Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show steps Electrolux of Sweden. Kristian Thalen has just joined the corporate treasury group at Electrolux of Sweden, a multinational Swedish appliance maker Electrolux is

show steps

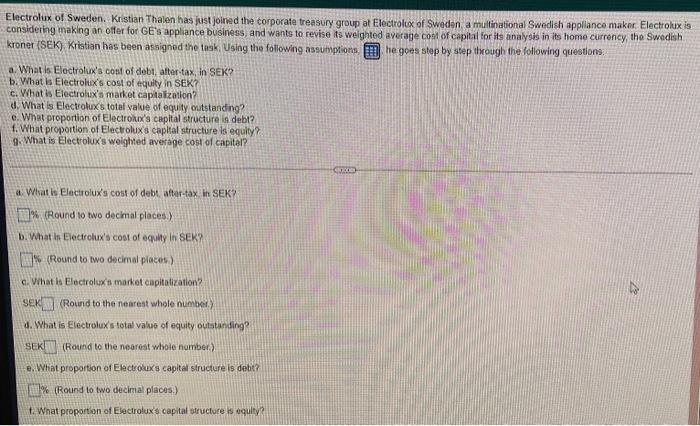

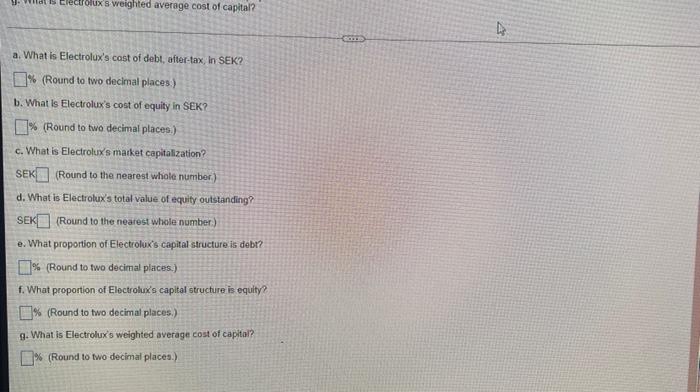

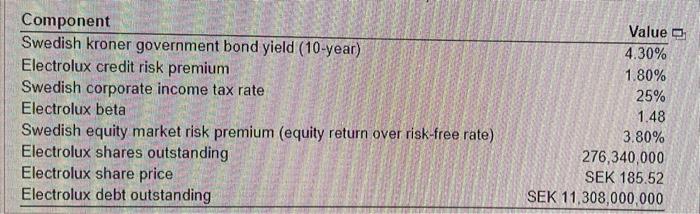

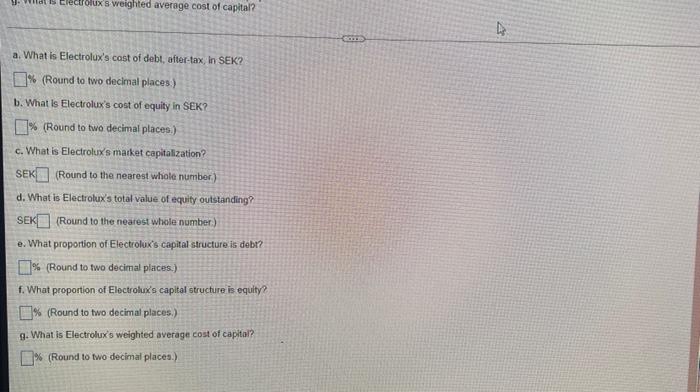

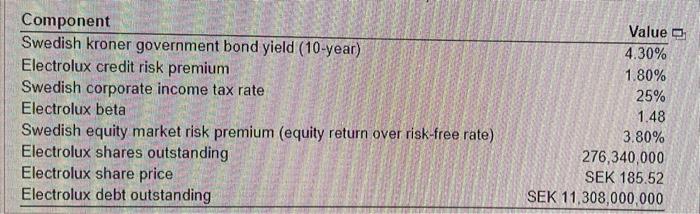

Electrolux of Sweden. Kristian Thalen has just joined the corporate treasury group at Electrolux of Sweden, a multinational Swedish appliance maker Electrolux is considering making an offer for GE's appliance business, and wants to revise its weighted average cost of capital for its analysis in its home currency, the Swedish kroner (SEK). Kristian has been assigned the task. Using the following assumptions he goes step by step through the following questions a. What is Electrolux's cost of debt, after-tax, in SEK? b. What is Electrolux's cost of equity in SEK? c. What is Electrolux's market capitalization? d. What is Electrolux's total value of equity outstanding? e. What proportion of Electrolux's capital structure is debt? f. What proportion of Electrolux's capital structure is equity? g. What is Electrolux's weighted average cost of capital? a. What is Electrolux's cost of debt, after-tax in SEK? % (Round to two decimal places.) b. What is Electrolux's cost of equity in SEK? (Round to two decimal places) c. What is Electrolux's market capitalization? SEK (Round to the nearest whole number.) d. What is Electrolux's total value of equity outstanding? SEK (Round to the nearest whole number.) e. What proportion of Electrolux's capital structure is debit? % (Round to two decimal places.) f. What proportion of Electrolux's capital structure is equity? y that Electrolux's weighted average cost of capital? a. What is Electrolux's cast of debt, after-tax, in SEK? %(Round to two decimal places) b. What is Electrolux's cost of equity in SEK? % (Round to two decimal places.) c. What is Electrolux's market capitalization? SEK (Round to the nearest whole number.) d. What is Electrolux's total value of equity outstanding? SEK (Round to the nearest whole number) e. What proportion of Electrolux's capital structure is debt? % (Round to two decimal places.) f. What proportion of Electrolux's capital structure is equity? % (Round to two decimal places.) g. What is Electrolux's weighted average cost of capital? % (Round to two decimal places.) GOLD D Component Swedish kroner government bond yield (10-year) Electrolux credit risk premium Swedish corporate income tax rate Electrolux beta Swedish equity market risk premium (equity return over risk-free rate) Electrolux shares outstanding Electrolux share price Electrolux debt outstanding Value 4.30% 1.80% 25% 1.48 3.80% 276,340,000 SEK 185.52 SEK 11,308,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started