Show as much work as you can :)

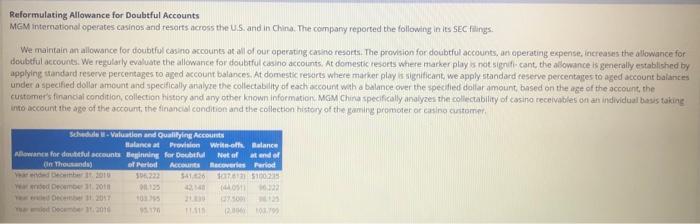

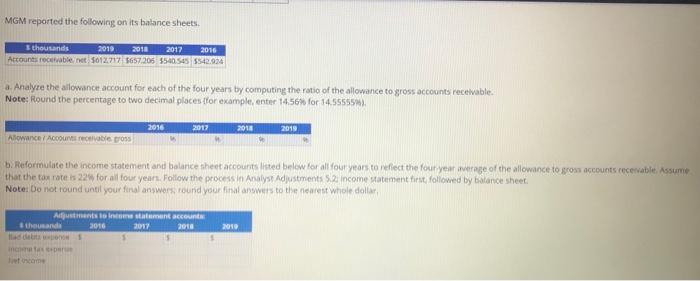

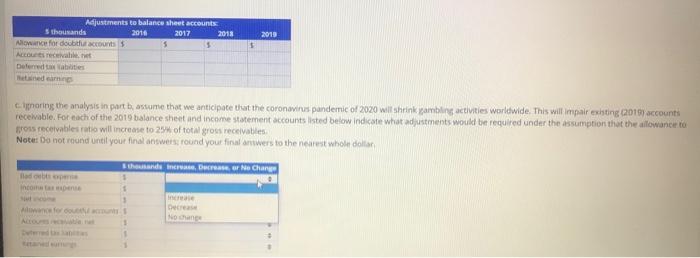

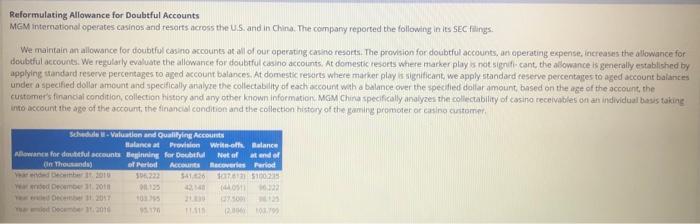

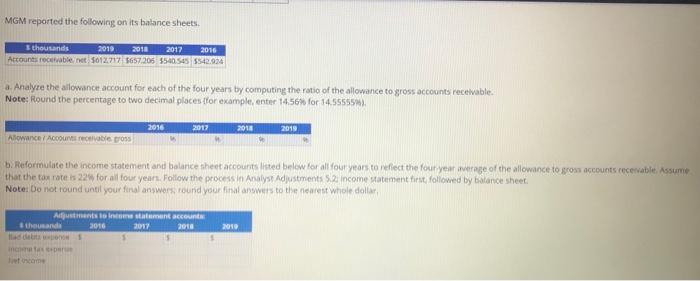

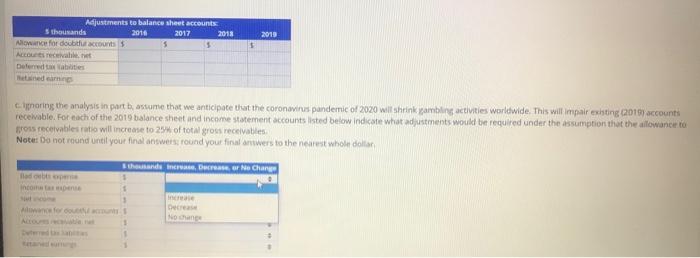

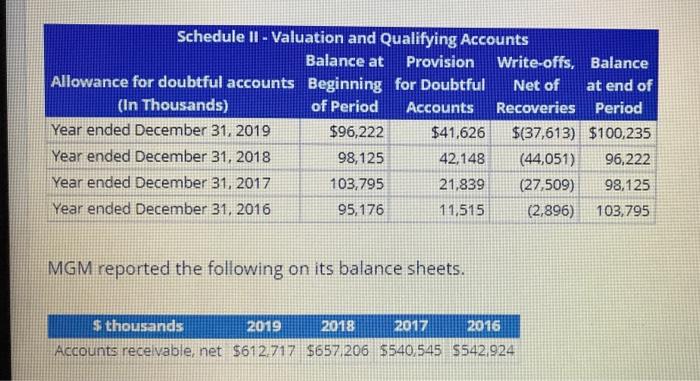

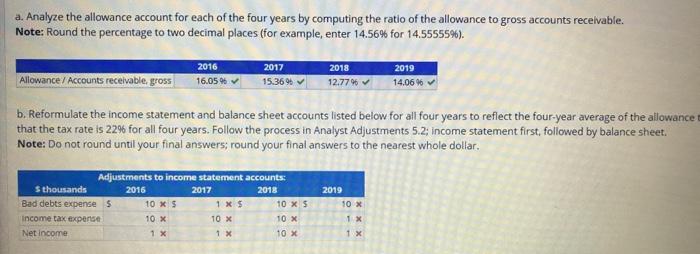

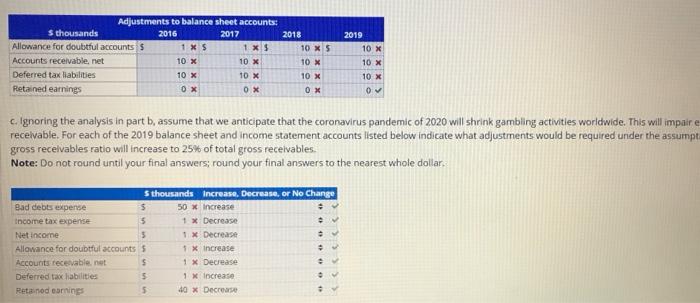

Reformulating Allowance for Doubtful Accounts MGM international operates casinos and resorts across the US and in China. The company reported the following in its SEC filings. We maintain an allowance for doubtful casino accounts at all of our operating casino resorts. The provision for doubtful accounts, an operating expense, increases the allowance for doubtful accounts. We regularly evaluate the allowance for doubtful casino accounts. At domestic resorts where marker play not significant, the allowance is generally established by applying standard reserve percentages to aged account balances At domestic resorts where marker play significant we apply standard reserve percentages to aged account balances under a specified dollar amount and specifically analyze the collectability of each account with a balance over the specified dollar amount, based on the age of the account, the customer's financial condition, collection history and any other known information MGM China specifically analyzes the collectability of casino receivables on an individual basis taking into account the age of the account, the financial condition and the collection history of the gaming promoter or casino customer Schedule Valuation and Qualifying Account Balance at Provision Writmotte Balance Allowance for del account Beginning for Doubtful Net af atender On Monda oferol Accounts Recoveries Period 36.222 07651702 Wood December 2011 12 03 December 17 2009 MGM reported the following on its balance sheets. thousands 2017 2016 2010 2018 Accounts receivable.net, 012.717 5657.205 5540545 5542.924 a. Analyze the allowance account for each of the four years by computing the ratio of the allowance to gross accounts receivable. Note: Round the percentage to two decimal places for example, enter 1456% for 14.55555) 2018 2013 2018 2018 Allowance / ACCOUVross b. Reformulate the income statement and balance sheet accounts listed below for all four years to reflect the four year average of the allowance to gross accounts receivable. Assume that the tax rate is 22w for all four years. Follow the process in Analyst Adjustments 5.2 income statement fint followed by balance sheet. Note: Do not round until your final answers, round your final anwers to the nearest whole dollar Adjustments in statement account thousand 2016 2017 2018 2010 et som 2010 $ Adjustments to balance sheet accounts thousands 2016 2017 2018 Ale for doubts Accueil Defend tables and eaming coring the analysis in part bastume that we anticipate that the coronavirus pandemic of 2020 will shrink gambling activities worldwide. This will impair existing 2015 accounts receivable for each of the 2019 balance sheet and income statement accounts listed below indicate what adjustments would be required under the assumption that the allowance to tross receivables ratio will increase to 25% of total grous receivables Note: Do not round until your final answers, round your final answers to the nearest wholu dollar hand increas, Dresser Ne Chan Income 3 Decrease Acne Reformulating Allowance for Doubtful Accounts MGM International operates casinos and resorts across the US and in China. The company reported the following is stillings We maintain an allowance for doubtful casino accounts at all of our operating casino resorts. The provision for doubtful accounts, an operating expense, increases the allowance for doubtful accounts. We regularly evaluate the allowance for doubtful casino accounts. At domestic resorts where marker play is not significant, the allowance is generally established by applying Standard reserve percentages to aged account balances. Al domestic resorts where marker play is significant we apply standard reserve percentages to aged account balances under a specified dollar amount and specifically analyze the collectability of each account with a balance over the specified dollar amount based on the age of the account the customers inancial condition collection history and any other known information. MGM China specifically analyzes the collectability of casino receivables on an individual basis taking into account the age of the account the financial condition and the collection history of the gaming promoter or casino customer Schedule - Valuation and Qualifying Accounts Balance at Provision of Balance Allowance for del accounts Beginning for Dewul Net af ut end of On Thomanda of Period Account Recoveries Period STAT235 Ward 11.2010 42051) 962 web. 2017 2007 et concert 3517 20 2 MOM reported the flowing on its balance sheets thousands 2010 2018 2010 Schedule II - Valuation and Qualifying Accounts Balance at Provision Write-offs, Balance Allowance for doubtful accounts Beginning for Doubtful Net of at end of (In Thousands) of Period Accounts Recoveries Period Year ended December 31, 2019 $96,222 $41,626 $(37,613) $100,235 Year ended December 31, 2018 98,125 42,148 (44,051) 96,222 Year ended December 31, 2017 103,795 21,839 (27,509) 98,125 Year ended December 31, 2016 95,176 11,515 (2,896) 103,795 MGM reported the following on its balance sheets. S thousands 2019 2018 2017 2016 Accounts receivable, net $612.717 5657 206 $540,545 $542.924 a. Analyze the allowance account for each of the four years by computing the ratio of the allowance to gross accounts receivable. Note: Round the percentage to two decimal places (for example, enter 14.56% for 14,55555%). 2016 2017 2018 2019 Allowance / Accounts receivable, gross 16.05% 15.36% 12.77% 14.06% b. Reformulate the income statement and balance sheet accounts listed below for all four years to reflect the four-year average of the allowance that the tax rate is 22% for all four years. Follow the process in Analyst Adjustments 5.2: Income statement first, followed by balance sheet. Note: Do not round until your final answers: round your final answers to the nearest whole dollar. 2019 Adjustments to income statement accounts: S thousands 2016 2017 2018 Bad debts expenses 10 XS 1 x 5 10 X 5 income tax expense 10 X 10 X 10 X 10 x 1 x Net Income 1 x 1 x 10 X 1 x Adjustments to balance sheet accounts: thousands 2016 2017 2018 2019 1 XS 1 x 10 X 5 10 X 10 X 10 X 10 X 10 X Allowance for doubtful accounts 5 Accounts receivable, net Deferred tax liabilities Retained earnings 10 X 10 X 10 X 10 X OX 0 X OX 0 c.Ignoring the analysis in part b, assume that we anticipate that the coronavirus pandemic of 2020 will shrink gambling activities worldwide. This will impaire receivable. For each of the 2019 balance sheet and income statement accounts listed below indicate what adjustments would be required under the assumpt gross receivables ratio will increase to 25% of total gross receivables. Note: Do not round until your final answers; round your final answers to the nearest whole dollar. S thousands increase. Decrease, or No Change Bad debts expense $ 50 x Increase income tax expense 5 1 x Decrease 1 x Decrease 1 x increase Net incorne 5 Allowance for doubtful accounts 5 Accounts receivable net S Deferred tax habilities 5 1 x Decrease 1 x increase 2 Retained earnings 40 x Decrease