show functions in excell

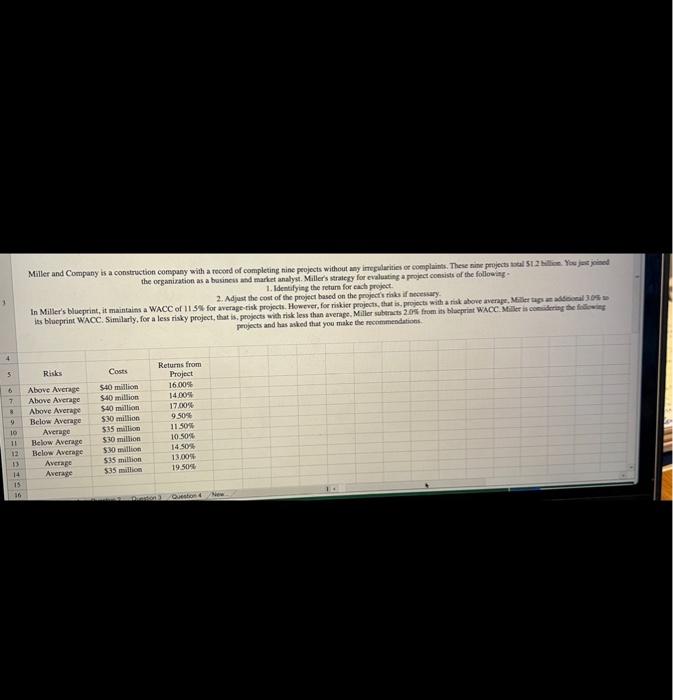

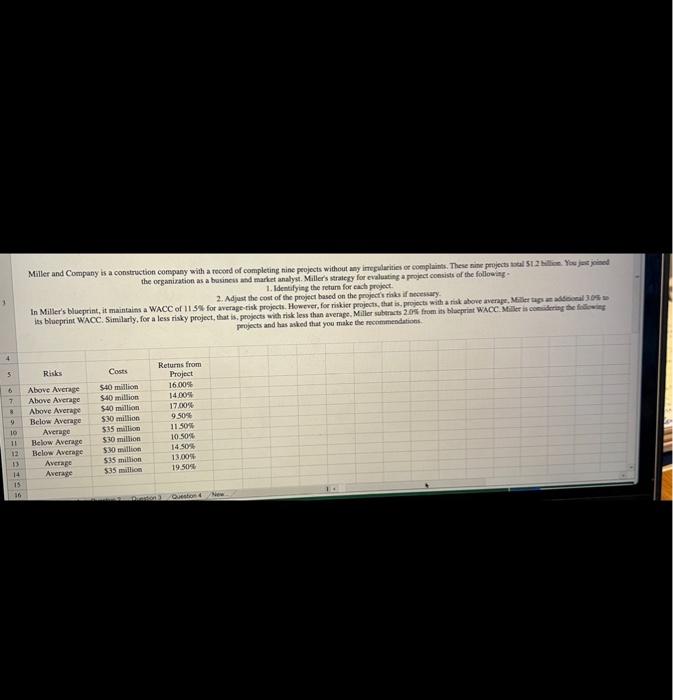

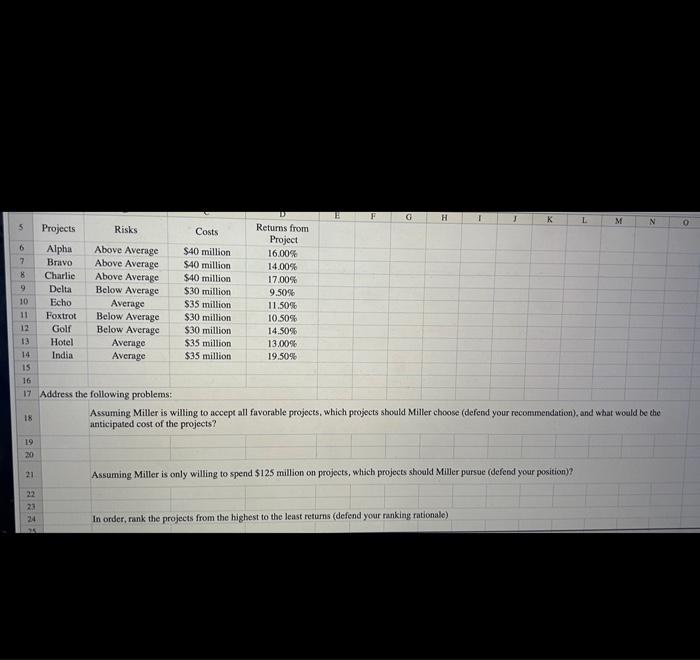

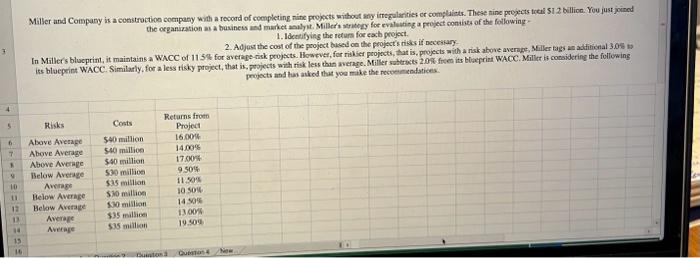

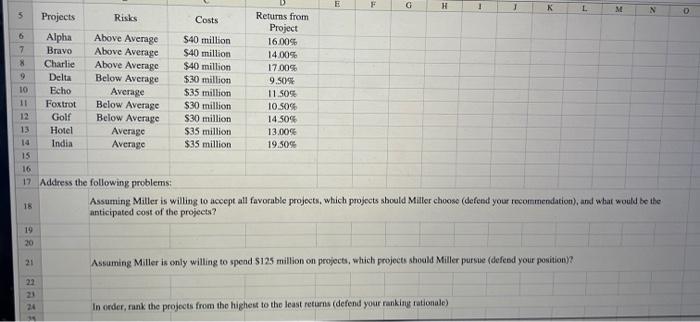

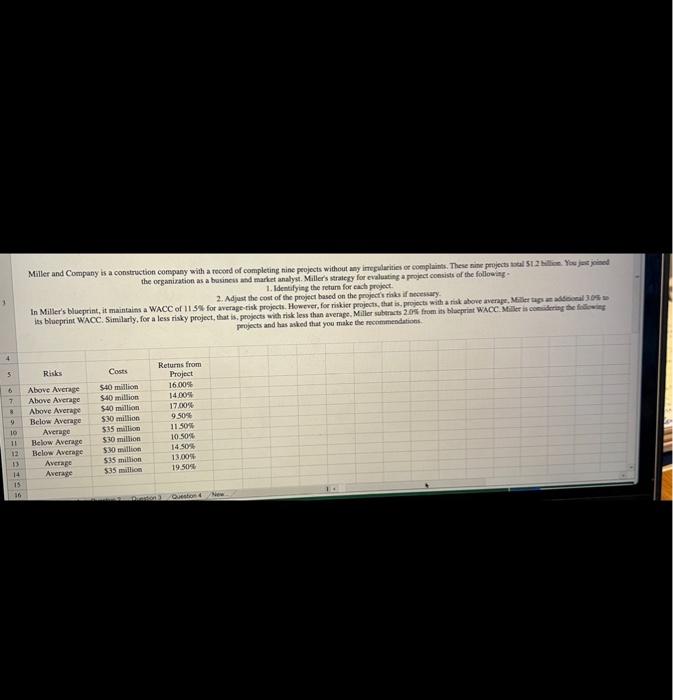

the organiration as a basiness and market analys. Miller's stralegy for evaluating a project consists of the followitg " 1. Identifyieg the return for cach proyoct. 2. Adjust the coit of the project based on the projocfis rinks if noeesiry. pevjects and has akked that you make the mormmendations. Assuming Miller is willing to accept all favorable projects, which projects sboald Miller choose (defend your recommendation), and what woald be ehe anticipated cost of the projects? Assuming Miller is only willing to spend $125 million on projects, which projects shoald Miller pursac (defend yoar position)? In order, rank the projects from the highest to the least returns (defend your ranking rationalo) Miller and Coinpany is a constroction company with a recond of coenpleting nine projects withoot any itrogalanities or complaints. These nine propets tret SI 2 billion. You just joinnd the organimation a a busines and makket andly it. Miller stritery for evaleating a project contibet of the following - 1. Ideatitying the returs foe earh project. 2. Adjest the cost of the project busel on the project's tisiss if neceitary: In Miller blucprint, it maintains a WhCC of 115% for average-tisk peojpcts. However, for risker projocts, that is, projects ailh a risk above average, 3eiller tags an adtiliknal 3.05 is propects and has akked that yoe mike the roveremedatices. Assuming Miller is willing to aceept all favorable projects, which projects shoeld Maler choose (defend your recommendation), and whar would be the anticipated cost of the projects? Assuming Miller is only willing to spead $125 million on projects, which projects shocld Miller pursue (defecd your position)? In order, fank the projeets from the highest to the least returns (defend your ranking tationale) the organiration as a basiness and market analys. Miller's stralegy for evaluating a project consists of the followitg " 1. Identifyieg the return for cach proyoct. 2. Adjust the coit of the project based on the projocfis rinks if noeesiry. pevjects and has akked that you make the mormmendations. Assuming Miller is willing to accept all favorable projects, which projects sboald Miller choose (defend your recommendation), and what woald be ehe anticipated cost of the projects? Assuming Miller is only willing to spend $125 million on projects, which projects shoald Miller pursac (defend yoar position)? In order, rank the projects from the highest to the least returns (defend your ranking rationalo) Miller and Coinpany is a constroction company with a recond of coenpleting nine projects withoot any itrogalanities or complaints. These nine propets tret SI 2 billion. You just joinnd the organimation a a busines and makket andly it. Miller stritery for evaleating a project contibet of the following - 1. Ideatitying the returs foe earh project. 2. Adjest the cost of the project busel on the project's tisiss if neceitary: In Miller blucprint, it maintains a WhCC of 115% for average-tisk peojpcts. However, for risker projocts, that is, projects ailh a risk above average, 3eiller tags an adtiliknal 3.05 is propects and has akked that yoe mike the roveremedatices. Assuming Miller is willing to aceept all favorable projects, which projects shoeld Maler choose (defend your recommendation), and whar would be the anticipated cost of the projects? Assuming Miller is only willing to spead $125 million on projects, which projects shocld Miller pursue (defecd your position)? In order, fank the projeets from the highest to the least returns (defend your ranking tationale)