Show the Calculation too, thanks

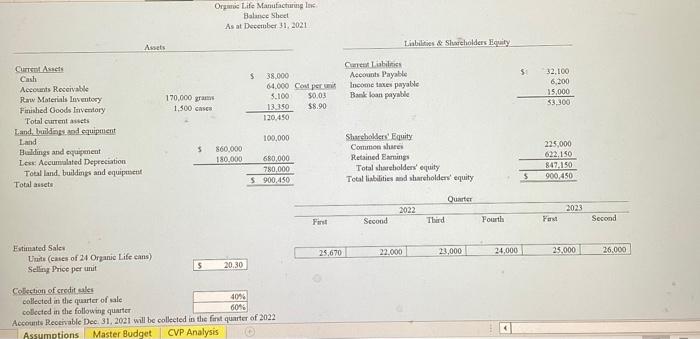

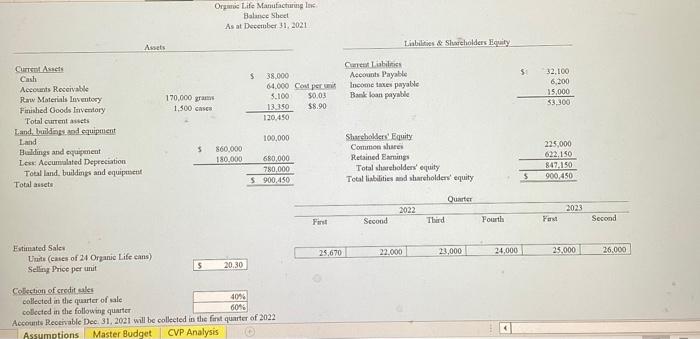

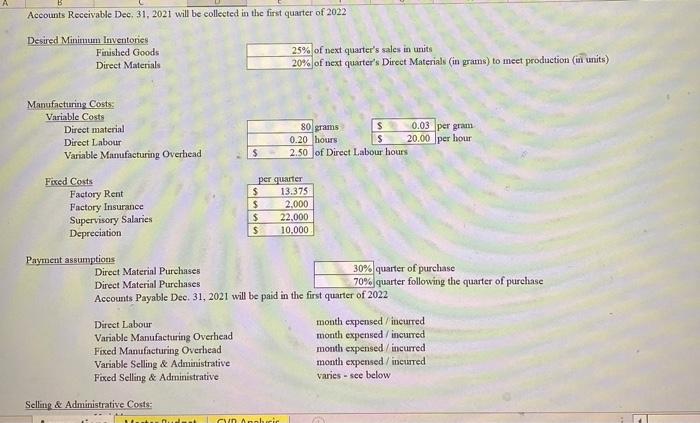

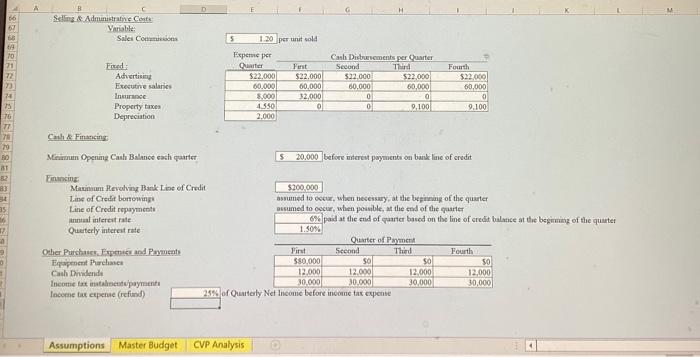

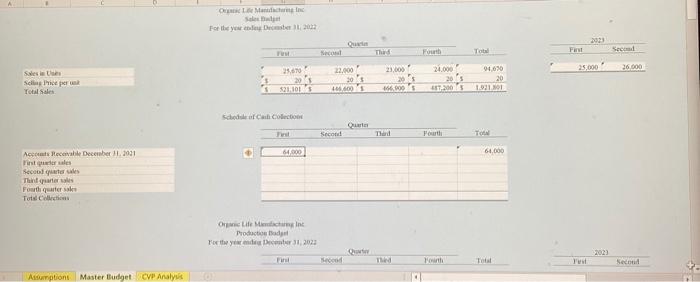

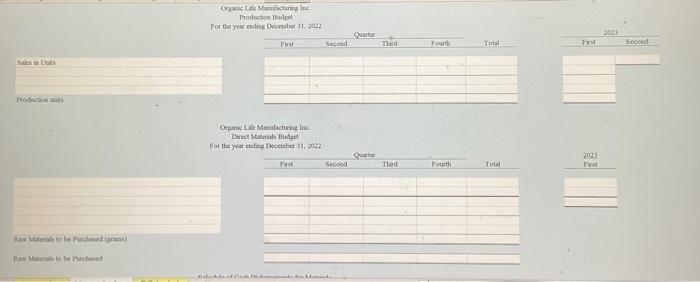

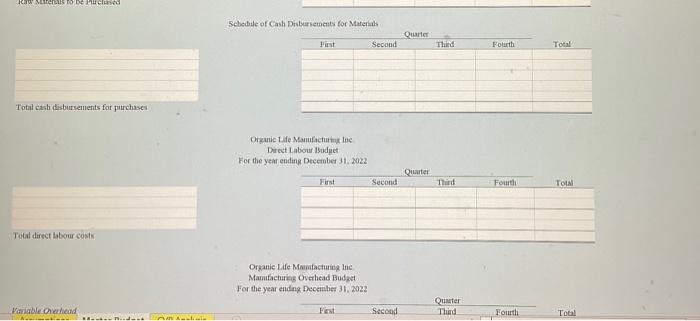

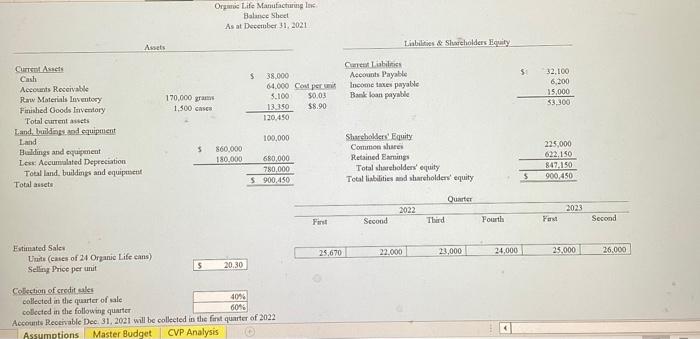

Ora Life Manufacturing In Balance Sheet As at December 31, 2021 Lisbilities & Shareholders Equity Assets $ Carpet Liabilities Accounts Payable Income taxes payable Bank loan payable 38.000 64.000 Coupe 5.100 30.03 13.350 $8.90 120.450 32.100 6.200 15.000 $3,300 170,000 gram 1.300 C CUITSL Assets Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total current assets and buildings and equipment Land Huildings and equipment Les Accumulated Depreciation Total land buildings and equipment Total assets 100,000 $ 860,000 180.000 680,000 780,000 S 900.450 Shareholders' Equity Commons Retained Eag Total shareholders' equity Total liabilities and shareholders' equity 225,000 622,150 847150 900.450 5 Quarter 2022 2023 First Second Third Fourth Fast Second 25,670 22.000 23,000 24,000 25.000 26.000 Estimated Sales Unito (cases of 24 Organic Life cans) Selling Price per unit 5 20.30 Collection of credit cales collected in the quarter of sale 4044 collected in the following quarter 60% Accounts Receivable Dec 31, 2021 will be collected in the first quarter of 2022 Assumptions Master Budget CVP Analysis Accounts Receivable Dec 31, 2021 will be collected in the first quarter of 2022 Desired Minimum Inventories Finished Goods Direct Materials 25% of next quarter's sales in units 20% of next quarter's Direct Materials (in grams) to meet production (in units) Manufacturing Costs: Variable Costs Direct material Direct Labour Variable Manufacturing Overhead 80 grams 0.03 per gram 0.20 hours 20.00 per hour 2.50 of Direct Labour hours nu $ Fixed Costs Factory Rent Factory Insurance Supervisory Salaries Depreciation per quarter $ 13.375 $ 2.000 $ 22.000 $ 10.000 Payment assumptions Direct Materinl Purchases 30% quarter of purchase Direct Material Purchases 70% quarter following the quarter of purchase Accounts Payable Dec 31, 2021 will be paid in the first quarter of 2022 Direct Labour month expensed /incurred Variable Manufacturing Overhead month expensed / incurred Fixed Manufacturing Overhead month expensed/incurred Variable Selling & Administrative month expensed/incurred Fixed Selling & Administrative varics - see below Selling & Administrative Costs: WAR A H 66 67 60 B Sding & Administratie Costa Variable Sales Cocos 10 71 72 5 1.20 per un sold Experie per Quarter Fest $22.000 $22.000 60.000 00,000 8.000 32,000 4.550 o 2.000 Ered Advertising Executive salaries Insurance Property taxes Depreciation Casb Diurements per Outer Second Third $22.000 $22.000 60.000 60,000 0 0 0 9.100 Fourth $22.000 60,000 9.100 Cash & Financing Minimum Opening Cash Balance each quartet 79 B0 1 32 $ 20.000 before interest payments on bunke line of credit Fring Macinum Revolving Bank Loe of Credit $200,000 Line of Credit borrowing assumed to occur, when necessary, at the beginning of the quarter Line of Credit repayments musumed to occur when posible at the end of the quarter Intul interest rate 6% paid at the end of quer based on the line of credit balance at the beginning of the quarter Quarterly interest rate 1.50% Quarter of Payment Other Purchases. Express and Payments First Second Third Fourth Equipment Purchase 550.000 so $0 50 Cash Dridende 12,000 12.000 12.000 12,000 Income tax instalmente payments 30.000 30.000 30.000 30,000 Income ut etpense (refund) 25% of Ortaly Net Income before income tax expense Assumptions Master Budget CVP Analysis OLI Mann Sce For the year 2003 The Fouth To Se 3,670 22.000 28.000 25.000 26.000 Sales Scheeper Total Sales 2000 20 2018 04.630 20 1.1.1 21.10 LOOS 6.000 Schedule of Cal Collection Second Fort TON 64000 66.000 Ac Recevable December 11.2001 Pinturas Second quarteles Thant quarters Fourth quarterske Tot Colectie On Life Machine Production Torty decenter 31, 2023 Que Ft Second To Second Assumptions Master Budget CVP Analyst On Life Mag Products Hot For the year and December 11, 2002 2003 Quarter Second Pist Tad Horth Total rut Steed Todos Ora de Santacturing Inc. Direct Maillud For the year en December 1, 2012 Q second Tard 2033 Ft Pearth Total Kwa bei ce Kaw Matens to be used Schedule of Cash Disbursements for Material Quarter Second Thund Fourth Total Total cash disbursements for purchases Organic Life Manifacturing loc Direct Labour Budget For the year ending December 31, 2022 Quarter First Second Third Fourth TOIN Total direct labour costs Organic Life Marachung Inc Mamitacturing Overhead Budget For the year ending December 31, 2022 Variable head First Quater Third Second Fourth Total A