Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work and make sure it does not get cut off please! in previous answers i can only see half of the answer 11. Mike

show work and make sure it does not get cut off please! in previous answers i can only see half of the answer

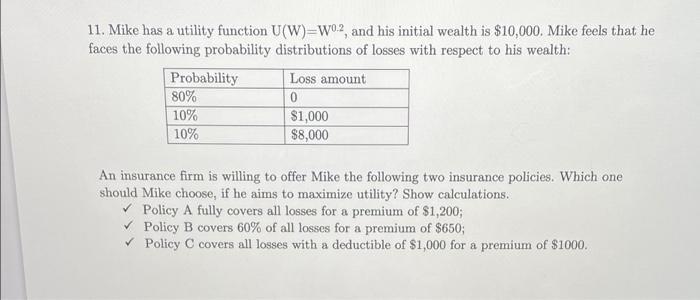

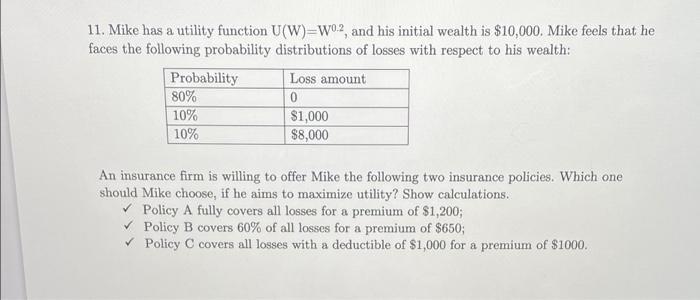

11. Mike has a utility function U(W)=W02, and his initial wealth is $10,000. Mike feels that he faces the following probability distributions of losses with respect to his wealth: Probability Loss amount 80% 0 10% $1,000 10% $8,000 An insurance firm is willing to offer Mike the following two insurance policies. Which one should Mike choose, if he aims to maximize utility? Show calculations. Policy A fully covers all losses for a premium of $1,200; Policy B covers 60% of all losses for a premium of $650; Policy C covers all losses with a deductible of $1,000 for a premium of $1000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started