Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show how to create a spreadsheet that shows the free cash flows the product would generate, and shows what the products net present value and

Show how to create a spreadsheet that shows the free cash flows the product would generate, and shows what the products net present value and internal rate of return are. And the thoughts and a recommendation for this product.

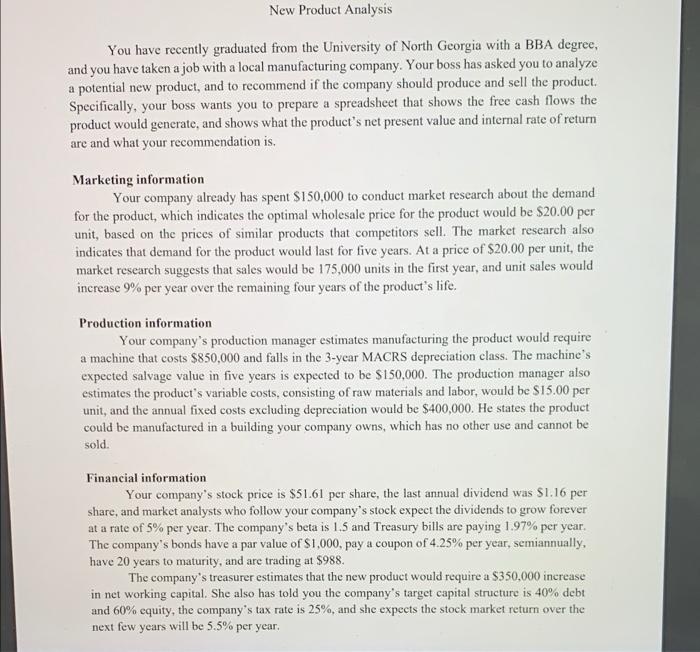

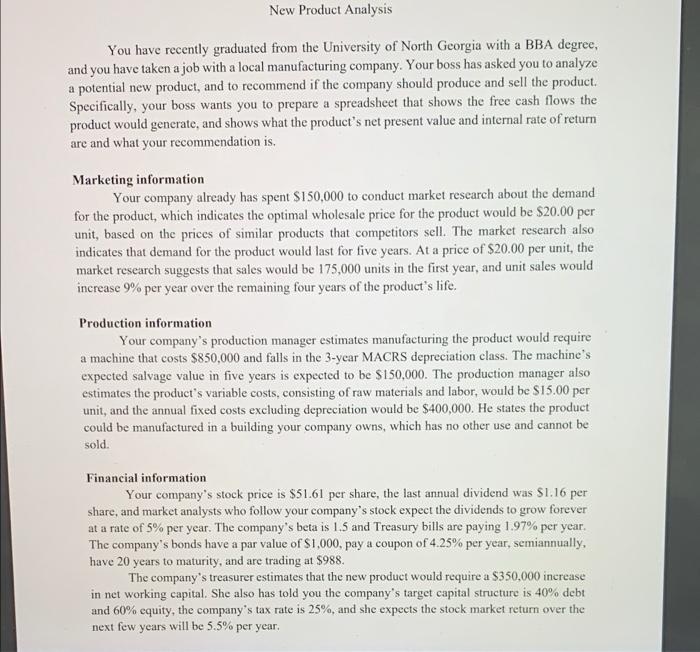

New Product Analysis You have recently graduated from the University of North Georgia with a BBA degree, and you have taken a job with a local manufacturing company. Your boss has asked you to analyze a potential new product, and to recommend if the company should produce and sell the product. Specifically, your boss wants you to prepare a spreadsheet that shows the free cash flows the product would generate, and shows what the product's net present value and internal rate of return are and what your recommendation is. Marketing information Your company already has spent $150,000 to conduct market research about the demand for the product, which indicates the optimal wholesale price for the product would be $20.00 per unit, based on the prices of similar products that competitors sell. The market research also indicates that demand for the product would last for five years. At a price of $20.00 per unit, the market research suggests that sales would be 175,000 units in the first year, and unit sales would increase 9% per year over the remaining four years of the product's life. Production information Your company's production manager estimates manufacturing the product would require a machine that costs $850,000 and falls in the 3-year MACRS depreciation class. The machine's expected salvage value in five years is expected to be $150,000. The production manager also estimates the product's variable costs, consisting of raw materials and labor, would be $15.00 per unit, and the annual fixed costs excluding depreciation would be $400,000. He states the product could be manufactured in a building your company owns, which has no other use and cannot be sold. Financial information Your company's stock price is $51.61 per share, the last annual dividend was $1.16 per share, and market analysts who follow your company's stock expect the dividends to grow forever at a rate of 5% per year. The company's beta is 1.5 and Treasury bills are paying 1.97% per year. The company's bonds have a par value of $1,000, pay a coupon of 4.25% per year, semiannually. have 20 years to maturity, and are trading at $988. The company's treasurer estimates that the new product would require a $350,000 increase in net working capital. She also has told you the company's target capital structure is 40% debt and 60% equity, the company's tax rate is 25%, and she expects the stock market return over the years will be 5.5% per year. next few

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started