Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show steps Harrison Holdings, Inc. (HHI) is publicly traded, with a current share price of $37 per share. HHI has 25 million shares outstanding, as

show steps

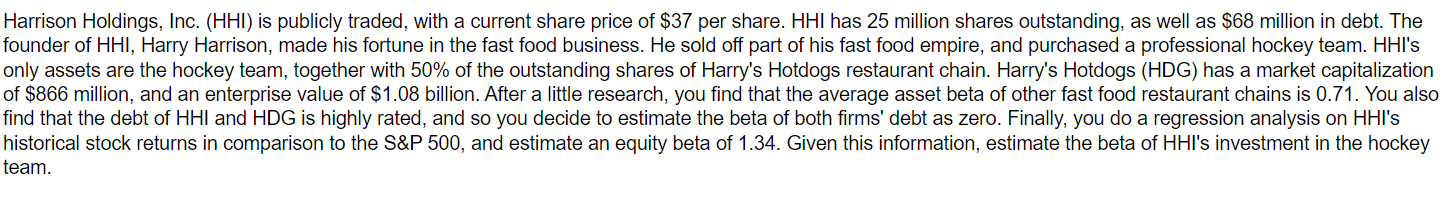

Harrison Holdings, Inc. (HHI) is publicly traded, with a current share price of $37 per share. HHI has 25 million shares outstanding, as well as $68 million in debt. The founder of HHI, Harry Harrison, made his fortune in the fast food business. He sold off part of his fast food empire, and purchased a professional hockey team. HHI's only assets are the hockey team, together with 50% of the outstanding shares of Harry's Hotdogs restaurant chain. Harry's Hotdogs (HDG) has a market capitalization of $866 million, and an enterprise value of $1.08 billion. After a little research, you find that the average asset beta of other fast food restaurant chains is 0.71 . You also find that the debt of HHI and HDG is highly rated, and so you decide to estimate the beta of both firms' debt as zero. Finally, you do a regression analysis on HHI's historical stock returns in comparison to the S\&P 500, and estimate an equity beta of 1.34. Given this information, estimate the beta of HHI's investment in the hockey teamStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started