Answered step by step

Verified Expert Solution

Question

1 Approved Answer

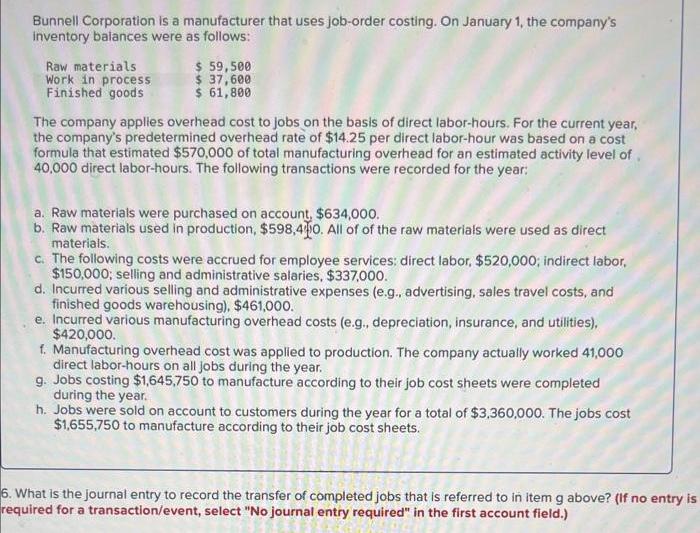

Show image transcript Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials Work

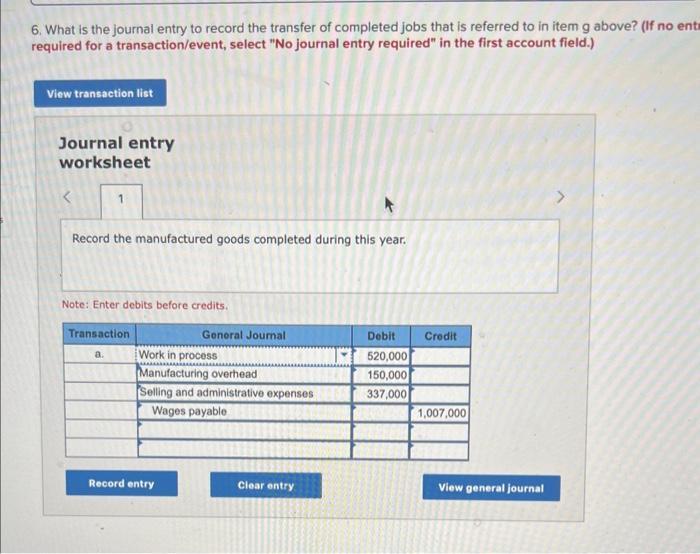

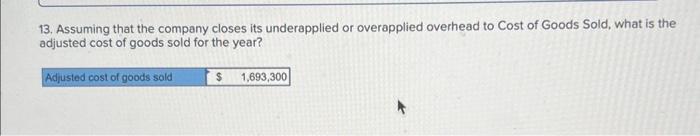

Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials Work in process Finished goods $ 59,500 $ 37,600 $ 61,800. The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $14.25 per direct labor-hour was based on a cost formula that estimated $570,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $634,000. b. Raw materials used in production, $598,400. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $520,000; indirect labor, $150,000; selling and administrative salaries, $337,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $461,000. e. Incurred various manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $420,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. g. Jobs costing $1,645,750 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $3,360,000. The jobs cost $1,655,750 to manufacture according to their job cost sheets. 6. What is the journal entry to record the transfer of completed jobs that is referred to in item g above? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started