Question

Show all work. Label and clearly explain your answer. This is very important. You must explain how you arrived at your answer in order to

Show all work. Label and clearly explain your answer. This is very important. You must explain how you arrived at your answer in order to get full credit.

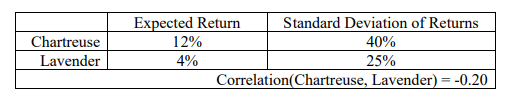

The expected returns, standard deviations, and correlation for Chartreuse Corporation and Lavender Ltd. are shown below.

a. You have $10,000 to invest and are trying to decide how much money to invest in each of the two companies. Calculate the expected return and the standard deviation for a portfolio consisting of $2000 of Chartreuse and $8000 of Lavender.

b. What is the lowest possible standard deviation for a portfolio consisting of Chartreuse and Lavender? What allocation between Chartreuse and Lavender produces the lowest standard deviation?

Chartreuse Lavender Expected Return 12% 4% Standard Deviation of Returns 40% 25% Correlation (Chartreuse, Lavender) = -0.20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started