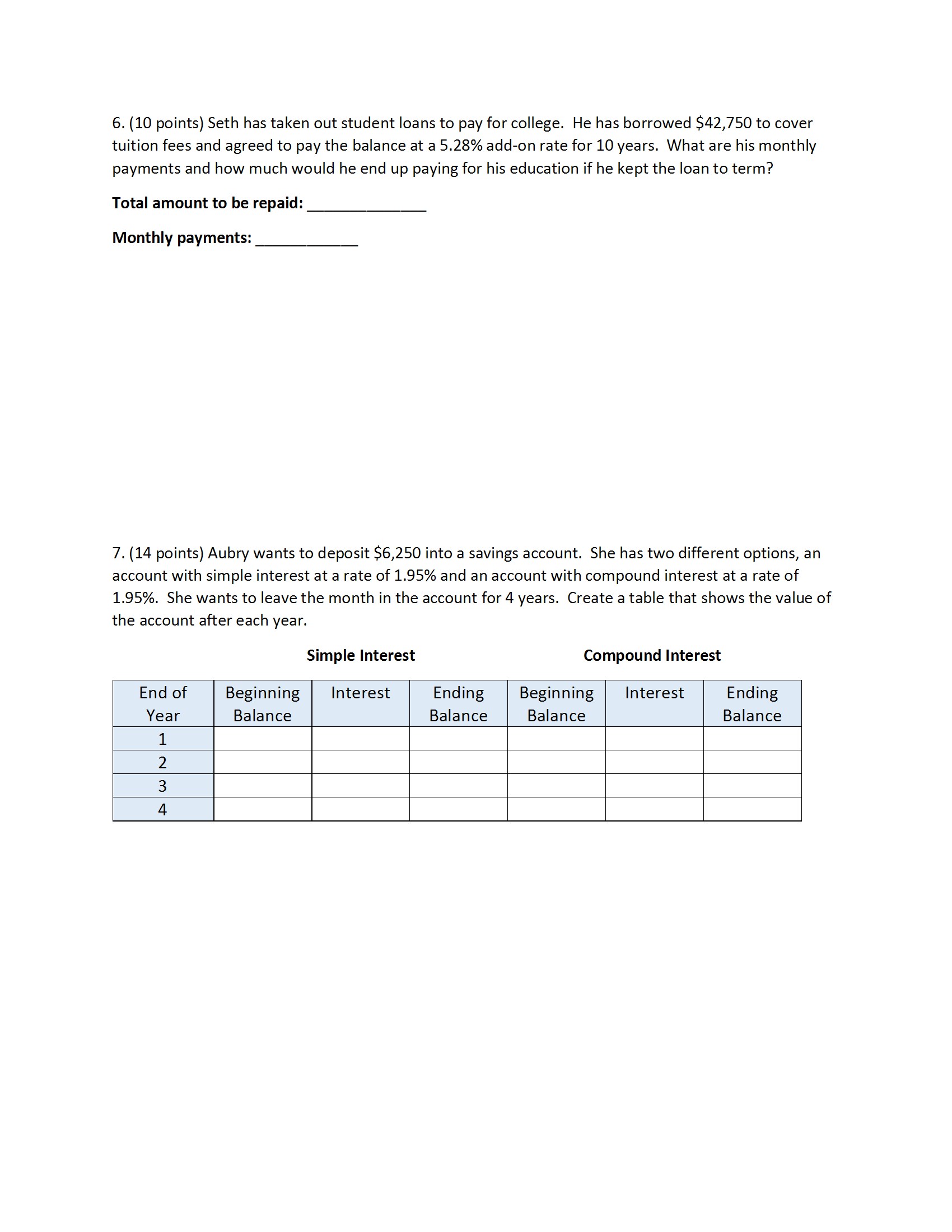

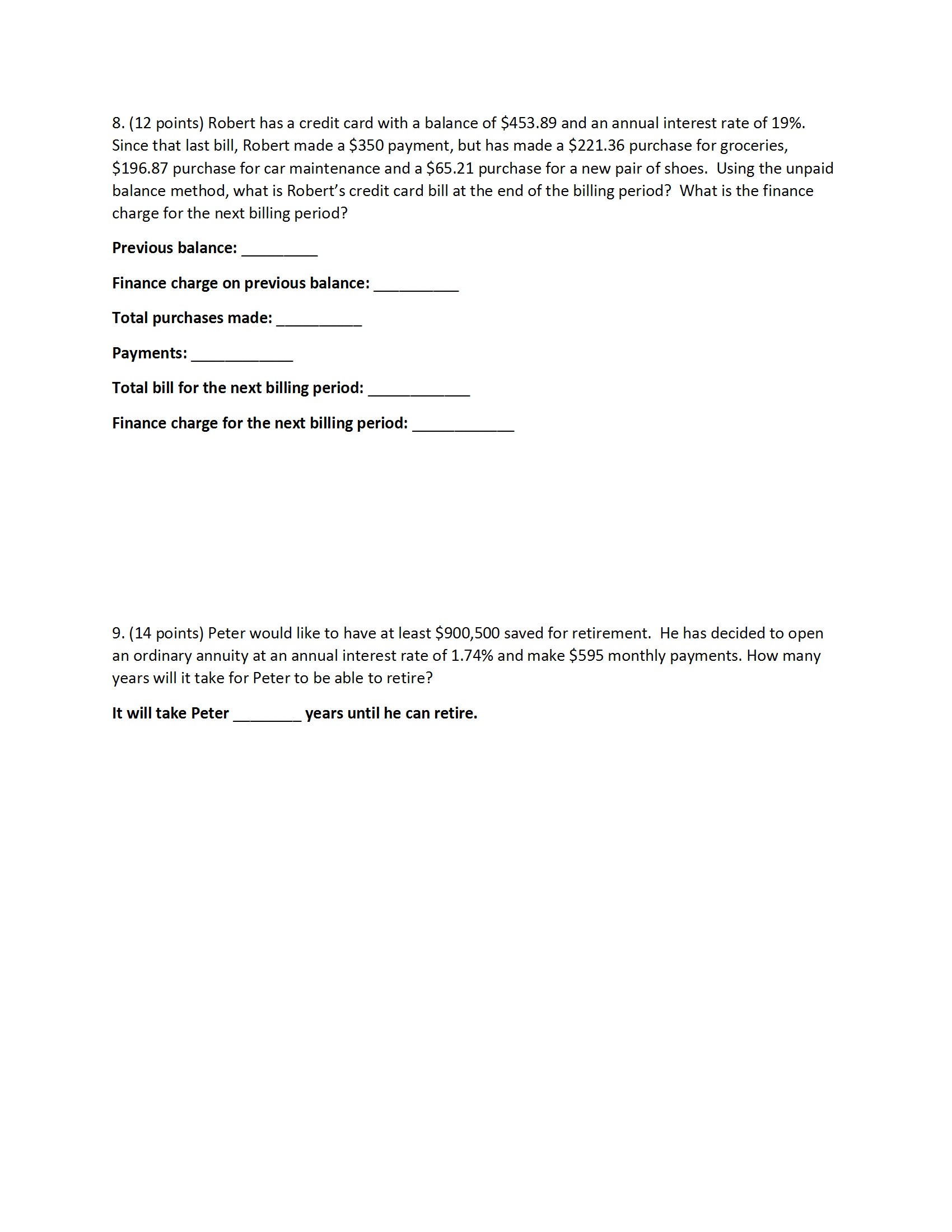

Show all necessary work for each problem; your work is part of the grading criteria. Precise usage of language and symbols/notations is part of the grading. 1. (9 points) Sally wants to save up for a vacation. She wants to have $3,250 to purchase for the trip in 28 months. If she opens a savings account that pays 1.38% annual interest compounded monthly, how much will she need to deposit to reach her goal? 2. (6 points) Set up and solve the following percent equations. If necessary, round your answers to the nearest tenth. 52 is what percent of 634? What is 12% of 850? 32% of what number is 72? 3. (12 points) For the credit card account, assume one month between billing dates and interest of 1.66% per month on the average daily balance. Previous Balance: $781.45 February 1 Billing Date February 4 Gas February 6 Clothes February 11 Dinner February 16 Gas February 24 Payment February 27 Car Maintenance $58.21 $134.82 $84.67 $63.54 $475.00 $238.97 Find the average daily balance by filling in the table below. Once you have the average daily balance, find the monthly finance charge and the account balance for the next monthly billing period. Date Running Balance Number of Days Until Balance Changed (Running Balance) x (Number of Days) Totals: Average daily balance: Finance charge: Balance for the next billing period: 4. (13 points) Jerry is buying a house for $375,000 and he has 20% for a down payment. Find the monthly payment necessary to amortize this mortgage if it is financed at 6.25% for 30 years. Prepare an amortization schedule for the first two months of his mortgage. How much would be paid for this house if the loan were kept to term? How much would be paid in interest? Amount financed: Monthly payment: Total paid if the loan is kept to term: Total interest paid: End of Month Portion towards Portion towards Balance of principle interest principle 1 2 5. (10 points) Bethany has come up with a five-year plan to purchase a new SUV. She wants to have $26,000 saved up for a down payment. To accomplish this, she has selected a savings account that pays 2.24% interest compounded daily. How much would she need to deposit in the account to reach her goal? She would need to deposit $ in the account to reach her goal. 6. (10 points) Seth has taken out student loans to pay for college. He has borrowed $42,750 to cover tuition fees and agreed to pay the balance at a 5.28% add-on rate for 10 years. What are his monthly payments and how much would he end up paying for his education if he kept the loan to term? Total amount to be repaid: Monthly payments: 7. (14 points) Aubry wants to deposit $6,250 into a savings account. She has two different options, an account with simple interest at a rate of 1.95% and an account with compound interest at a rate of 1.95%. She wants to leave the month in the account for 4 years. Create a table that shows the value of the account after each year. Simple Interest Compound Interest End of Beginning Interest Year Balance Ending Balance Beginning Interest Balance Ending Balance 1 2 3 4 8. (12 points) Robert has a credit card with a balance of $453.89 and an annual interest rate of 19%. Since that last bill, Robert made a $350 payment, but has made a $221.36 purchase for groceries, $196.87 purchase for car maintenance and a $65.21 purchase for a new pair of shoes. Using the unpaid balance method, what is Robert's credit card bill at the end of the billing period? What is the finance charge for the next billing period? Previous balance: Finance charge on previous balance: Total purchases made: Payments: Total bill for the next billing period: Finance charge for the next billing period: 9. (14 points) Peter would like to have at least $900,500 saved for retirement. He has decided to open an ordinary annuity at an annual interest rate of 1.74% and make $595 monthly payments. How many years will it take for Peter to be able to retire? It will take Peter years until he can retire.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started