Question

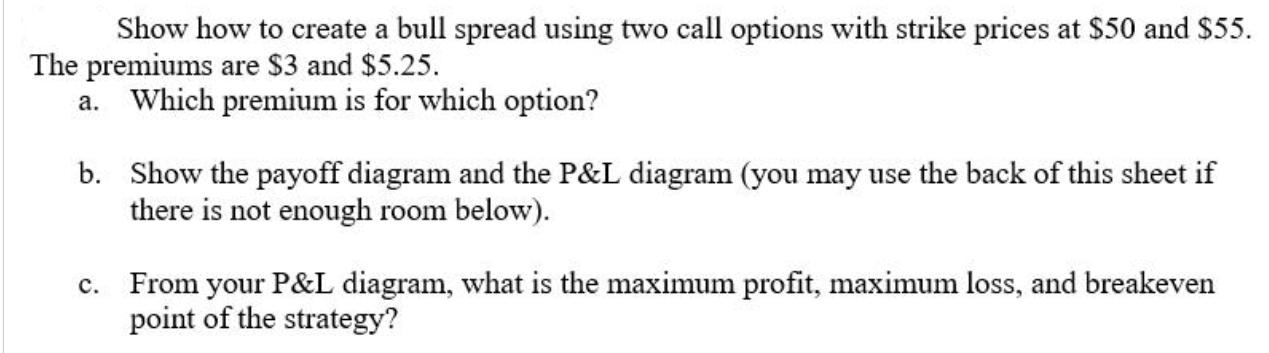

Show how to create a bull spread using two call options with strike prices at $50 and $55. The premiums are $3 and $5.25.

Show how to create a bull spread using two call options with strike prices at $50 and $55. The premiums are $3 and $5.25. a. Which premium is for which option? b. Show the payoff diagram and the P&L diagram (you may use the back of this sheet if there is not enough room below). c. From your P&L diagram, what is the maximum profit, maximum loss, and breakeven point of the strategy?

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Certainly lets work through this stepbystep a Which premium is for which option The premium of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Stochastic Finance With Market Examples

Authors: Nicolas Privault

2nd Edition

1032288272, 9781032288277

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App