show all work please i will rate up

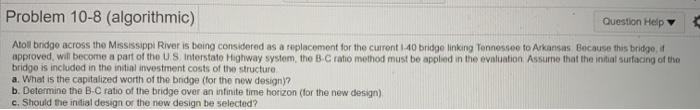

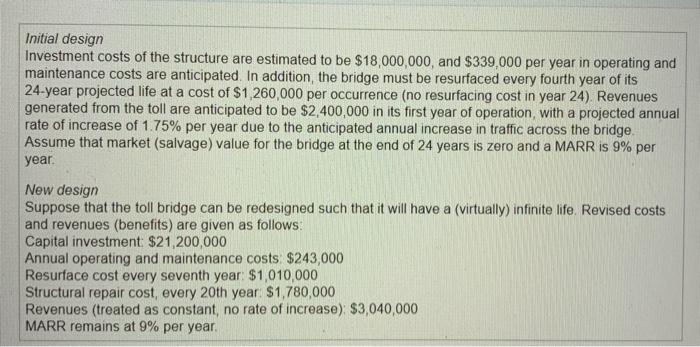

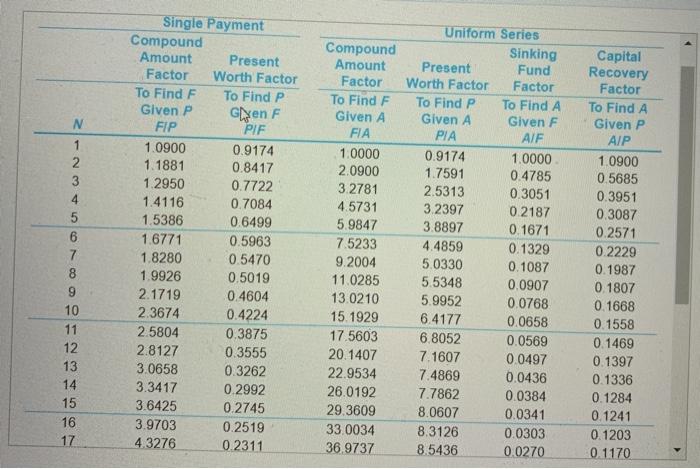

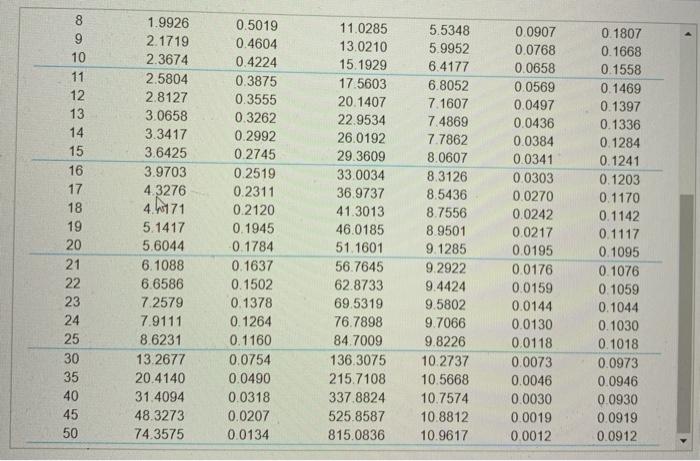

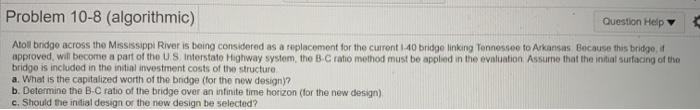

Problem 10-8 (algorithmic) Question Help Atoll bridge across the Mississippi River is being considered as a replacement for the current 140 bridge linking Tennessee to Arkansas Because this bridge, approved, will become a part of the US Interstate Highway system the B C ratio method must be applied in the evaluation Assume that the initial surfacing of the bridgo is included in the initial investment costs of the structure a. What is the capitalized worth of the bridge (for the new design)? b. Determine the B-C ratio of the bridge over an infinite time horizon (for the new design) c. Should the indial design of the new design be selected? Initial design Investment costs of the structure are estimated to be $18,000,000, and $339,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fourth year of its 24-year projected life at a cost of $1,260,000 per occurrence (no resurfacing cost in year 24). Revenues generated from the toll are anticipated to be $2,400,000 in its first year of operation, with a projected annual rate of increase of 1.75% per year due to the anticipated annual increase in traffic across the bridge Assume that market (salvage) value for the bridge at the end of 24 years is zero and a MARR is 9% per year New design Suppose that the toll bridge can be redesigned such that it will have a (virtually) infinite life. Revised costs and revenues (benefits) are given as follows: Capital investment $21,200,000 Annual operating and maintenance costs $243,000 Resurface cost every seventh year $1,010,000 Structural repair cost, every 20th year $1,780,000 Revenues (treated as constant, no rate of increase) $3,040,000 MARR remains at 9% per year. 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Single Payment Compound Amount Present Factor Worth Factor To Find F To Find P Given P GenF FIP PIE 1.0900 0.9174 1.1881 0.8417 1.2950 0.7722 1.4116 0.7084 1.5386 0.6499 1.6771 0.5963 1.8280 0.5470 1.9926 0.5019 2.1719 0.4604 2.3674 0.4224 2.5804 0.3875 2.8127 0.3555 3.0658 0.3262 3.3417 0.2992 3.6425 0.2745 3.9703 0.2519 4.3276 0.2311 Compound Amount Factor To Find F Given A FIA 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 9.2004 11.0285 13.0210 15.1929 17.5603 20.1407 22.9534 26.0192 29.3609 33.0034 36.9737 Uniform Series Sinking Present Fund Worth Factor Factor To Find P To Find A Given A Given F PIA AIF 0.9174 1.0000 1.7591 0.4785 2.5313 0.3051 3.2397 02187 3.8897 0.1671 4.4859 0.1329 5.0330 0.1087 5.5348 0.0907 5.9952 0.0768 6.4177 0.0658 6.8052 0.0569 7.1607 0.0497 7.4869 0.0436 7.7862 0.0384 8.0607 0.0341 8.3126 0.0303 8.5436 0.0270 Capital Recovery Factor To Find A Given P AIP 1.0900 0.5685 0.3951 0.3087 0.2571 0.2229 0.1987 0.1807 0.1668 0.1558 0.1469 0.1397 0.1336 0.1284 0.1241 0.1203 0.1170 1.9926 2.1719 2.3674 2.5804 2.8127 3.0658 3.3417 3.6425 3.9703 4.3276 4.71 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 45 50 5.1417 5.6044 6.1088 6.6586 7.2579 7.9111 8.6231 13.2677 20.4140 31.4094 48.3273 74 3575 0.5019 0.4604 0.4224 0.3875 0.3555 0.3262 0.2992 0.2745 0.2519 0.2311 0.2120 0.1945 0 1784 0.1637 0.1502 0.1378 0.1264 0.1160 0.0754 0.0490 0.0318 0.0207 0.0134 11.0285 13.0210 15.1929 17.5603 20.1407 22.9534 26.0192 29.3609 33.0034 36.9737 41.3013 46.0185 51 1601 56.7645 62.8733 69.5319 76.7898 84.7009 136.3075 215.7108 337.8824 525.8587 815.0836 5.5348 5.9952 6.4177 6.8052 7.1607 7.4869 7.7862 8.0607 8.3126 8.5436 8.7556 8.9501 9 1285 9.2922 9.4424 9.5802 9.7066 9.8226 10.2737 10.5668 10.7574 10.8812 10.9617 0.0907 0.0768 0.0658 0.0569 0.0497 0.0436 0.0384 0.0341 0.0303 0.0270 0.0242 0.0217 0.0195 0.0176 0.0159 0.0144 0.0130 0.0118 0.0073 0.0046 0.0030 0.0019 0.0012 0.1807 0.1668 0.1558 0 1469 0.1397 0.1336 0.1284 0.1241 0.1203 0.1170 0.1142 0 1117 0.1095 0.1076 0.1059 0.1044 0.1030 0.1018 0.0973 0.0946 0.0930 0.0919 0.0912 Problem 10-8 (algorithmic) Question Help Atoll bridge across the Mississippi River is being considered as a replacement for the current 140 bridge linking Tennessee to Arkansas Because this bridge, approved, will become a part of the US Interstate Highway system the B C ratio method must be applied in the evaluation Assume that the initial surfacing of the bridgo is included in the initial investment costs of the structure a. What is the capitalized worth of the bridge (for the new design)? b. Determine the B-C ratio of the bridge over an infinite time horizon (for the new design) c. Should the indial design of the new design be selected? Initial design Investment costs of the structure are estimated to be $18,000,000, and $339,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fourth year of its 24-year projected life at a cost of $1,260,000 per occurrence (no resurfacing cost in year 24). Revenues generated from the toll are anticipated to be $2,400,000 in its first year of operation, with a projected annual rate of increase of 1.75% per year due to the anticipated annual increase in traffic across the bridge Assume that market (salvage) value for the bridge at the end of 24 years is zero and a MARR is 9% per year New design Suppose that the toll bridge can be redesigned such that it will have a (virtually) infinite life. Revised costs and revenues (benefits) are given as follows: Capital investment $21,200,000 Annual operating and maintenance costs $243,000 Resurface cost every seventh year $1,010,000 Structural repair cost, every 20th year $1,780,000 Revenues (treated as constant, no rate of increase) $3,040,000 MARR remains at 9% per year. 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Single Payment Compound Amount Present Factor Worth Factor To Find F To Find P Given P GenF FIP PIE 1.0900 0.9174 1.1881 0.8417 1.2950 0.7722 1.4116 0.7084 1.5386 0.6499 1.6771 0.5963 1.8280 0.5470 1.9926 0.5019 2.1719 0.4604 2.3674 0.4224 2.5804 0.3875 2.8127 0.3555 3.0658 0.3262 3.3417 0.2992 3.6425 0.2745 3.9703 0.2519 4.3276 0.2311 Compound Amount Factor To Find F Given A FIA 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 9.2004 11.0285 13.0210 15.1929 17.5603 20.1407 22.9534 26.0192 29.3609 33.0034 36.9737 Uniform Series Sinking Present Fund Worth Factor Factor To Find P To Find A Given A Given F PIA AIF 0.9174 1.0000 1.7591 0.4785 2.5313 0.3051 3.2397 02187 3.8897 0.1671 4.4859 0.1329 5.0330 0.1087 5.5348 0.0907 5.9952 0.0768 6.4177 0.0658 6.8052 0.0569 7.1607 0.0497 7.4869 0.0436 7.7862 0.0384 8.0607 0.0341 8.3126 0.0303 8.5436 0.0270 Capital Recovery Factor To Find A Given P AIP 1.0900 0.5685 0.3951 0.3087 0.2571 0.2229 0.1987 0.1807 0.1668 0.1558 0.1469 0.1397 0.1336 0.1284 0.1241 0.1203 0.1170 1.9926 2.1719 2.3674 2.5804 2.8127 3.0658 3.3417 3.6425 3.9703 4.3276 4.71 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 45 50 5.1417 5.6044 6.1088 6.6586 7.2579 7.9111 8.6231 13.2677 20.4140 31.4094 48.3273 74 3575 0.5019 0.4604 0.4224 0.3875 0.3555 0.3262 0.2992 0.2745 0.2519 0.2311 0.2120 0.1945 0 1784 0.1637 0.1502 0.1378 0.1264 0.1160 0.0754 0.0490 0.0318 0.0207 0.0134 11.0285 13.0210 15.1929 17.5603 20.1407 22.9534 26.0192 29.3609 33.0034 36.9737 41.3013 46.0185 51 1601 56.7645 62.8733 69.5319 76.7898 84.7009 136.3075 215.7108 337.8824 525.8587 815.0836 5.5348 5.9952 6.4177 6.8052 7.1607 7.4869 7.7862 8.0607 8.3126 8.5436 8.7556 8.9501 9 1285 9.2922 9.4424 9.5802 9.7066 9.8226 10.2737 10.5668 10.7574 10.8812 10.9617 0.0907 0.0768 0.0658 0.0569 0.0497 0.0436 0.0384 0.0341 0.0303 0.0270 0.0242 0.0217 0.0195 0.0176 0.0159 0.0144 0.0130 0.0118 0.0073 0.0046 0.0030 0.0019 0.0012 0.1807 0.1668 0.1558 0 1469 0.1397 0.1336 0.1284 0.1241 0.1203 0.1170 0.1142 0 1117 0.1095 0.1076 0.1059 0.1044 0.1030 0.1018 0.0973 0.0946 0.0930 0.0919 0.0912