Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show the details of adjusting accounting entries. 2. (1 point) Write the best accounting word/phrase that is defined. Write ONLY ONE word/phrase next to each

show the details of adjusting accounting entries.

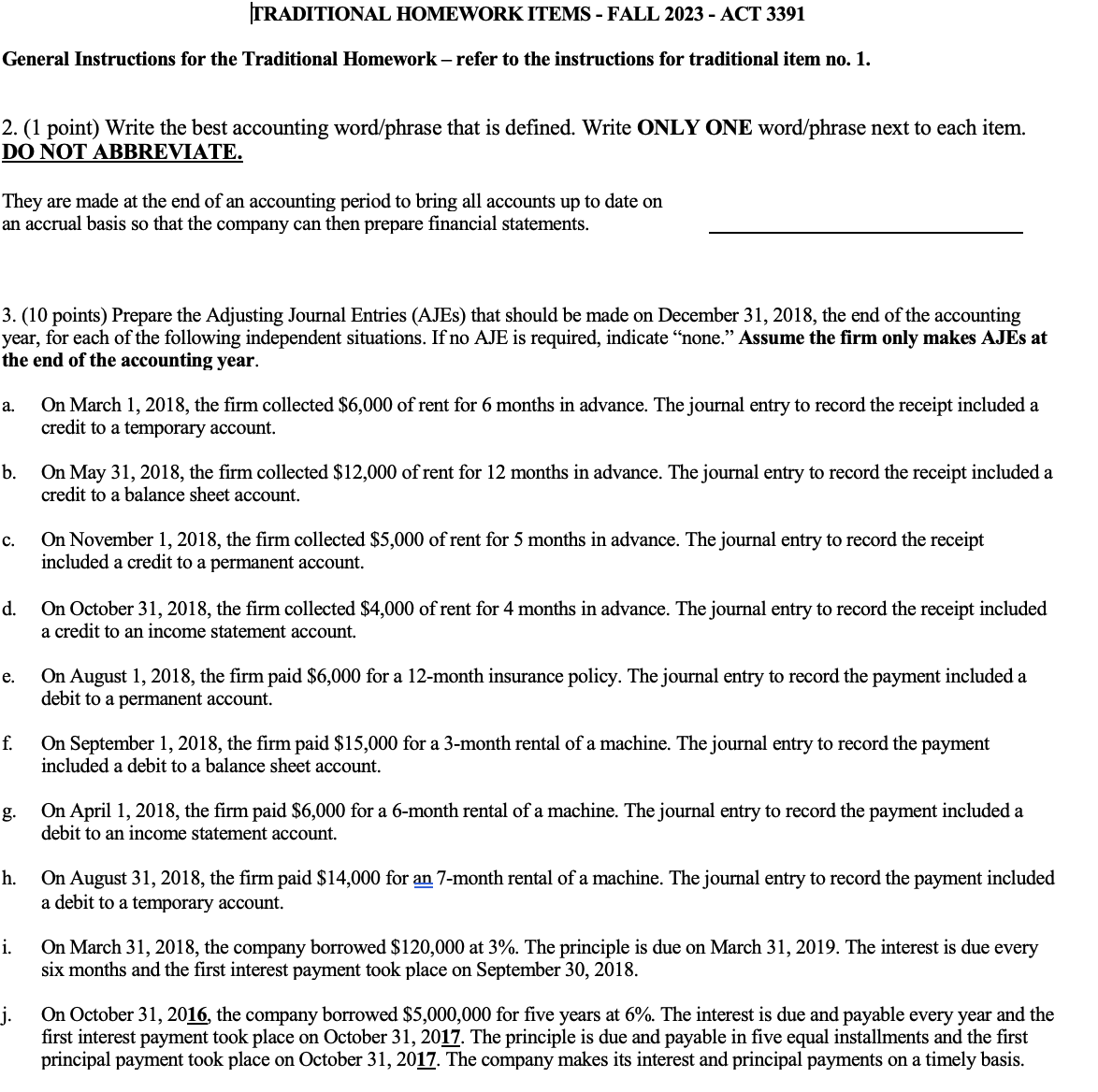

2. (1 point) Write the best accounting word/phrase that is defined. Write ONLY ONE word/phrase next to each item. DO NOT ABBREVIATE. They are made at the end of an accounting period to bring all accounts up to date on an accrual basis so that the company can then prepare financial statements. 3. (10 points) Prepare the Adjusting Journal Entries (AJEs) that should be made on December 31, 2018, the end of the accounting year, for each of the following independent situations. If no AJE is required, indicate "none." Assume the firm only makes AJEs at the end of the accounting year. a. On March 1, 2018, the firm collected $6,000 of rent for 6 months in advance. The journal entry to record the receipt included a credit to a temporary account. On May 31, 2018, the firm collected $12,000 of rent for 12 months in advance. The journal entry to record the receipt included a credit to a balance sheet account. c. On November 1,2018 , the firm collected $5,000 of rent for 5 months in advance. The journal entry to record the receipt included a credit to a permanent account. d. On October 31,2018 , the firm collected $4,000 of rent for 4 months in advance. The journal entry to record the receipt included a credit to an income statement account. e. On August 1, 2018, the firm paid $6,000 for a 12-month insurance policy. The journal entry to record the payment included a debit to a permanent account. On September 1, 2018, the firm paid $15,000 for a 3-month rental of a machine. The journal entry to record the payment included a debit to a balance sheet account. g. On April 1, 2018, the firm paid $6,000 for a 6-month rental of a machine. The journal entry to record the payment included a debit to an income statement account. On August 31, 2018, the firm paid $14,000 for an 7-month rental of a machine. The journal entry to record the payment included a debit to a temporary account. On March 31, 2018, the company borrowed $120,000 at 3\%. The principle is due on March 31, 2019. The interest is due every six months and the first interest payment took place on September 30, 2018. On October 31,2016 , the company borrowed $5,000,000 for five years at 6%. The interest is due and payable every year and the first interest payment took place on October 31,2017 . The principle is due and payable in five equal installments and the first principal payment took place on October 31,2017 . The company makes its interest and principal payments on a timely basis

2. (1 point) Write the best accounting word/phrase that is defined. Write ONLY ONE word/phrase next to each item. DO NOT ABBREVIATE. They are made at the end of an accounting period to bring all accounts up to date on an accrual basis so that the company can then prepare financial statements. 3. (10 points) Prepare the Adjusting Journal Entries (AJEs) that should be made on December 31, 2018, the end of the accounting year, for each of the following independent situations. If no AJE is required, indicate "none." Assume the firm only makes AJEs at the end of the accounting year. a. On March 1, 2018, the firm collected $6,000 of rent for 6 months in advance. The journal entry to record the receipt included a credit to a temporary account. On May 31, 2018, the firm collected $12,000 of rent for 12 months in advance. The journal entry to record the receipt included a credit to a balance sheet account. c. On November 1,2018 , the firm collected $5,000 of rent for 5 months in advance. The journal entry to record the receipt included a credit to a permanent account. d. On October 31,2018 , the firm collected $4,000 of rent for 4 months in advance. The journal entry to record the receipt included a credit to an income statement account. e. On August 1, 2018, the firm paid $6,000 for a 12-month insurance policy. The journal entry to record the payment included a debit to a permanent account. On September 1, 2018, the firm paid $15,000 for a 3-month rental of a machine. The journal entry to record the payment included a debit to a balance sheet account. g. On April 1, 2018, the firm paid $6,000 for a 6-month rental of a machine. The journal entry to record the payment included a debit to an income statement account. On August 31, 2018, the firm paid $14,000 for an 7-month rental of a machine. The journal entry to record the payment included a debit to a temporary account. On March 31, 2018, the company borrowed $120,000 at 3\%. The principle is due on March 31, 2019. The interest is due every six months and the first interest payment took place on September 30, 2018. On October 31,2016 , the company borrowed $5,000,000 for five years at 6%. The interest is due and payable every year and the first interest payment took place on October 31,2017 . The principle is due and payable in five equal installments and the first principal payment took place on October 31,2017 . The company makes its interest and principal payments on a timely basis Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started