Answered step by step

Verified Expert Solution

Question

1 Approved Answer

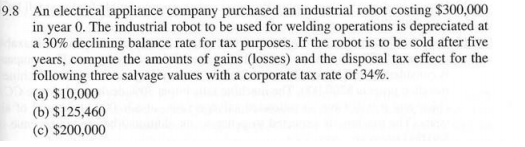

Show all working, try not to use excel please. 9.8 An electrical appliance company purchased an industrial robot costing $300,000 in year 0. The industrial

Show all working, try not to use excel please.

9.8 An electrical appliance company purchased an industrial robot costing $300,000 in year 0. The industrial robot to be used for welding operations is depreciated at a 30% declining balance rate for tax purposes. If the robot is to be sold after five years, compute the amounts of gains (losses) and the disposal tax effect for the following three salvage values with a corporate tax rate of 34%. (a) $10,000 (b) $125,460 (c) $200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started