Answered step by step

Verified Expert Solution

Question

1 Approved Answer

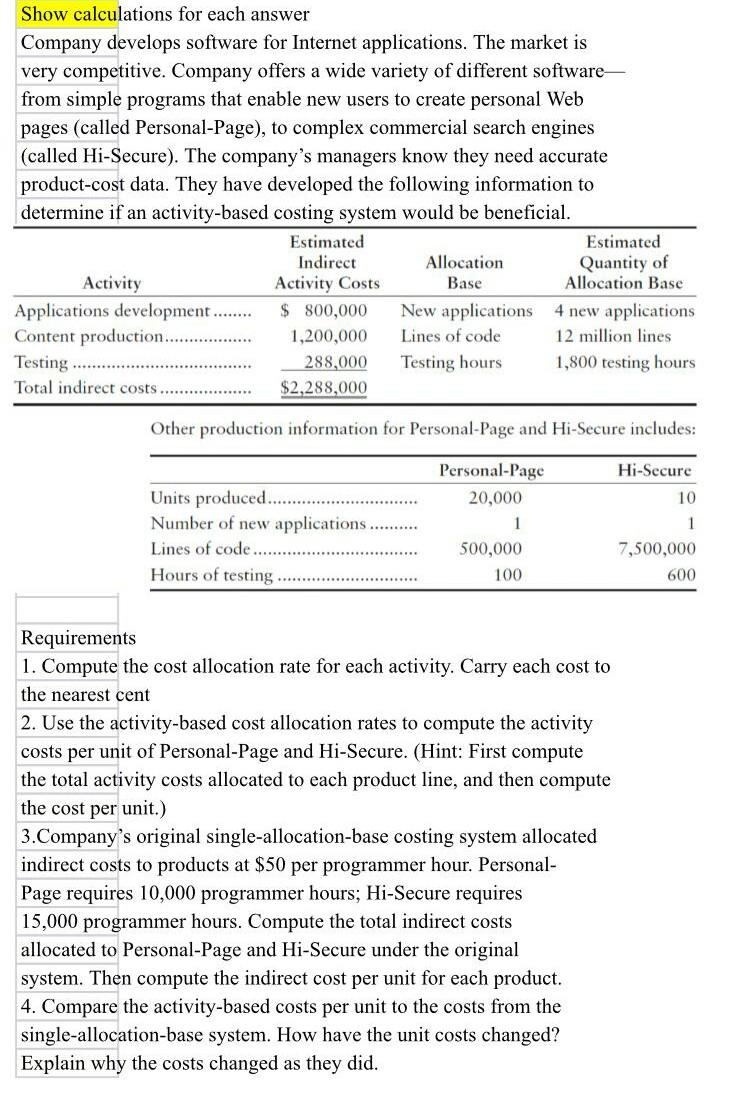

Show calculations for each answer Company develops software for Internet applications. The market is very competitive. Company offers a wide variety of different software from

Show calculations for each answer Company develops software for Internet applications. The market is very competitive. Company offers a wide variety of different software from simple programs that enable new users to create personal Web pages (called Personal-Page), to complex commercial search engines (called Hi-Secure). The company's managers know they need accurate product-cost data. They have developed the following information to determine if an activity-based costing system would be beneficial. Estimated Estimated Indirect Allocation Quantity of Activity Activity Costs Base Allocation Base Applications development ........ $ 800,000 New applications 4 new applications Content production 1,200,000 Lines of code 12 million lines Testing 288,000 Testing hours 1,800 testing hours Total indirect costs $2,288,000 Other production information for Personal-Page and Hi-Secure includes: Personal Page Hi-Secure 20,000 10 1 1 Units produced. Number of new applications Lines of code..... Hours of testing ....... 500,000 7,500,000 100 600 Requirements 1. Compute the cost allocation rate for each activity. Carry each cost to the nearest cent 2. Use the activity-based cost allocation rates to compute the activity costs per unit of Personal-Page and Hi-Secure. (Hint: First compute the total activity costs allocated to each product line, and then compute the cost per unit.) 3.Company's original single-allocation-base costing system allocated indirect costs to products at $50 per programmer hour. Personal- Page requires 10,000 programmer hours; Hi-Secure requires 15,000 programmer hours. Compute the total indirect costs allocated to Personal-Page and Hi-Secure under the original system. Then compute the indirect cost per unit for each product. 4. Compare the activity-based costs per unit to the costs from the single-allocation-base system. How have the unit costs changed? Explain why the costs changed as they did

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started