Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show the formulas for excel. KExcel assignment 1: Valuation cases> Question 1: Your neighbor, Jane, approaches you with a proposal. She says, I'm planning to

Show the formulas for excel.

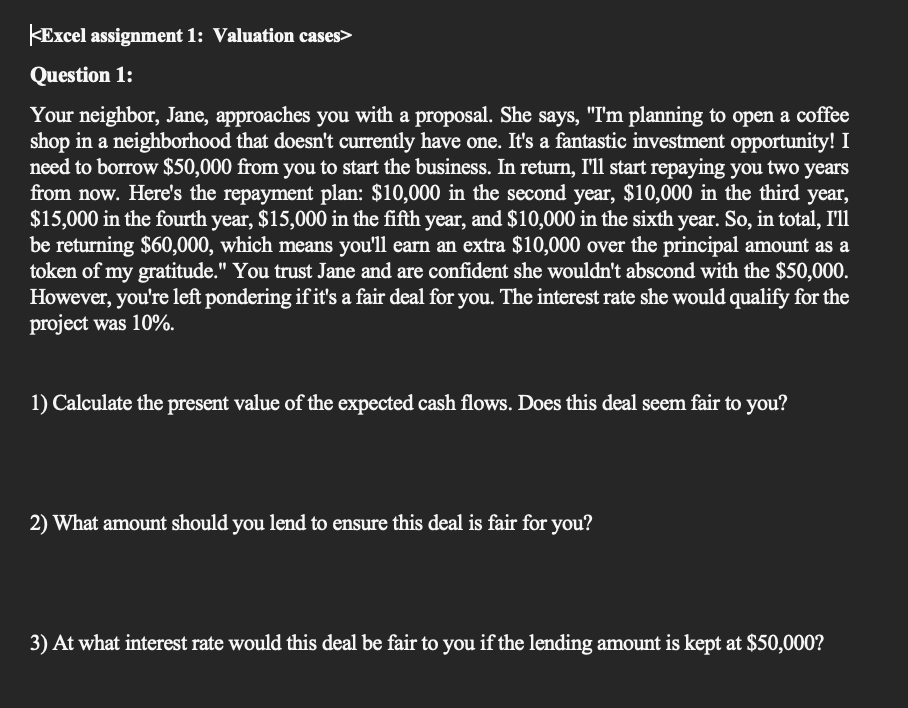

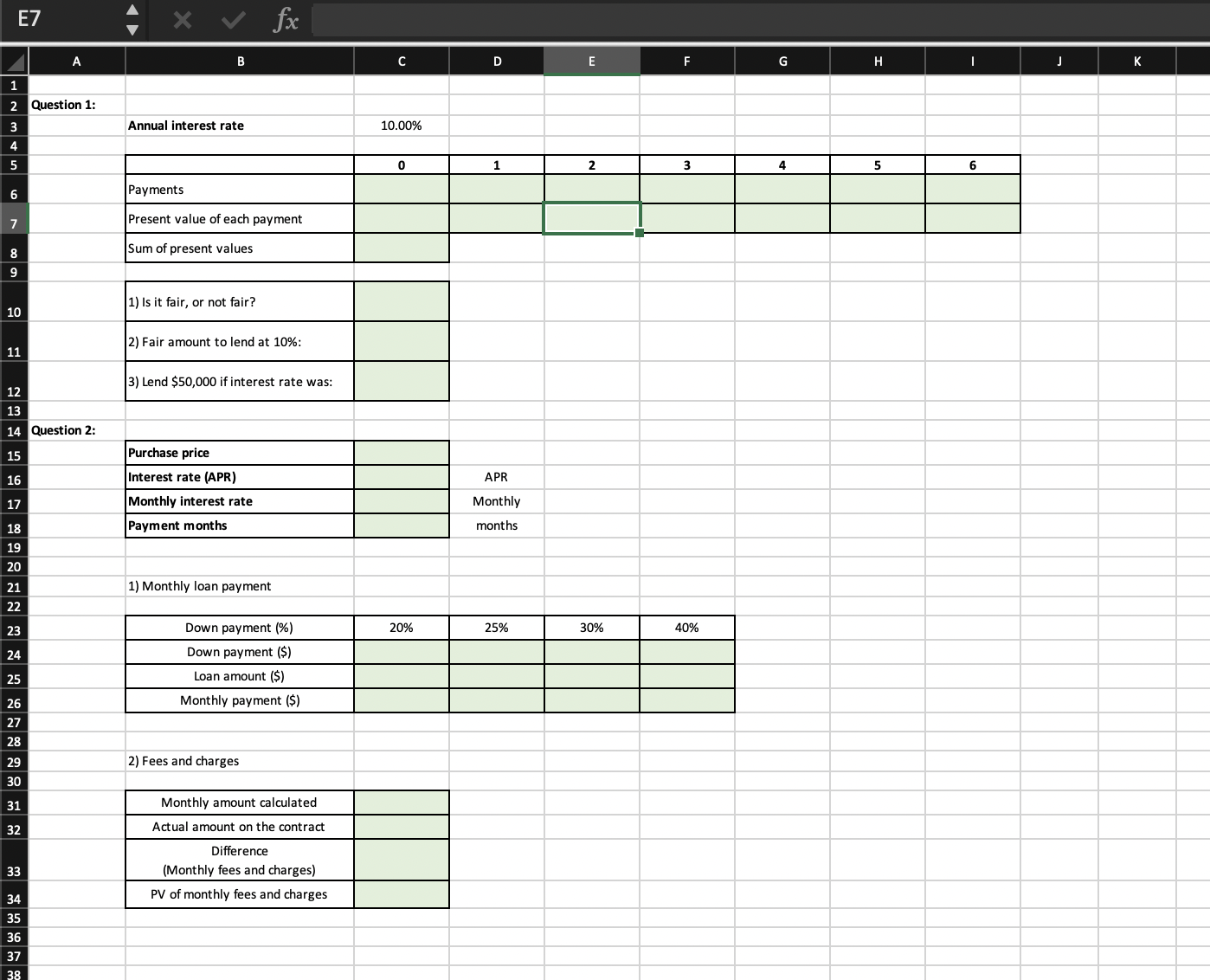

KExcel assignment 1: Valuation cases> Question 1: Your neighbor, Jane, approaches you with a proposal. She says, "I'm planning to open a coffee shop in a neighborhood that doesn't currently have one. It's a fantastic investment opportunity! I need to borrow $50,000 from you to start the business. In return, Ill start repaying you two years from now. Here's the repayment plan: $10,000 in the second year, $10,000 in the third year, $15,000 in the fourth year, $15,000 in the fifth year, and $10,000 in the sixth year. So, in total, I'll be returning $60,000, which means you'll earn an extra $10,000 over the principal amount as a token of my gratitude." You trust Jane and are confident she wouldn't abscond with the $50,000. However, you're left pondering if it's a fair deal for you. The interest rate she would qualify for the project was 10%. 1) Calculate the present value of the expected cash flows. Does this deal seem fair to you? 2) What amount should you lend to ensure this deal is fair for you? 3) At what interest rate would this deal be fair to you if the lending amount is kept at $50,000 ? E7 fx A 1 2 Question 1: 3 4 6 7 8 Sum of present values 9 10 11 12 13 14 Question 2: 15 16 17 18 Payment months 19 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 B Annual interest rate \begin{tabular}{|l|l|} \hline & 0 \\ \hline Payments & \\ \hline Present value of each payment & \\ \hline Sum of present values & \\ \hline 1) Is it fair, or not fair? & \\ \hline 2) Fair amount to lend at 10%: & \\ \hline 3) Lend \$50,000 if interest rate was: & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Purchase price & \\ \hline Interest rate (APR) & \\ \hline Monthly interest rate & \\ \hline Payment months & \\ \hline \end{tabular} 1) Monthly loan payment \begin{tabular}{|c|c|c|c|c|} \hline Down payment (\%) & 20% & 25% & 30% & 40% \\ \hline Down payment (\$) & & & & \\ \hline Loan amount (\$) & & & & \\ \hline Monthly payment (\$) & & & & \\ \hline \end{tabular} 2) Fees and charges \begin{tabular}{|c|c|} \hline Monthly amount calculated & \\ \hline Actual amount on the contract & \\ \hline Difference & \\ (Monthly fees and charges) & \\ \hline PV of monthly fees and charges & \\ \hline \end{tabular} D E 1 2 2 G 3 F H H 4 , I J K K APR Monthly months \begin{tabular}{|l|l|} \hline 5 & 6 \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline APR \\ \hline Monthly \\ \hline months \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} 3

KExcel assignment 1: Valuation cases> Question 1: Your neighbor, Jane, approaches you with a proposal. She says, "I'm planning to open a coffee shop in a neighborhood that doesn't currently have one. It's a fantastic investment opportunity! I need to borrow $50,000 from you to start the business. In return, Ill start repaying you two years from now. Here's the repayment plan: $10,000 in the second year, $10,000 in the third year, $15,000 in the fourth year, $15,000 in the fifth year, and $10,000 in the sixth year. So, in total, I'll be returning $60,000, which means you'll earn an extra $10,000 over the principal amount as a token of my gratitude." You trust Jane and are confident she wouldn't abscond with the $50,000. However, you're left pondering if it's a fair deal for you. The interest rate she would qualify for the project was 10%. 1) Calculate the present value of the expected cash flows. Does this deal seem fair to you? 2) What amount should you lend to ensure this deal is fair for you? 3) At what interest rate would this deal be fair to you if the lending amount is kept at $50,000 ? E7 fx A 1 2 Question 1: 3 4 6 7 8 Sum of present values 9 10 11 12 13 14 Question 2: 15 16 17 18 Payment months 19 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 B Annual interest rate \begin{tabular}{|l|l|} \hline & 0 \\ \hline Payments & \\ \hline Present value of each payment & \\ \hline Sum of present values & \\ \hline 1) Is it fair, or not fair? & \\ \hline 2) Fair amount to lend at 10%: & \\ \hline 3) Lend \$50,000 if interest rate was: & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Purchase price & \\ \hline Interest rate (APR) & \\ \hline Monthly interest rate & \\ \hline Payment months & \\ \hline \end{tabular} 1) Monthly loan payment \begin{tabular}{|c|c|c|c|c|} \hline Down payment (\%) & 20% & 25% & 30% & 40% \\ \hline Down payment (\$) & & & & \\ \hline Loan amount (\$) & & & & \\ \hline Monthly payment (\$) & & & & \\ \hline \end{tabular} 2) Fees and charges \begin{tabular}{|c|c|} \hline Monthly amount calculated & \\ \hline Actual amount on the contract & \\ \hline Difference & \\ (Monthly fees and charges) & \\ \hline PV of monthly fees and charges & \\ \hline \end{tabular} D E 1 2 2 G 3 F H H 4 , I J K K APR Monthly months \begin{tabular}{|l|l|} \hline 5 & 6 \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline APR \\ \hline Monthly \\ \hline months \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} 3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started