Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show steps as to how the answer is given so i cna follow through thank you . B D E F 1 PROBLEM 4-3 2

show steps as to how the answer is given so i cna follow through thank you

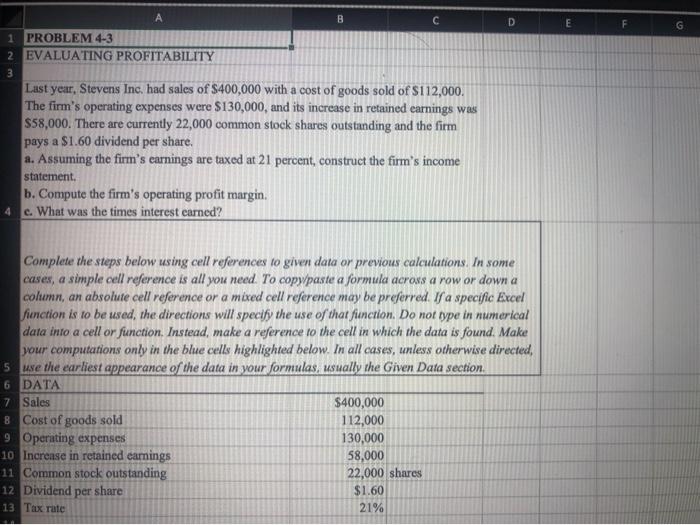

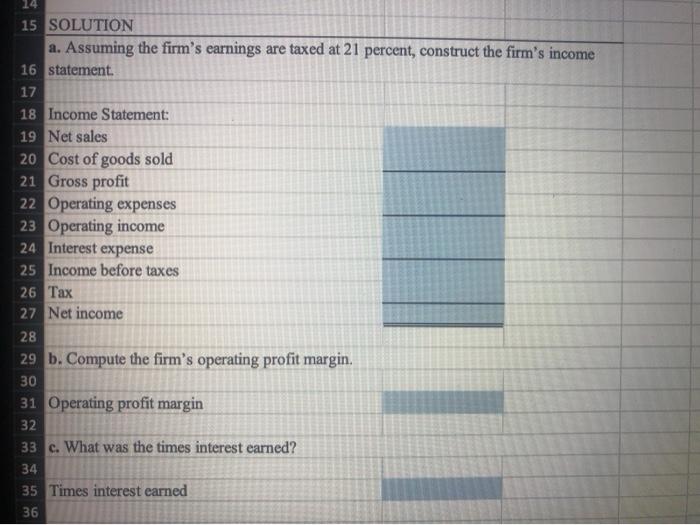

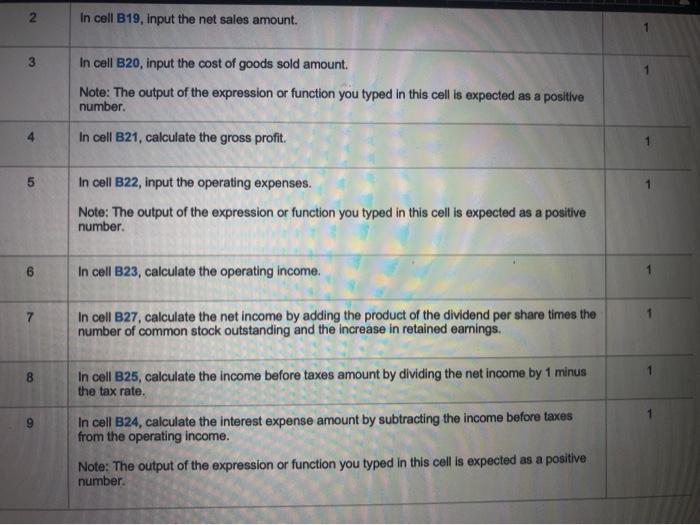

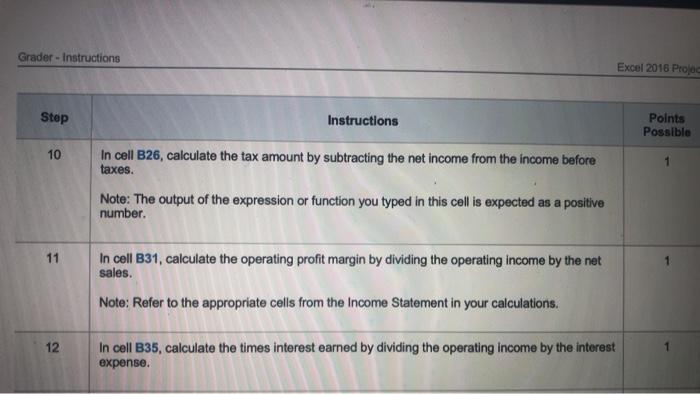

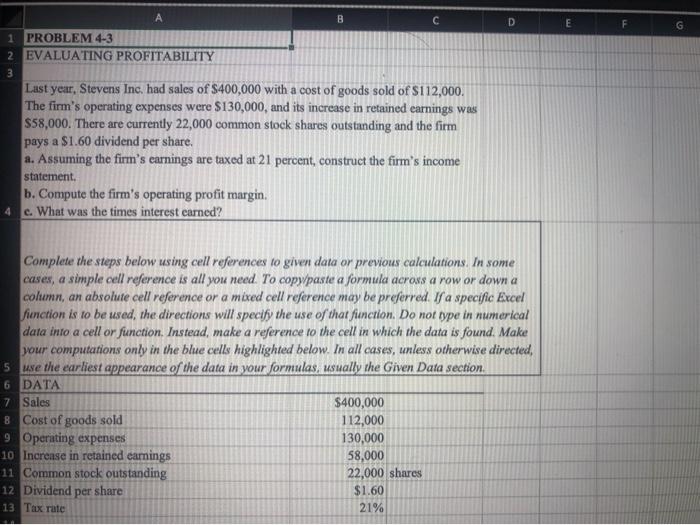

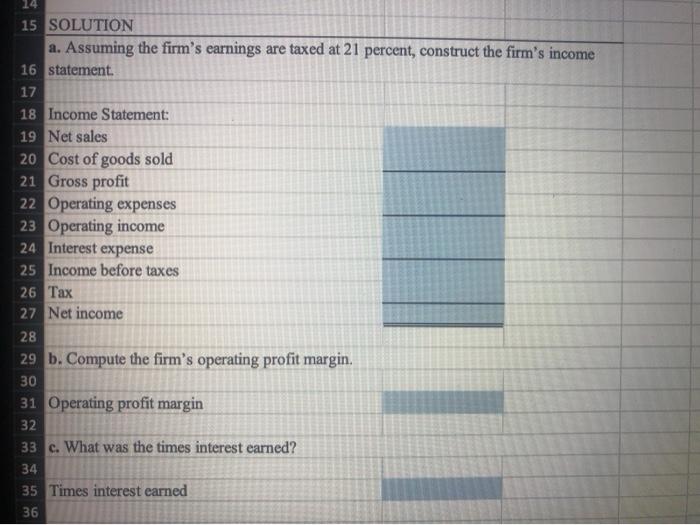

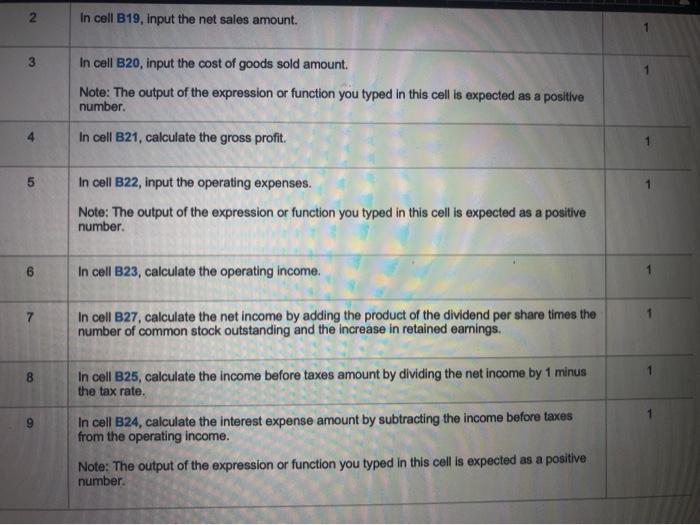

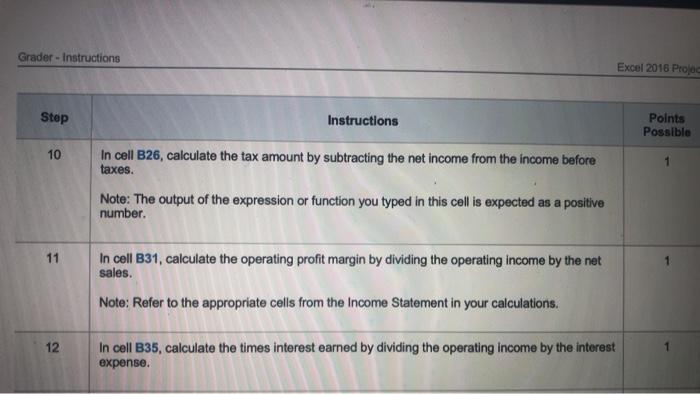

. B D E F 1 PROBLEM 4-3 2 EVALUATING PROFITABILITY 3 Last year, Stevens Inc. had sales of $400,000 with a cost of goods sold of S112,000. The firm's operating expenses were $130,000, and its increase in retained earnings was $58,000. There are currently 22,000 common stock shares outstanding and the firm pays a $1.60 dividend per share, a. Assuming the firm's earnings are taxed at 21 percent, construct the firm's income statement, b. Compute the firm's operating profit margin. c. What was the times interest earned? 5 Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. 6 DATA 7 Sales $400,000 8 Cost of goods sold 112,000 9 Operating expenses 130,000 10 Increase in retained earnings 58,000 11 Common stock outstanding 22,000 shares 12 Dividend per share $1.60 13 Tax rate 21% 14 15 SOLUTION a. Assuming the firm's earnings are taxed at 21 percent, construct the firm's income 16 statement. 17 18 Income Statement: 19 Net sales 20 Cost of goods sold 21 Gross profit 22 Operating expenses 23 Operating income 24 Interest expense 25 Income before taxes 26 Tax 27 Net income 28 29 b. Compute the firm's operating profit margin. 30 31 Operating profit margin 32 33 c. What was the times interest earned? 34 35 Times interest earned 36 2 In cell B19, input the net sales amount. In cell B20, input the cost of goods sold amount. Note: The output of the expression or function you typed in this cell is expected as a positive number. In cell B21, calculate the gross profit. 4 5 In cell B22, input the operating expenses. Note: The output of the expression or function you typed in this cell is expected as a positive number 6 In cell B23, calculate the operating income. 7 In cell B27, calculate the net income by adding the product of the dividend per share times the number of common stock outstanding and the increase in retained earnings. 8 In cell B25, calculate the income before taxes amount by dividing the net income by 1 minus the tax rate. In cell B24, calculate the interest expense amount by subtracting the income before taxes from the operating income. Note: The output of the expression or function you typed in this cell is expected as a positive number Grader - Instructions Excel 2016 Proje Step Instructions Points Possible 10 In cell B26, calculate the tax amount by subtracting the net income from the income before taxes. 1 Note: The output of the expression or function you typed in this cell is expected as a positive number. 11 In cell B31, calculate the operating profit margin by dividing the operating income by the net sales. Note: Refer to the appropriate cells from the Income Statement in your calculations. 12 In cell B35, calculate the times interest earned by dividing the operating income by the interest expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started