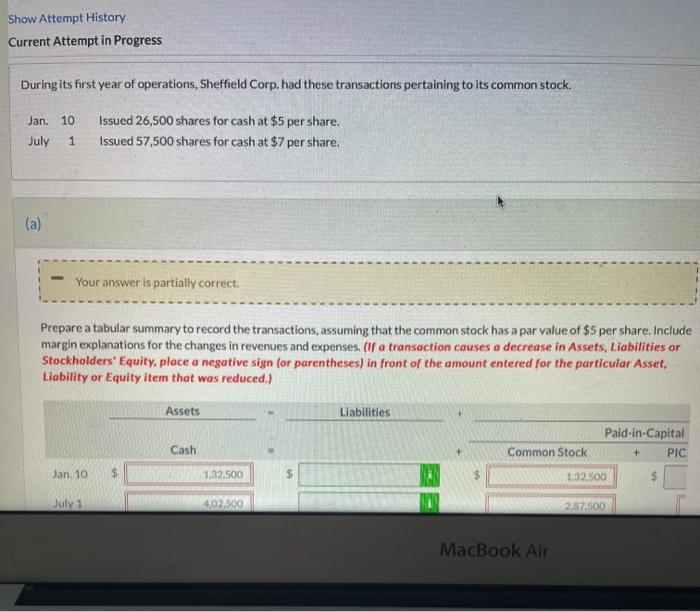

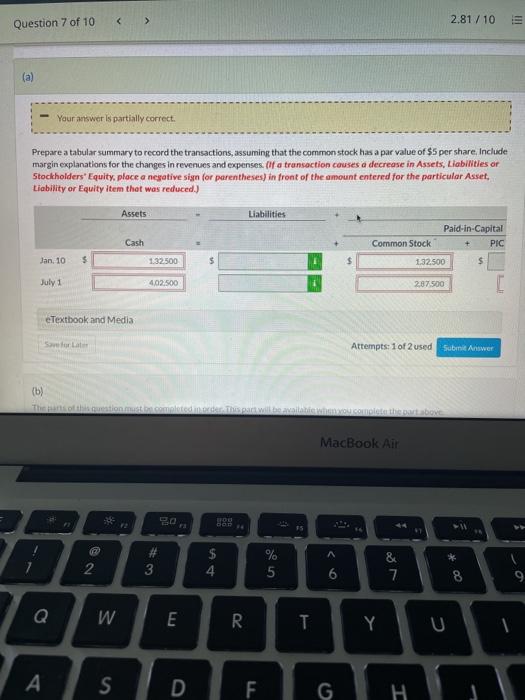

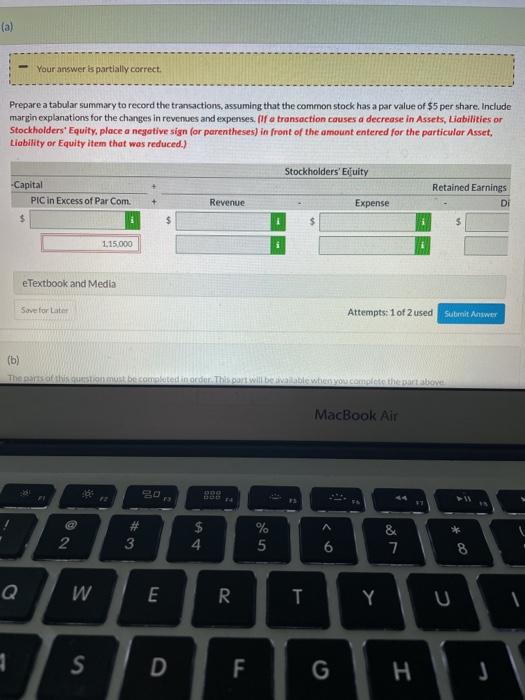

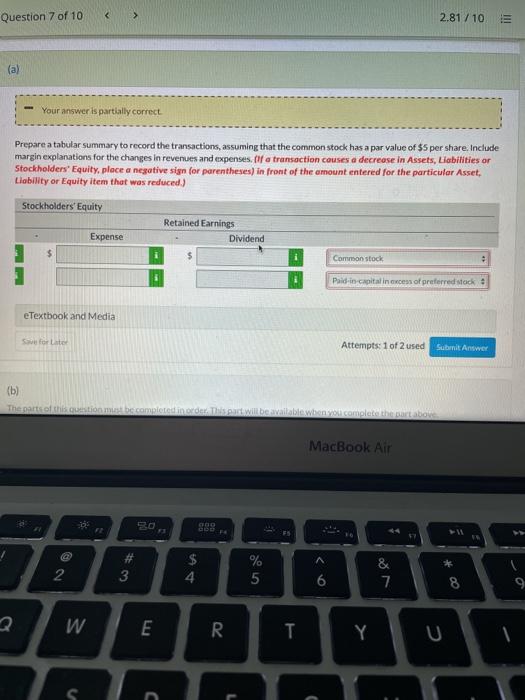

Show Attempt History Current Attempt in Progress During its first year of operations, Sheffield Corp. had these transactions pertaining to its common stock. Jan. 10 July 1 Issued 26,500 shares for cash at $5 per share. Issued 57,500 shares for cash at $7 per share. (a) Your answer is partially correct. Prepare a tabular summary to record the transactions, assuming that the common stock has a par value of $5 per share. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Pald-in-Capital + PIC Cash Common Stock Jan. 10 $ 1.32.500 1.32.500 July 1 4,02,500 2.87.500 MacBook Air 2.81 / 10 Question 7 of 10 (a) Your answer is partially correct. Prepare a tabular summary to record the transactions, assuming that the common stock has a par value of $5 per share. Include margin explanations for the changes in revenues and expenses. Of a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset Liability or Equity item that was reduced.) Assets Liabilities Cash Paid-in-Capital Common Stock PIC 1:32.500 $ + Jan, 10 $ 1.32500 5 $ July 1 4.02.500 287.500 [ e Textbook and Media Attempts: 1 of 2 used Submit Answer (6) MacBook Air pa BOB A 2 $ 4 3 % 5 & 7 6 8 Q W E R. T T Y A S DF G H (a) Your answer is partially correct Prepare a tabular summary to record the transactions, assuming that the common stock has a par value of $5 per share. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders'Etuity -Capital PIC in Excess of Par Com. Retained Earnings Di Revenue Expense $ 115.000 e Textbook and Media Save for Later Attempts: 1 of 2 used Submit Answer (b) The parts of ton must be comated in order. This will be able when you complete the partaboy MacBook Air D 44 $ # 3 & 2 % 5 6 7 8 Q W E R T Y 1 S D F G . J 2.81 / 10 ill (a) Your answer is partially correct Prepare a tabular summary to record the transactions, assuming that the common stock has a par value of $5 per share. Include margin explanations for the changes in revenues and expenses. Of a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Dividend Expense i Common stock Paid-in-capital in excess of preferred stock e Textbook and Media Sve for later Attempts: 1 of 2 used Submit Answer (b) The parts of this question become despart will be availablewbonyol complete the above MacBook Air Ba 00 #3 2 $ 4 % 5 & 7 6 8 W E R. T T Y C