show work i already know answer

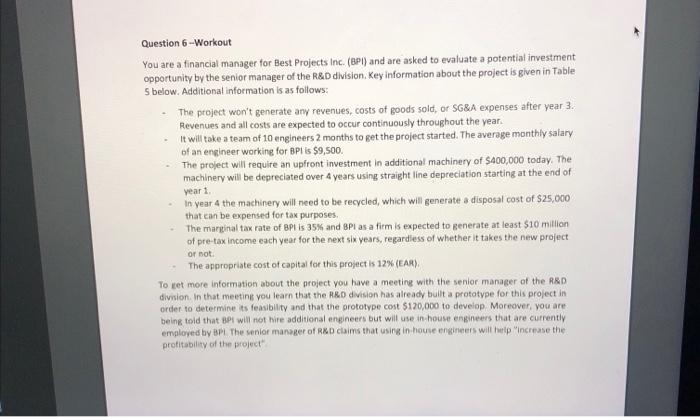

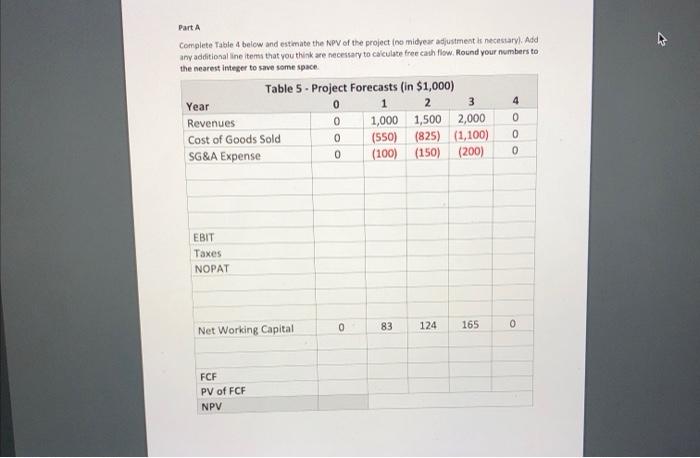

Question 6 -Workout You are a financial manager for Best Projects Inc. (BPI) and are asked to evaluate a potential investment opportunity by the senior manager of the R&D division Key information about the project is given in Table s below. Additional information is as follows: The project won't generate any revenues, costs of goods sold, or SG&A expenses after year 3. Revenues and all costs are expected to occur continuously throughout the year. It will take a team of 10 engineers 2 months to get the project started. The average monthly salary of an engineer working for BPI is $9,500. The project will require an upfront investment in additional machinery of $400,000 today. The machinery will be depreciated over 4 years using straight line depreciation starting at the end of year 1 In year 4 the machinery will need to be recycled, which will generate a disposal cost of $25,000 that can be expensed for tax purposes. The marginal tax rate of BPI is 35% and BPI as a firm is expected to generate at least $10 million of pre-tax income each year for the next six years, regardless of whether it takes the new project or not The appropriate cost of capital for this project is 12% (AR) To get more information about the project you have a meeting with the senior manager of the R&D division. In that meeting you learn that the R&D division has already built a prototype for this project in order to determine its feasibility and that the prototype cost $120,000 to develop Moreover, you are being told that BPI will not hire additional engineers but will use in house engineers that are currently employed by BP. The enor manager of R&D claims that using in-house engineers will help increase the profitability of the project his Part A Complete Table 4 below and estimate the NPV of the project ne midyear adjustment is necessary. Add any additional line items that you think are necessary to calculate free cash flow. Round your numbers to the nearest Integer to save some space Table 5 - Project Forecasts (in $1,000) Year 1 2 3 4 Revenues 1,000 1,500 2,000 0 Cost of Goods Sold (550) (825) (1,100) 0 SG&A Expense (100) (150) (200) 0 OOOO EBIT Taxes NOPAT 0 83 124 165 0 Net Working Capital FCF PV of FCF NPV