show how to do it please

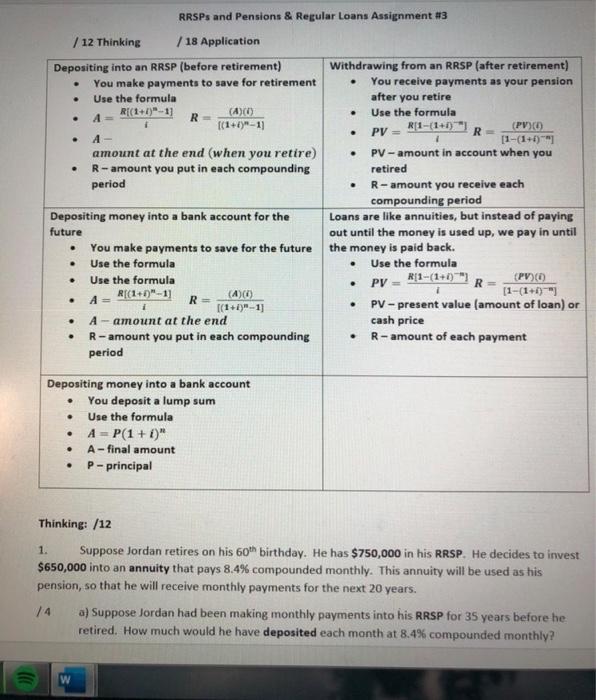

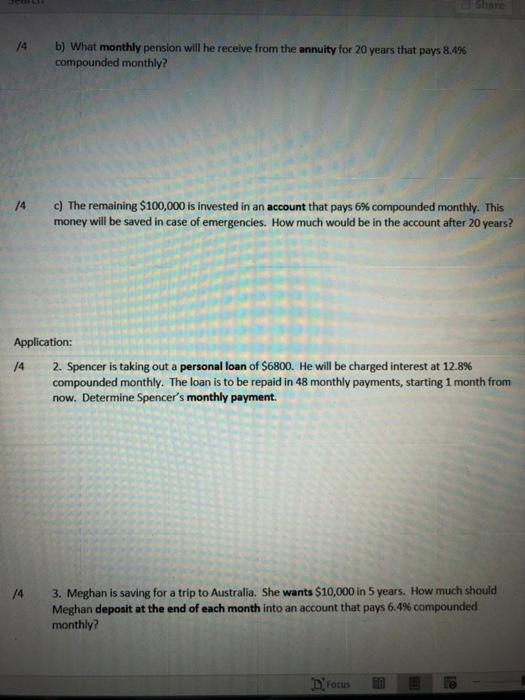

. . . . . . . RRSPs and Pensions & Regular Loans Assignment #3 / 12 Thinking / 18 Application Depositing into an RRSP (before retirement) Withdrawing from an RRSP (after retirement) You make payments to save for retirement You receive payments as your pension Use the formula after you retire R[(1+0)-1] A R Use the formula f(1+x)" - 11 (PV) PV = R [1-(1+)" diamount at the end (when you retire) PV - amount in account when you R - amount you put in each compounding retired period R-amount you receive each compounding period Depositing money into a bank account for the Loans are like annuities, but instead of paying future out until the money is used up, we pay in until You make payments to save for the future the money is paid back. Use the formula Use the formula Use the formula (PV) R R[(1+0"-11 (40) [1-(1+1)- R ((1+)-1] PV - present value (amount of loan) or A - amount at the end cash price R -amount you put in each compounding R-amount of each payment period . PV = Rp1-(1+0) . . . Depositing money into a bank accour You deposit a lump sum Use the formula A = P(1+)" A - final amount P-principal . . . 1. Thinking: /12 Suppose Jordan retires on his Go" birthday. He has $750,000 in his RRSP. He decides to invest $650,000 into an annuity that pays 8.4% compounded monthly. This annuity will be used as his pension, so that he will receive monthly payments for the next 20 years. al suppose Jordaan had been making monthly payments into his RRSP for 35 years before he retired. How much would he have deposited each month at 8.4 % compounded monthly? ))) W 74 b) What monthly pension will he receive from the annuity for 20 years that pays 8.4% compounded monthly? 74 c) The remaining $100,000 is invested in an account that pays 6% compounded monthly. This money will be saved in case of emergencies. How much would be in the account after 20 years? Application: 14 2. Spencer is taking out a personal loan of $6800. He will be charged interest at 12.8% compounded monthly. The loan is to be repaid in 48 monthly payments, starting 1 month from now. Determine Spencer's monthly payment. 14 3. Meghan is saving for a trip to Australia. She wants $10,000 in 5 years. How much should Meghan deposit at the end of each month into an account that pays 6.4% compounded monthly? Drocis B AEEE 14 t Normal No Spac... Heading 1 Heading 2 Title Su Paragraph Styles 14 4. Luis saves $60 at the end of each month in an account that pays 5.5% compounded monthly Calculate the amount in his account at the end of 15 months. 16 5. Tamara borrowed $29,000 from her credit union to buy a car. She is charged 9.9% compounded monthly. Tamara will repay the loan with monthly payments for the next 3 years starting 1 month from now. a) Determine Tamara's monthly payment b) How much interest will Tamara pay over the term of the loan? W

show how to do it please

show how to do it please