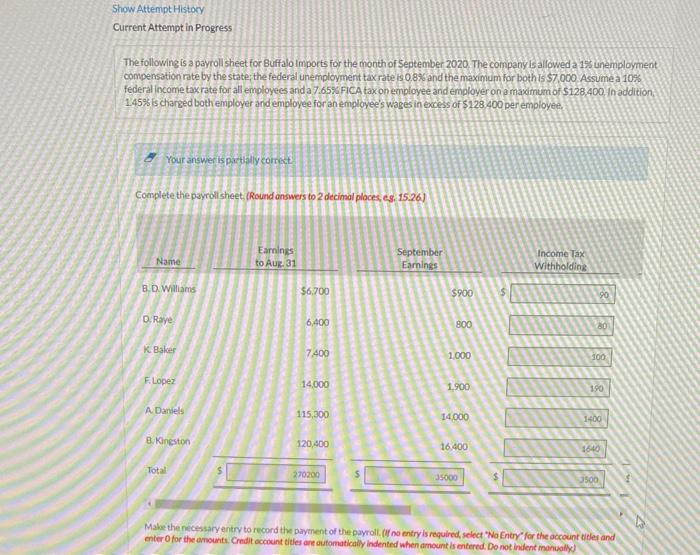

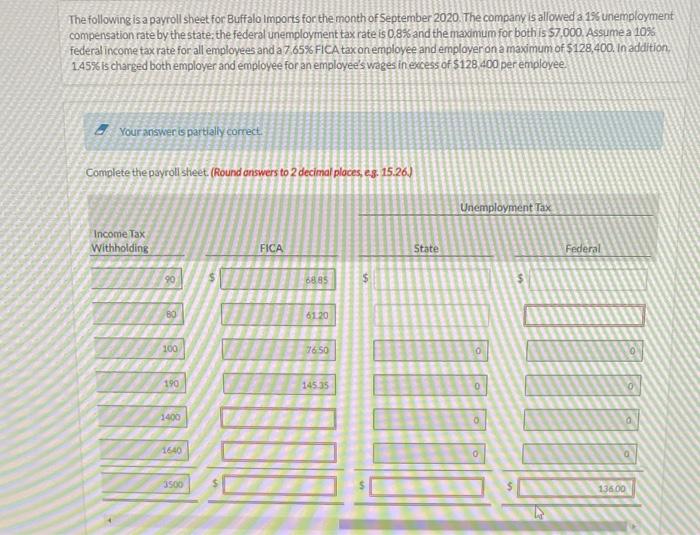

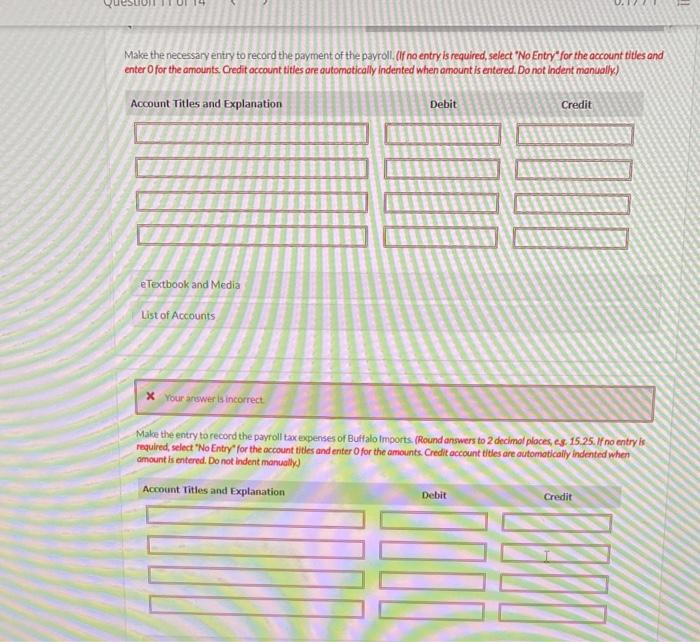

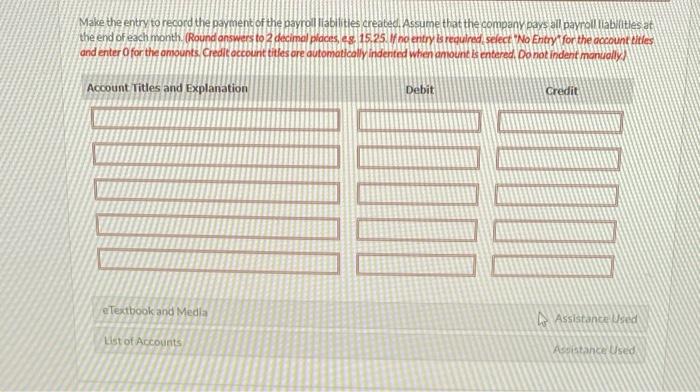

Show Attempt History Current Attempt in Progress The following is a payroll sheet for Buffalo Imports for the month of September 2020. The company is allowed a 1% unemployment compensation rate by the state the federal unemployment tax rate is 0.8% and the maximum for both is $7.000 Assume a 10% federal income tax rate for all employees and a 7.65% FICA tax on employee and employer on a maximum of $128,400. In addition 145% is charged both employer and employee for an employee's wages in excess of $128.400 per employee. Your answer is partially correct Complete the payroll sheet. (Round answers to 2 decimal places, es 15.26) Name Earnings to Aug. 31 September Earnings Income Tax Withholding B.D. Williams $6,700 $900 $ 90 DRaye 6,400 800 20 K. Baker 7400 1000 100 1!!!!!! F. Lopez 14,000 1.900 190 A Daniels 115,300 14000 1400 B. Kingston 120,400 16.400 1640 Total 270200 35000 3500 Make the necessary entry to record the payment of the payroll. (if no entry is required, select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when amount is entered. Do not indent manually The following is a payroll sheet for Buffalo Imports for the month of September 2020. The company is allowed a 15 unemployment compensation rate by the state: the federal unemployment tax rate is 0.8% and the maximum for both is 57,000. Assume a 10% federal income tax rate for all employees and a 7,65% FICA taxon employee and employer on a maximum of $128,400. In addition, 145% is charged both employer and employee for an employee's wages in excess of $128.400 per employee, Your answer is partially correct. Complete the payroll sheet. (Round answers to 2 decimal places, eg. 15.26.) Unemployment Tax Income Tax Withholding FICA State Federal 90 8885 $ 80 61 20 100 76.50 0 190 14535 0 O 1640 3500 13600 Make the necessary entry to record the payment of the payroll. (If no entry is required, select "No Entry* for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not Indent manually) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts X your answer is incorrect Make the entry to record the payroll tax expenses of Buffalo imports. (Round answers to 2 decimal places, s. 15.25. If no entry is required, select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit WA Make the entry to record the payment of the payroll liabilities created. Assume that the company pays all payroll liabilities at the end of each month (Round answers to 2 decimal places, eg 15.25. no entry required select "No Entry for the dacount et les and enter for the amounts Credit account titles are automatically indented when an lount is entered. Do not indent manually Account Titles and Explanation Debit Credit DIO eTextbook and Media List of Accounts Assistance Used Atance Used