Answered step by step

Verified Expert Solution

Question

1 Approved Answer

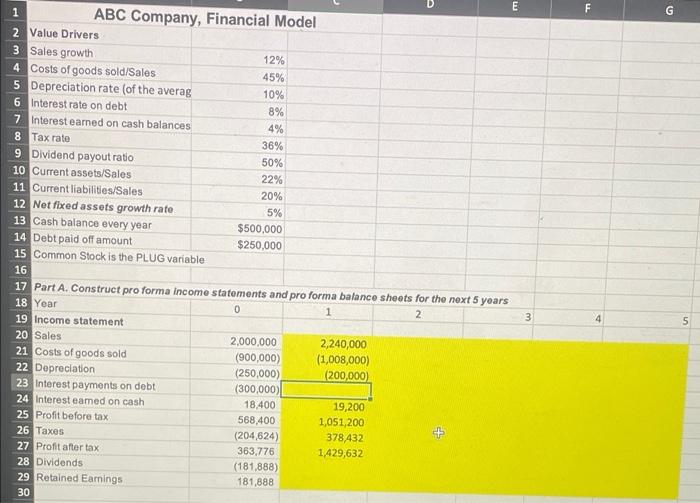

show formulas. thank you 1 G E ABC Company, Financial Model 2 Value Drivers 3 Sales growth 12% 4 Costs of goods sold/Sales 45% 5

show formulas. thank you

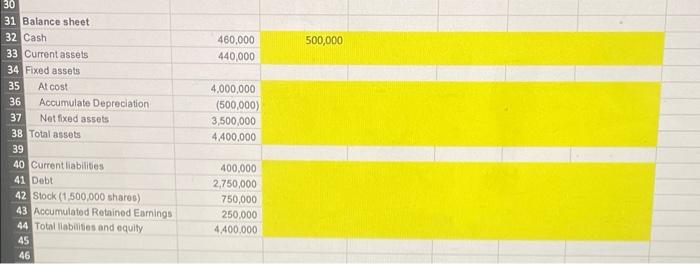

1 G E ABC Company, Financial Model 2 Value Drivers 3 Sales growth 12% 4 Costs of goods sold/Sales 45% 5 Depreciation rate (of the averag 10% 6 Interest rate on debt 8% 7 Interest earned on cash balances 4% 8 Tax rate 36% 9 Dividend payout ratio 50% 10 Current assets/Sales 22% 11 Current liabilities/Sales 20% 12 Net fixed assets growth rate 5% 13 Cash balance every year $500,000 14 Debt paid off amount $250,000 15 Common Stock is the PLUG variable 16 17 Part A. Construct pro forma income statements and pro forma balance sheets for the next 5 years 18 Year 0 1 2 19 Income statement 20 Sales 2,000,000 2,240,000 21 Costs of goods sold (900,000) (1,008,000) 22 Depreciation (250,000) (200,000) 23 Interest payments on debt (300,000) 24 Interest eamed on cash 18.400 19,200 25 Profit before tax 568,400 1,051,200 26 Taxes (204,624) 378,432 27 Profit after tax 363.776 1,429,632 28 Dividends (181,888) 29 Retained Earnings 181,888 30 3 4 5 500,000 460,000 440,000 30 31 Balance sheet 32 Cash 33 Current assets 34 Fixed assets 35 Al cost 36 Accumulate Depreciation 37 Netfixed assets 38 Total assets 39 40 Current liabilities 41 Debt 42 Stock (1,500,000 shares) 43 Accumulated Retained Earnings 44 Total liabilities and equity 45 46 4,000,000 (500,000) 3,500,000 4.400,000 400,000 2,750,000 750,000 250,000 4.400.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started