Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work in excel with formulas 2. (13 pts.) A factory is considering replacing its existing coining press with a newer, more efficient one. The

show work in excel with formulas

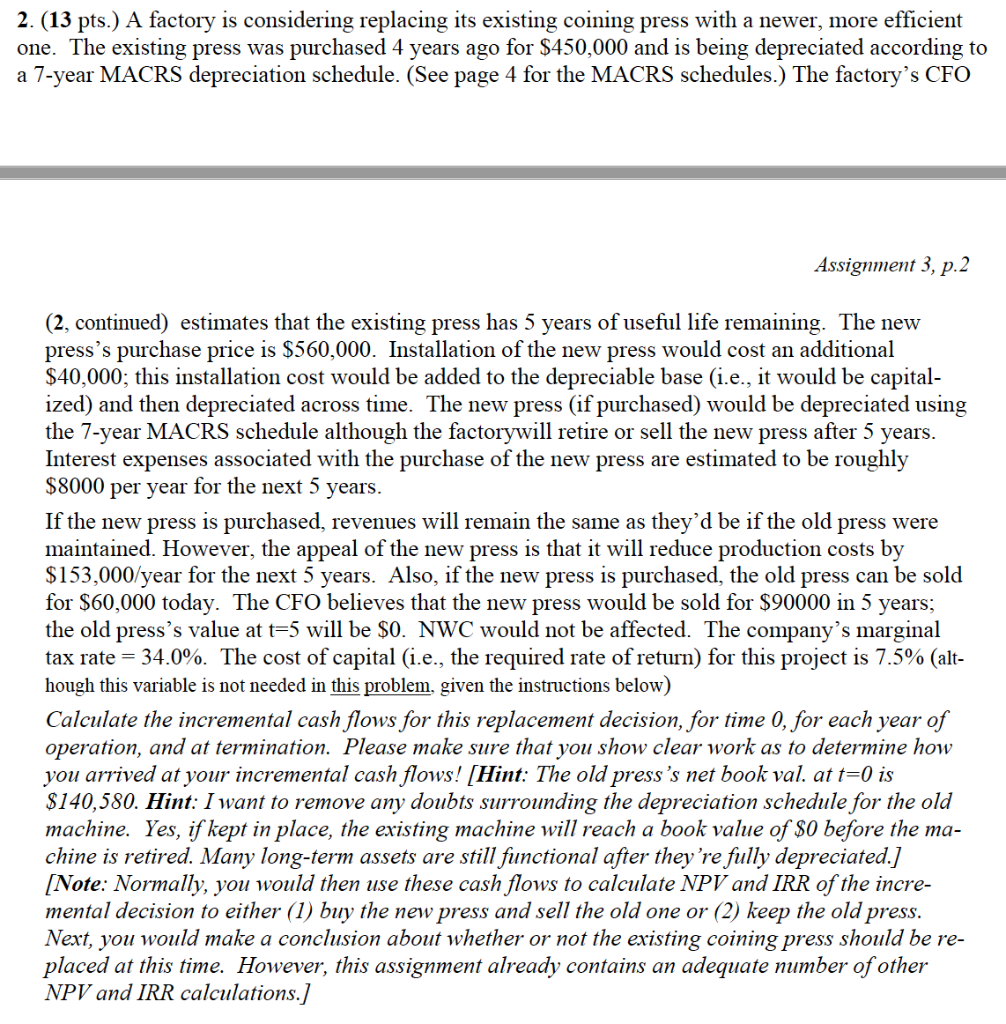

2. (13 pts.) A factory is considering replacing its existing coining press with a newer, more efficient one. The existing press was purchased 4 years ago for $450,000 and is being depreciated according to a 7-year MACRS depreciation schedule. (See page 4 for the MACRS schedules.) The factory's CFO Assignment 3, p.2 (2, continued) estimates that the existing press has 5 years of useful life remaining. The new press's purchase price is $560,000. Installation of the new press would cost an additional $40,000; this installation cost would be added to the depreciable base (i.e., it would be capital- ized) and then depreciated across time. The new press (if purchased) would be depreciated using the 7-year MACRS schedule although the factorywill retire or sell the new press after 5 years. Interest expenses associated with the purchase of the new press are estimated to be roughly $8000 per year for the next 5 years. If the new press is purchased, revenues will remain the same as they'd be if the old press were maintained. However, the appeal of the new press is that it will reduce production costs by $153,000/year for the next 5 years. Also, if the new press is purchased, the old press can be sold for $60,000 today. The CFO believes that the new press would be sold for $90000 in 5 years; the old press's value at t=5 will be $0. NWC would not be affected. The company's marginal tax rate = 34.0%. The cost of capital (i.e., the required rate of return) for this project is 7.5% (alt- hough this variable is not needed in this problem, given the instructions below) Calculate the incremental cash flows for this replacement decision, for time 0, for each year of operation, and at termination. Please make sure that you show clear work as to determine how you arrived at your incremental cash flows! (Hint: The old press's net book val. at t=0 is $140,580. Hint: I want to remove any doubts surrounding the depreciation schedule for the old machine. Yes, if kept in place, the existing machine will reach a book value of $0 before the ma- chine is retired. Many long-term assets are still functional after they're fully depreciated.] Note: Normally, you would then use these cash flows to calculate NPV and IRR of the incre- mental decision to either (1) buy the new press and sell the old one or (2) keep the old press. Next, you would make a conclusion about whether or not the existing coining press should be re- placed at this time. However, this assignment already contains an adequate number of other NPV and IRR calculations.]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started