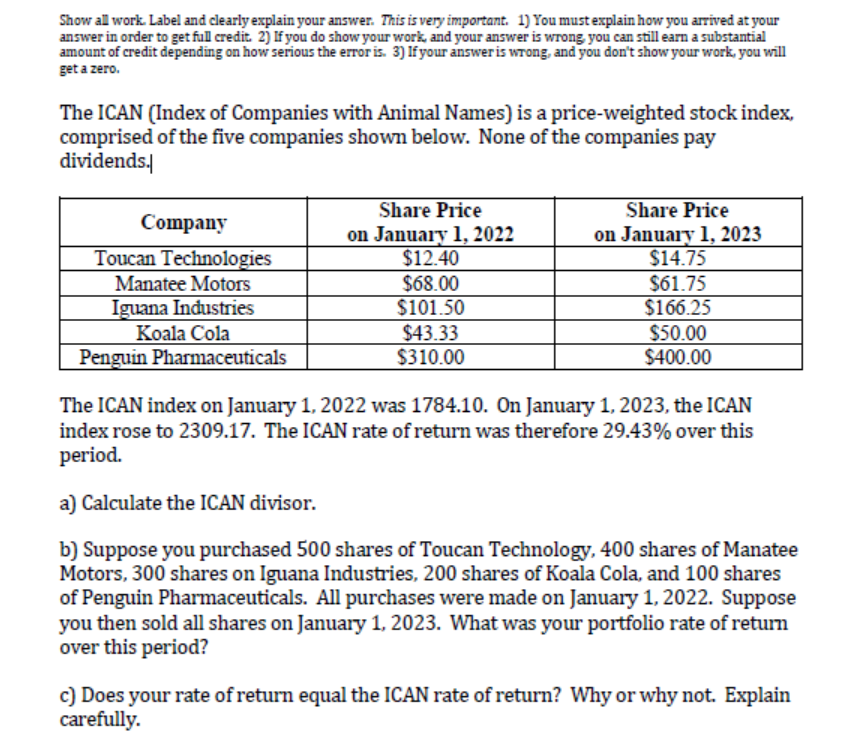

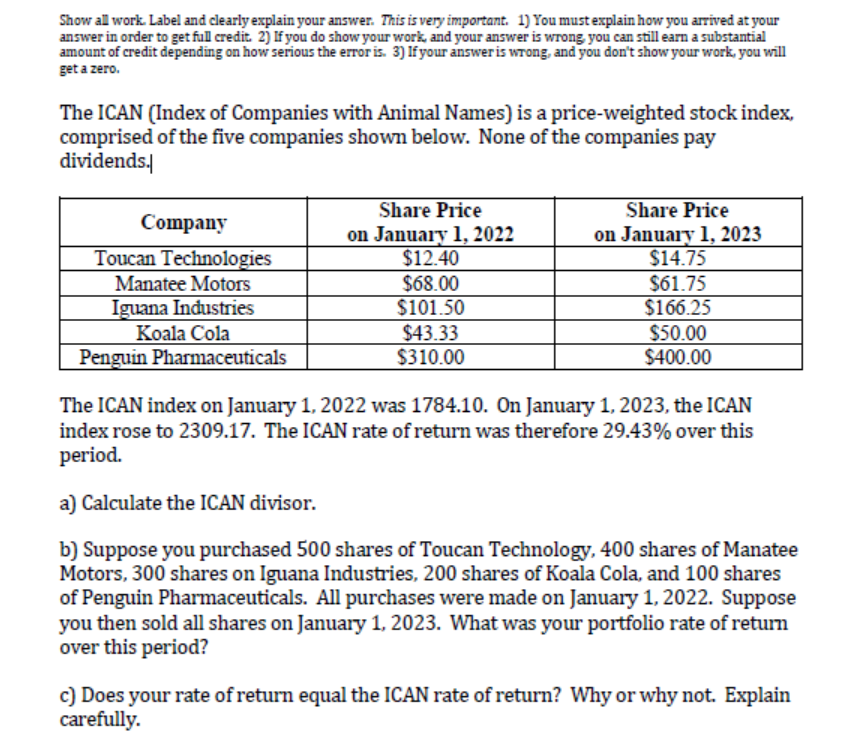

Show all work. Label and clearly explain your answer. This is very important. 1) You must explain how you arrived at your answer in order to get full credit 2) If you do show your work and your answer is wrong you can still earn a substantial amount of credit depending on how serious the error is. 3) Ifyour answer is wrong, and you don't show your work, you will get a zero. The ICAN (Index of Companies with Animal Names) is a price-weighted stock index, comprised of the five companies shown below. None of the companies pay dividends./ Company Toucan Technologies Manatee Motors Iguana Industries Koala Cola Penguin Pharmaceuticals Share Price on January 1, 2022 $12.40 $68.00 $101.50 $43.33 $310.00 Share Price on January 1, 2023 $14.75 $61.75 $166.25 $50.00 $400.00 The ICAN index on January 1, 2022 was 1784.10. On January 1, 2023, the ICAN index rose to 2309.17. The ICAN rate of return was therefore 29.43% over this period. a) Calculate the ICAN divisor. b) Suppose you purchased 500 shares of Toucan Technology, 400 shares of Manatee Motors, 300 shares on Iguana Industries, 200 shares of Koala Cola, and 100 shares of Penguin Pharmaceuticals. All purchases were made on January 1, 2022. Suppose you then sold all shares on January 1, 2023. What was your portfolio rate of return over this period? c) Does your rate of return equal the ICAN rate of return? Why or why not. Explain carefully. Show all work. Label and clearly explain your answer. This is very important. 1) You must explain how you arrived at your answer in order to get full credit 2) If you do show your work and your answer is wrong you can still earn a substantial amount of credit depending on how serious the error is. 3) Ifyour answer is wrong, and you don't show your work, you will get a zero. The ICAN (Index of Companies with Animal Names) is a price-weighted stock index, comprised of the five companies shown below. None of the companies pay dividends./ Company Toucan Technologies Manatee Motors Iguana Industries Koala Cola Penguin Pharmaceuticals Share Price on January 1, 2022 $12.40 $68.00 $101.50 $43.33 $310.00 Share Price on January 1, 2023 $14.75 $61.75 $166.25 $50.00 $400.00 The ICAN index on January 1, 2022 was 1784.10. On January 1, 2023, the ICAN index rose to 2309.17. The ICAN rate of return was therefore 29.43% over this period. a) Calculate the ICAN divisor. b) Suppose you purchased 500 shares of Toucan Technology, 400 shares of Manatee Motors, 300 shares on Iguana Industries, 200 shares of Koala Cola, and 100 shares of Penguin Pharmaceuticals. All purchases were made on January 1, 2022. Suppose you then sold all shares on January 1, 2023. What was your portfolio rate of return over this period? c) Does your rate of return equal the ICAN rate of return? Why or why not. Explain carefully