Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show equations, formulas and diagrams Part I The only years A liability consists of a payment of $1000 to be paid year from nowe and

show equations, formulas and diagrams

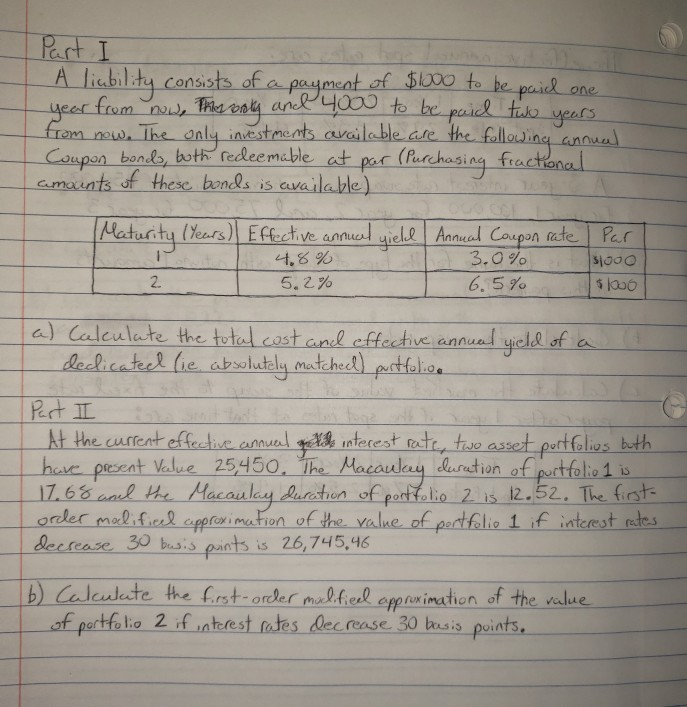

Part I The only years A liability consists of a payment of $1000 to be paid year from nowe and 4000 to be paid two from now. The only investments available are the following annual Coupon bonds, both redeemable at par fractional amounts of these bonds is available) (Purchasing Maturity ( Years) Effective annual yield Annual Coupon rate 4.8% 5.2% 3.0% 6.5% Par S1000 $1000 2 a a) Calculate the total cost and effective annual yield of declicated (ie absolutely matched) portfolico Part I At the current effective annual de interest rate, two asset portfolios both have present Value 25,450. The Macaulay duration of portfolio 1 is 17.6% and the Macaulay duration of portfolio 2 is 12.52. The first order modificed approximation of the value of portfolio 1 if interest rates decrease 30 busis points is 26,745,46 (6) Calculate the first-order modificed approximation of the value of portfolio 2 if interest rates decrease 30 busis points. Part I The only years A liability consists of a payment of $1000 to be paid year from nowe and 4000 to be paid two from now. The only investments available are the following annual Coupon bonds, both redeemable at par fractional amounts of these bonds is available) (Purchasing Maturity ( Years) Effective annual yield Annual Coupon rate 4.8% 5.2% 3.0% 6.5% Par S1000 $1000 2 a a) Calculate the total cost and effective annual yield of declicated (ie absolutely matched) portfolico Part I At the current effective annual de interest rate, two asset portfolios both have present Value 25,450. The Macaulay duration of portfolio 1 is 17.6% and the Macaulay duration of portfolio 2 is 12.52. The first order modificed approximation of the value of portfolio 1 if interest rates decrease 30 busis points is 26,745,46 (6) Calculate the first-order modificed approximation of the value of portfolio 2 if interest rates decrease 30 busis pointsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started