Question

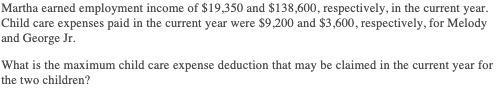

Martha earned employment income of $19,350 and $138,600, respectively, in the current year. Child care expenses paid in the current year were $9,200 and

Martha earned employment income of $19,350 and $138,600, respectively, in the current year. Child care expenses paid in the current year were $9,200 and $3,600, respectively, for Melody and George Jr. What is the maximum child care expense deduction that may be claimed in the current year for the two children?

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The child care expense deduction is subject to certain limits As of my last knowledge update in Janu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Economics

Authors: Paul Keat, Philip K Young, Steve Erfle

7th edition

0133020266, 978-0133020267

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App