Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all work. explain how tou got answes for esch portion. answer entire question. thank you Your firm has a weighted average cost of capital

show all work. explain how tou got answes for esch portion. answer entire question. thank you

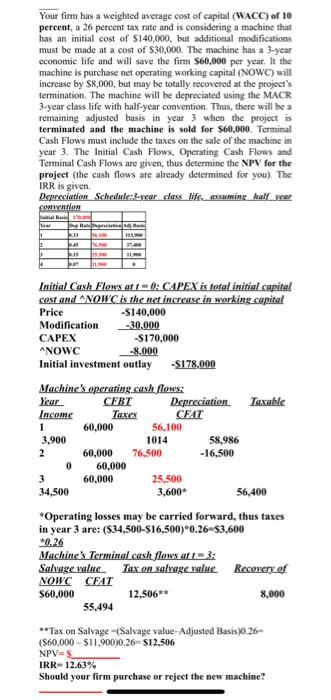

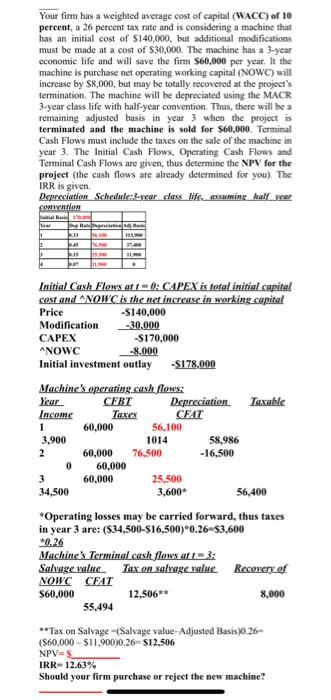

Your firm has a weighted average cost of capital (WACC) of 10 percent, a 26 percent tax rate and is considering a machine that has an initial cost of $140,000, but additional modifications must be made at a cost of $30,000. The machine has a 3-year economic life and will save the firm $60.000 per year. It the machine is purchase net operating working capital (NOWC) will increase by $8,000, but may be totally recovered at the project's termination. The machine will be depreciated using the MACR 3-year class life with half-year convention. Thus, there will be a remaining adjusted basis in year 3 when the project is terminated and the machine is sold for $60,000. Terminal Cash Flows must include the taxes on the sale of the machine in year 3. The Initial Cash Flows, Operating Cash Flows and Terminal Cash Flows are given, thus determine the NPV for the project (the cash flows are already determined for you). The IRR is given. Depreciation Schedulcorrer dass die a ming half rear Initial Cash Flows at t= 0: CAPEX is total initial capital cost and NOW is the net increase in working capital Price -S140,000 Modification --30,000 CAPEX -$170,000 ANOWC -8.000 Initial investment outlay S178,000 Machine's operating cash flows: Year CFBT Depreciation Taxable Income Taxes CEAT 60,000 56,100 3,900 1014 58,986 60,000 76,500 -16,500 0 60,000 60,000 25.500 34,500 3,600* 56,400 3 *Operating losses may be carried forward, thus taxes in year 3 are: (534,500-S16,500)*0.26-53,600 *0.26 Machine's Terminal cash flows at 3: Salvage value_ Tax on salvage value Recovery of NOWC CEAT S60,000 12,506** 8,000 55,494 **Tax on Salvage (Salvage value-Adjusted Basis)0.26 (560,000 - $11.90070.26=$12,506 NPV=S IRR-12.63% Should your firm purchase or reject the new machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started