Question

Show all work and discuss. The questions goes with Questions 7 which i have include in this comment section. Question have been answered, i just

Show all work and discuss.

The questions goes with Questions 7 which i have include in this comment section. Question have been answered, i just need question 8. Thank You.

Bank 1 can issue five-year CDs at an annual rate of 11 percent fixed or at a vari- able rate of LIBOR plus 2 percent. Bank 2 can issue five year CDs at an annual rate of 13 percent fixed or at a variable rate of LIBOR plus 3 percent.

a. Is a mutually beneficial swap possible between the two banks?

b. Where is the comparative advantage of the two banks?

c. What is an example of a feasible swap?

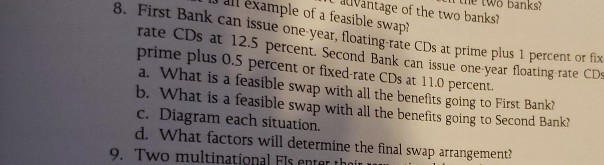

ee two banks vantage of the two banks? example of a feasible swap? 8. First Bank can issue one year, floating-rate CDs at prime plus 1 percent or fix rate CDs at 12.5 percent. Second Bank can issue one year floating rate CDs prime plus O.5 percent or fixed-rate CDs at 11.0 percent. a. What is a feasible swap with all the benefits going to First Bank? b. What is a feasible swap with all the benefits going to Second Bank C. Diagram each situation. d. What factors will determine the final swap arrangement? 9. Two multinational Fls enter theisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started