SHOW PLEASE ALL THE CALCULATIONS HOW YOU FOUD EACH AMMOUNT

SHOW PLEASE ALL THE CALCULATIONS HOW YOU FOUD EACH AMMOUNT

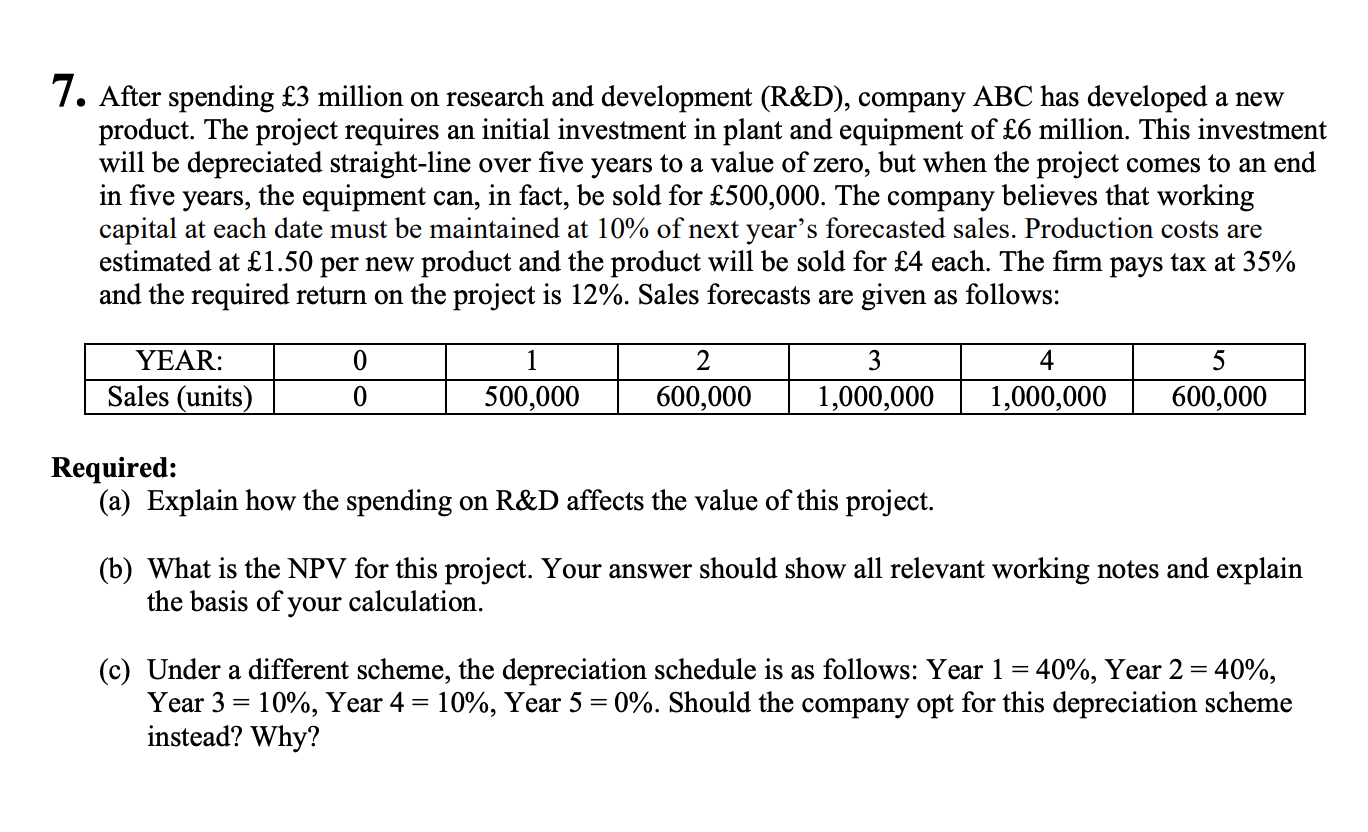

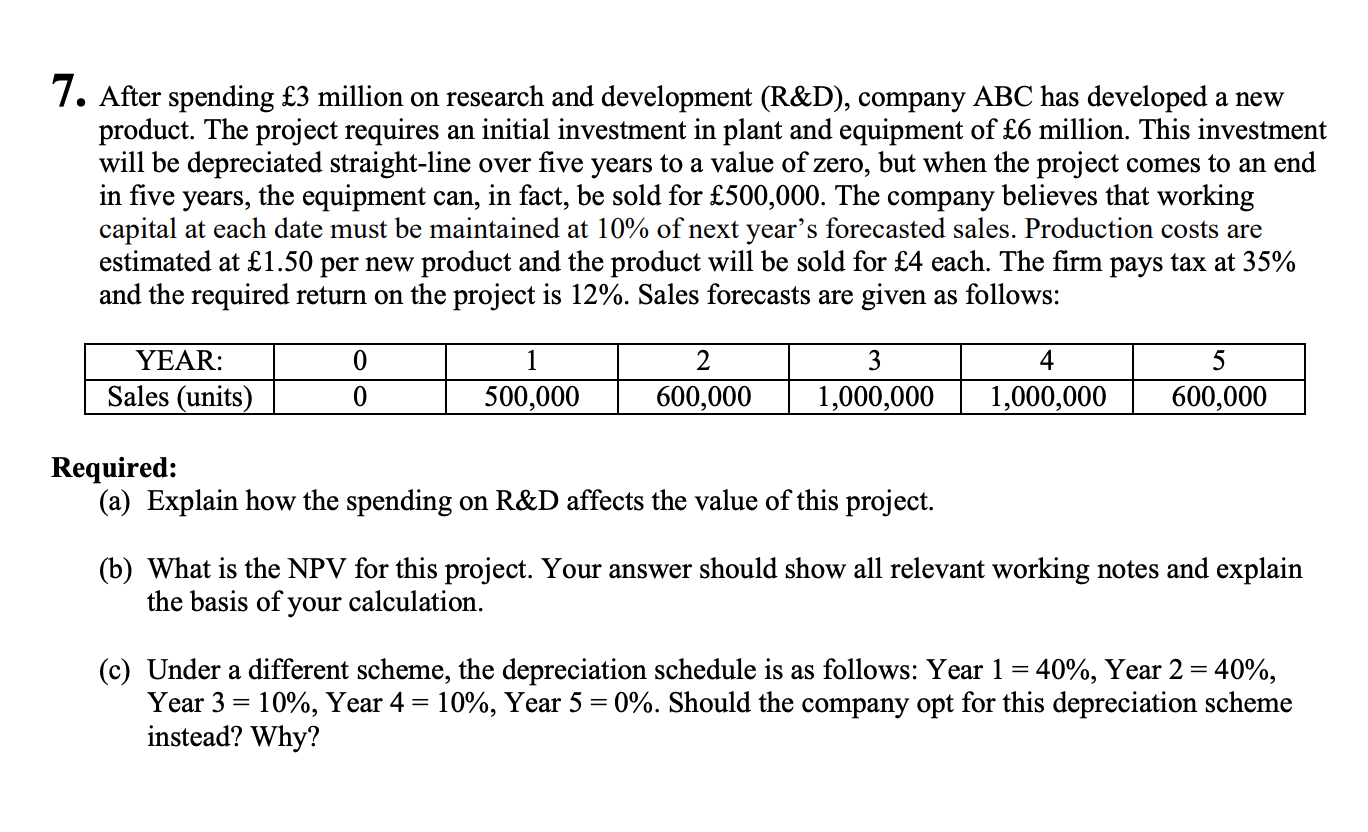

7. After spending 3 million on research and development (R\&D), company ABC has developed a new product. The project requires an initial investment in plant and equipment of 6 million. This investment will be depreciated straight-line over five years to a value of zero, but when the project comes to an end in five years, the equipment can, in fact, be sold for 500,000. The company believes that working capital at each date must be maintained at 10% of next year's forecasted sales. Production costs are estimated at 1.50 per new product and the product will be sold for 4 each. The firm pays tax at 35% and the required return on the project is 12%. Sales forecasts are given as follows: Required: (a) Explain how the spending on R\&D affects the value of this project. (b) What is the NPV for this project. Your answer should show all relevant working notes and explain the basis of your calculation. (c) Under a different scheme, the depreciation schedule is as follows: Year 1=40%, Year 2=40%, Year 3 =10%, Year 4=10%, Year 5=0%. Should the company opt for this depreciation scheme instead? Why? 7. After spending 3 million on research and development (R\&D), company ABC has developed a new product. The project requires an initial investment in plant and equipment of 6 million. This investment will be depreciated straight-line over five years to a value of zero, but when the project comes to an end in five years, the equipment can, in fact, be sold for 500,000. The company believes that working capital at each date must be maintained at 10% of next year's forecasted sales. Production costs are estimated at 1.50 per new product and the product will be sold for 4 each. The firm pays tax at 35% and the required return on the project is 12%. Sales forecasts are given as follows: Required: (a) Explain how the spending on R\&D affects the value of this project. (b) What is the NPV for this project. Your answer should show all relevant working notes and explain the basis of your calculation. (c) Under a different scheme, the depreciation schedule is as follows: Year 1=40%, Year 2=40%, Year 3 =10%, Year 4=10%, Year 5=0%. Should the company opt for this depreciation scheme instead? Why

SHOW PLEASE ALL THE CALCULATIONS HOW YOU FOUD EACH AMMOUNT

SHOW PLEASE ALL THE CALCULATIONS HOW YOU FOUD EACH AMMOUNT