Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all work 10 Points Lowe's, a national hardware chain, is considering purchasing a smaller chain, Ace Parts. Lowe's analysts project that the merger will

show all work

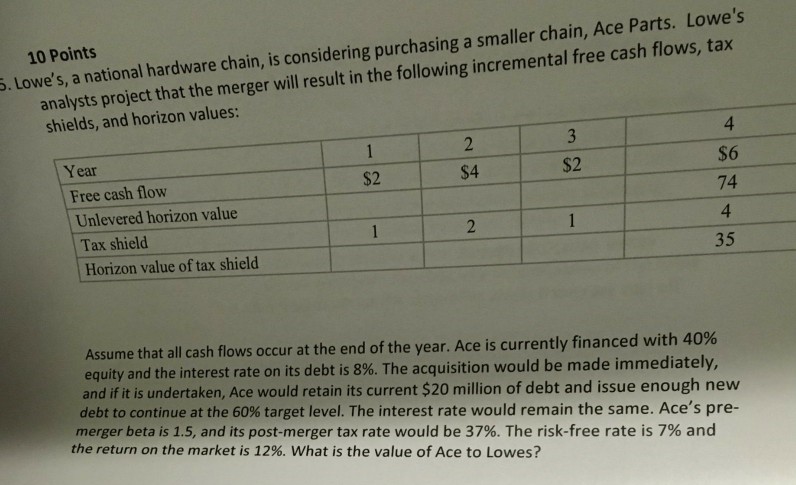

10 Points Lowe's, a national hardware chain, is considering purchasing a smaller chain, Ace Parts. Lowe's analysts project that the merger will result in the following incremental free cash flows, tax shields, and horizon values: 4 $6 74 4 35 Year $2 $4 $2 Free cash flow Unlevered horizon value Tax shield Horizon value of tax shield Assume that all cash flows occur at the end of the year. Ace is currently financed with 40% equity and the interest rate on its debt and if it is undertaken, Ace would retain its current $20 million of debt and issue enough new debt to continue at the 60% target level. The interest rate would remain the same. Ace's pre- merger beta is 1.5, and its post-merger tax rate would be 37%. The risk-free rate is 7% and is 8%. The acquisition would be made immediately, the return on the market is 12%, what is the value of Ace to LowesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started