Question

1. Owly Corporation's appliance division uses a predetermined overhead rate to apply overhead to the products produced. The appliance division uses machine hours as

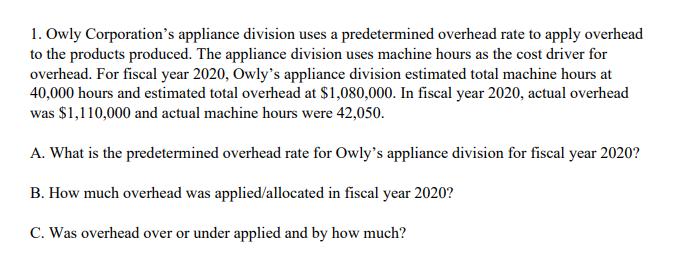

1. Owly Corporation's appliance division uses a predetermined overhead rate to apply overhead to the products produced. The appliance division uses machine hours as the cost driver for overhead. For fiscal year 2020, Owly's appliance division estimated total machine hours at 40,000 hours and estimated total overhead at $1,080,000. In fiscal year 2020, actual overhead was $1,110,000 and actual machine hours were 42,050. A. What is the predetermined overhead rate for Owly's appliance division for fiscal year 2020? B. How much overhead was applied/allocated in fiscal year 2020? C. Was overhead over or under applied and by how much?

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Predetermined overhead rate estimated total over...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Accounting And Control

Authors: Don R. Hansen, Maryanne M. Mowen, Liming Guan

6th Edition

324559674, 978-0324559675

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App