Answered step by step

Verified Expert Solution

Question

1 Approved Answer

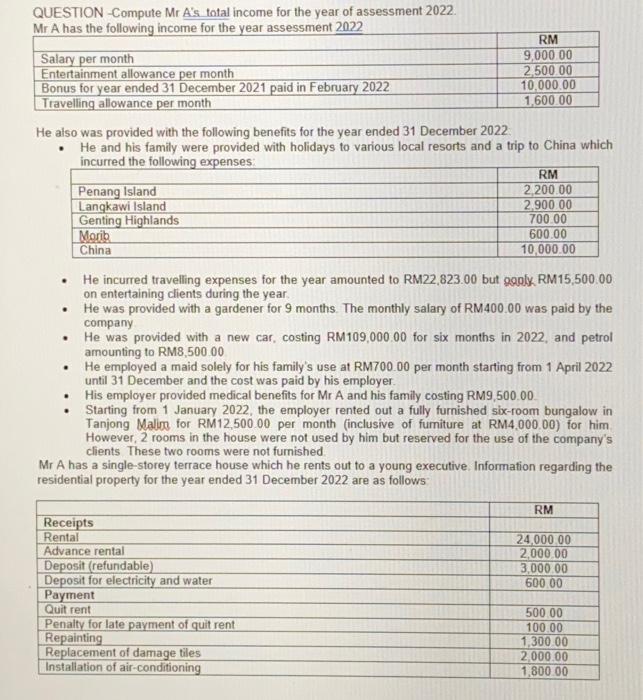

show full calculation and explanation QUESTION -Compute Mr A's total income for the year of assessment 2022. Mr A has the following income for the

show full calculation and explanation

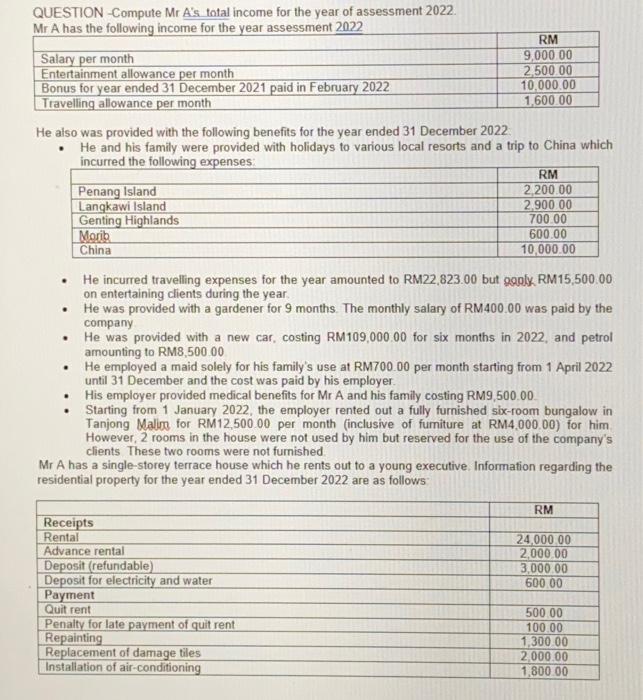

QUESTION -Compute Mr A's total income for the year of assessment 2022. Mr A has the following income for the vear assessment 2022 He also was provided with the following benefits for the year ended 31 December 2022 - He and his family were provided with holidays to various local resorts and a trip to China which incurred the followina exnenses: - He incurred travelling expenses for the year amounted to RM22,823.00 but ogoly. RM15,500.00 on entertaining clients during the year - He was provided with a gardener for 9 months. The monthly salary of RM 400.00 was paid by the company - He was provided with a new car, costing RM109,000.00 for six months in 2022, and petrol amounting to RM8,500.00 - He employed a maid solely for his family's use at RM700.00 per month starting from 1 April 2022 until 31 December and the cost was paid by his employer. - His employer provided medical benefits for Mr A and his family costing RM9,500.00. - Starting from 1 January 2022, the employer rented out a fully furnished six-room bungalow in Tanjong Malim for RM12,500.00 per month (inclusive of furmiture at RM4,000.00) for him However, 2 rooms in the house were not used by him but reserved for the use of the company's clients These two rooms were not furnished Mr A has a single-storey terrace house which he rents out to a young executive. Information regarding the residential property for the year ended 31 December 2022 are as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started