show me your solution

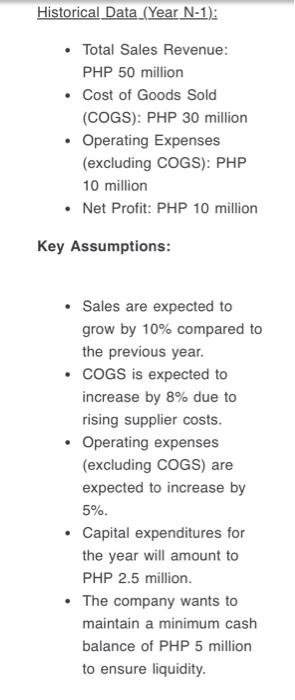

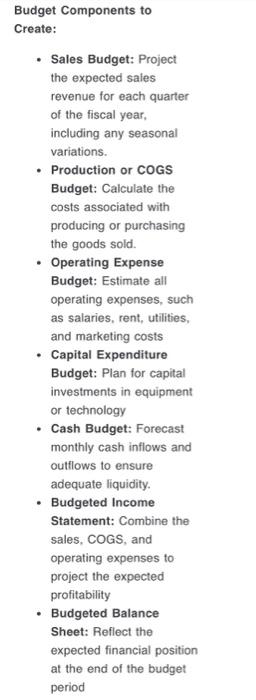

Historical Data_(Year N-1): - Total Sales Revenue: PHP 50 million - Cost of Goods Sold (COGS): PHP 30 million - Operating Expenses (excluding COGS): PHP 10 million - Net Profit: PHP 10 million Key Assumptions: - Sales are expected to grow by 10% compared to the previous year. - COGS is expected to increase by 8% due to rising supplier costs. - Operating expenses (excluding COGS) are expected to increase by 5%. - Capital expenditures for the year will amount to PHP 2.5 million. - The company wants to maintain a minimum cash balance of PHP 5 million to ensure liquidity. XYZ Retail, Inc. is a fictional retail company specializing in consumer electronics, operating in the Philippines. The company has been in operation for several years and is preparing its master budget for the upcoming fiscal year. As financial controllers, your task is to create a comprehensive master budget for XYZ Retail, Inc. in Philippine Pesos (PHP). Background Information: XYZ Retail, Inc. operates in a competitive industry with seasonal sales fluctuations, especially during the holiday season. The company's fiscal year begins on January 1st and ends on December 31st. Historical Data_(Year N-1): - Budgeted Statement of Cash Flows: Project cash movements during the budgeted period Budget Presentation (15 to 20 minutes each group): Each group should present their master budget to the class. They should explain their assumptions, methodologies, and key decisions made during the budgeting process. Emphasize the importance of effective communication and the ability to justify budgetary choices. *for distance learner, record a video of your presentation and upload in the class stream *for regular students, upload your powerpoint with explanation for each slides in the "notes" Budget Components to Create: - Sales Budget: Project the expected sales revenue for each quarter of the fiscal year, including any seasonal variations. - Production or COGS Budget: Calculate the costs associated with producing or purchasing the goods sold. - Operating Expense Budget: Estimate all operating expenses, such as salaries, rent, utilities, and marketing costs - Capital Expenditure Budget: Plan for capital investments in equipment or technology - Cash Budget: Forecast monthly cash inflows and outflows to ensure adequate liquidity. - Budgeted Income Statement: Combine the sales, COGS, and operating expenses to project the expected profitability - Budgeted Balance Sheet: Reflect the expected financial position at the end of the budget period