Question

Show calculations for each question if calculations are required. Keep two decimals for percentages and currency amounts. Refer to the information below for Cemex for

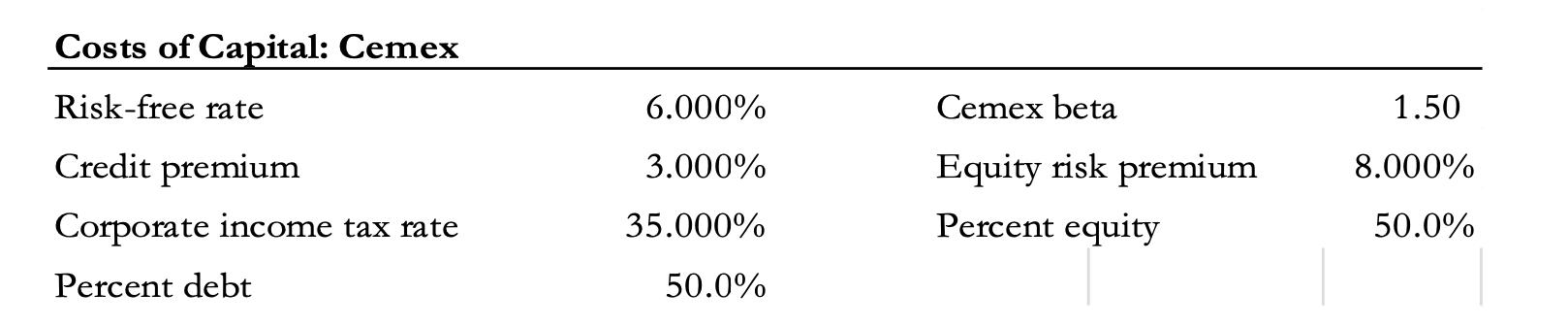

Refer to the information below for Cemex for Questions 1 and 2

1.What is the firm's cost of equity?

2.What is the firm's WACC?

Costs of Capital: Cemex Risk-free rate Credit premium Corporate income tax rate Percent debt 6.000% 3.000% 35.000% 50.0% Cemex beta Equity risk premium Percent equity 1.50 8.000% 50.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of Cemexs cost of equity using the Capital Asset ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Creating Value in a Dynamic Business Environment

Authors: Ronald W. Hilton

9th edition

78110912, 978-0078110917

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App