Answered step by step

Verified Expert Solution

Question

1 Approved Answer

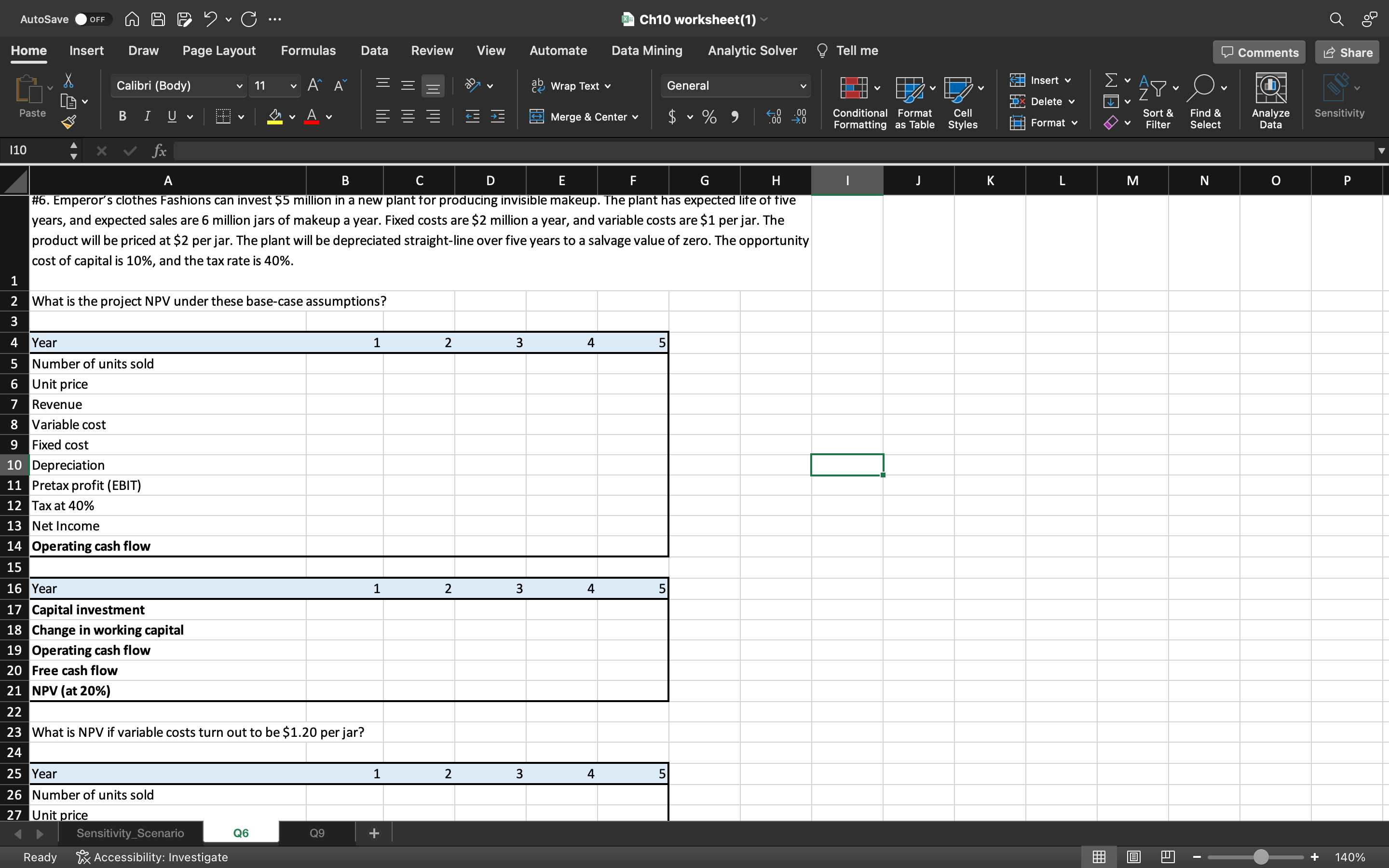

Show work in Excel What is NPV if variable costs turn out to be $1.20 per jar AutoSave Home Insert Draw Page Layout Calibri (Body)

Show work in Excel

AutoSave Home Insert Draw Page Layout Calibri (Body) v 11 Paste 110 Formulas Data Review View ChlO worksheet(l) Automate Data Mining Analytic Solver Q ab Wrap Text v Merge & Center v General Tell me Conditional Formatting Format as Table Cell Styles Insert v Delete v Format v Sort & Filter Find & Select Comments Analyze Data #6. Emperor's clothes Fashions can invest $5 million in a new plant tor producing invisible makeup. The plant has expected lite ot tive years, and expected sales are 6 million jars of makeup a year. Fixed costs are $2 million a year, and variable costs are $1 per jar. The product will be priced at $2 per jar. The plant will be depreciated straight-line over five years to a salvage value of zero. The opportunity cost of capital is 10%, and the tax rate is 40%. What is the project NPV under these base-case assumptions? Year Number of units sold Unit price Revenue Variable cost Fixed cost Depreciation Pretax profit (EBIT) 11 12 Tax at 13 Net Income Operating cash flow 15 16 Year Capital investment 17 Change in working capital 18 Operating cash flow Free cash flow NPV (at 20%) 21 22 What is NPV if variable costs turn out to be $1.20 per jar? 23 24 25 26 27 Year Number of units sold Unit rice Sensitivity_Scenario 06 Ready Accessibility: Investigate 09 1.4 Share Sensitivity 140%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started