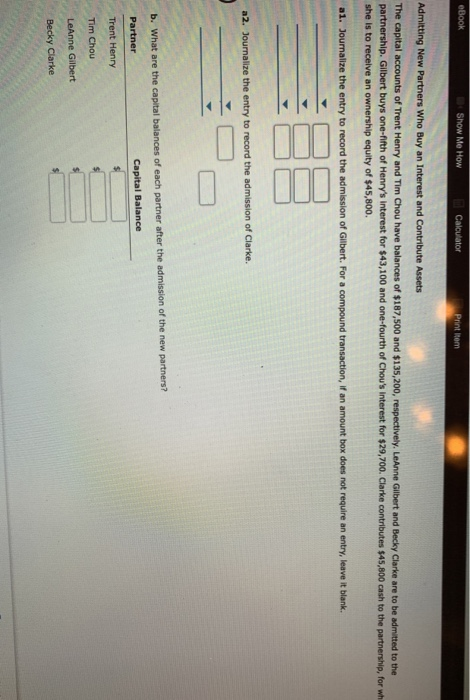

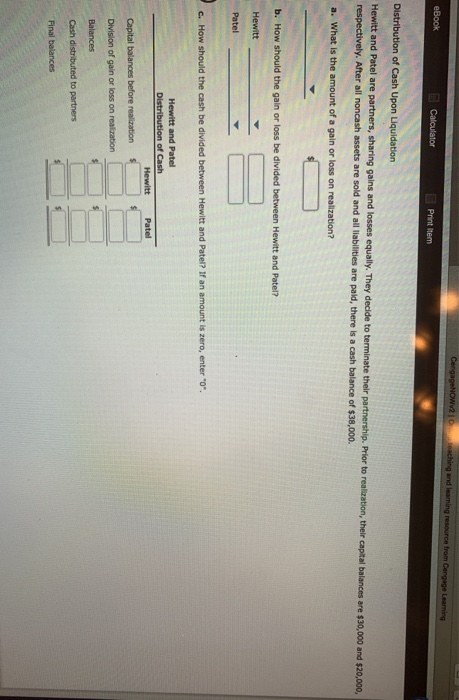

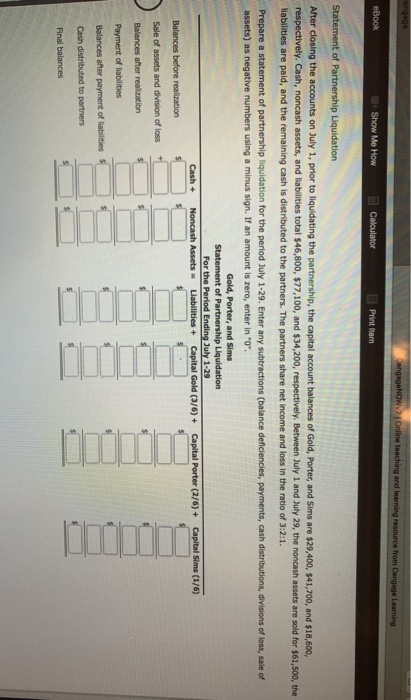

Show Me How Rem Admitting New Partners Who Buy an Interest and Contribute Assets The capital accounts of Trent Henry and Tim Chou have balances of $187,500 and $135,200, respectively. LeAnne Gilbert and Becky Clarke are to be admitted to the partnership. Gilbert buys one-fifth of Henry's interest for $43,100 and one-fourth of Chou's interest for $29,700. Clarke contributes $45,800 cash to the partnership, for wh she is to recelve an ownership equity of $45,800. a1. Journalize the entry to record the admission of Gilbert. For a compound transaction, If an amount box does not require an entry, leave it blank. a2. Journalize the entry to record the admission of Clarke. b. What are the capital balances of each partner after the admission of the new partners? Partner Trent Henry Tim Chou Becky Clarke and eBook Print Item Hewitt and Patel are partners, sharing gains and losses equally. They decide to terminate their partnership. respectively. After all noncash assets are sold and all liablities are palid, there ls a cash balance of $38,000. to realization, their capital balances are $30,000 and $20,000, a. What is the amount of a gain or loss on realization? How should the gain or loss be divided between Hewitt and Patel? b. How should the cash be divided between Hewitt and Patel? If an amount is zero, enter "O". c. Hewitt and Pate Capital balances before realization Divislon of gain or loss on realization Balances Cash distributed to partners and from Show Me How Print Item After closing the accounts on July 1, prior to liquidating the partnership, the capital account balances of Gold, Porter, and Sims are $29,400, $41,700, and $18,600, respectively. Cash, noncash assets, and liabilities total $46,800, $77,100, and $34,200, respectively. Between July 1 and July 29, the noncash assets are sold for $61,500, the llabilities are paid, and the remaining cash is distributed to the partners. The partners share net income and loss in the ratio of 3:2:1 Prepare a statement of partnership liquidation for the period July 1-29. Enter any subtractions (balance deficiencies, payments, cash distributions, divisions of loss, sale of assets) as negative numbers using a minus sign. If an amount is zero, enter in "0. Gold, Porter, and Sims p Liquidation Statement of P For the Period Ending July 1-29 Capital Sims (1/6) Capital Gold (3/6)+ Capital Porter (2/6)+ + Balances before realization Payment of liabilities Cash distributed to partners