SHOW WORK PLEASE

SHOW WORK PLEASE

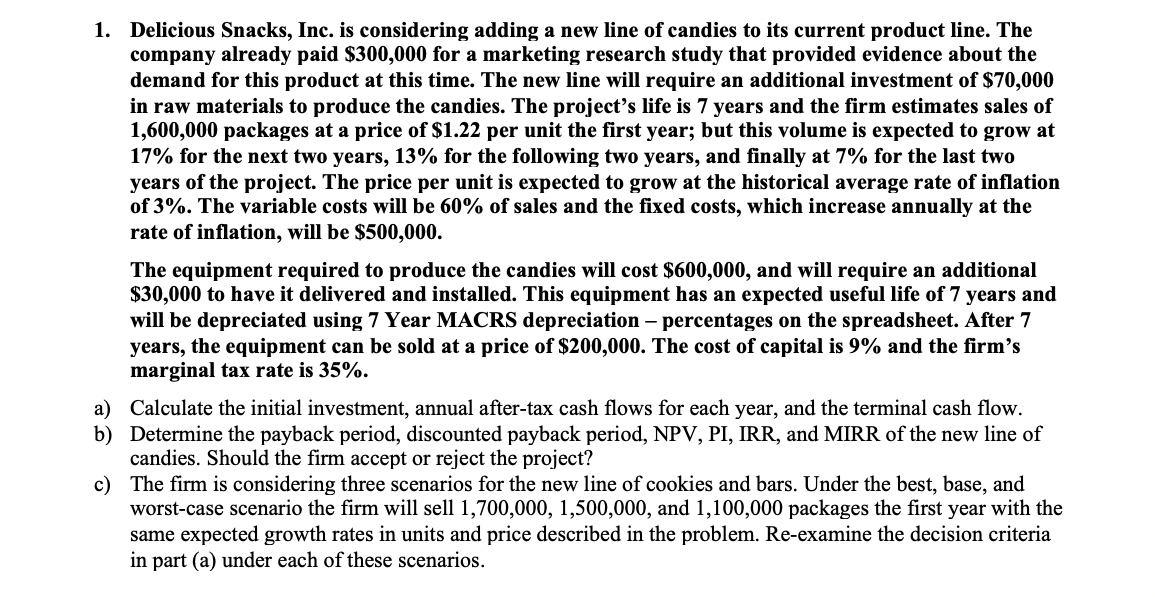

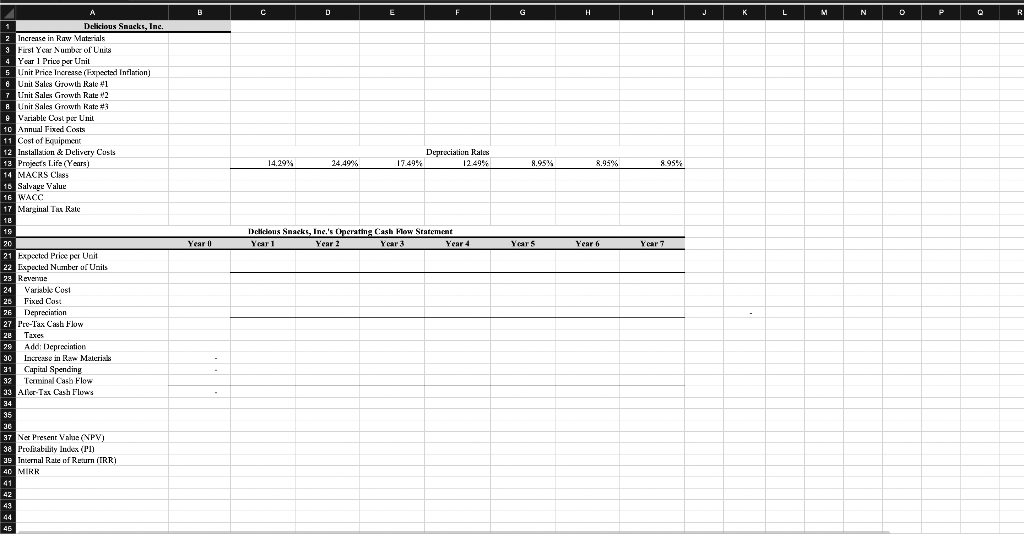

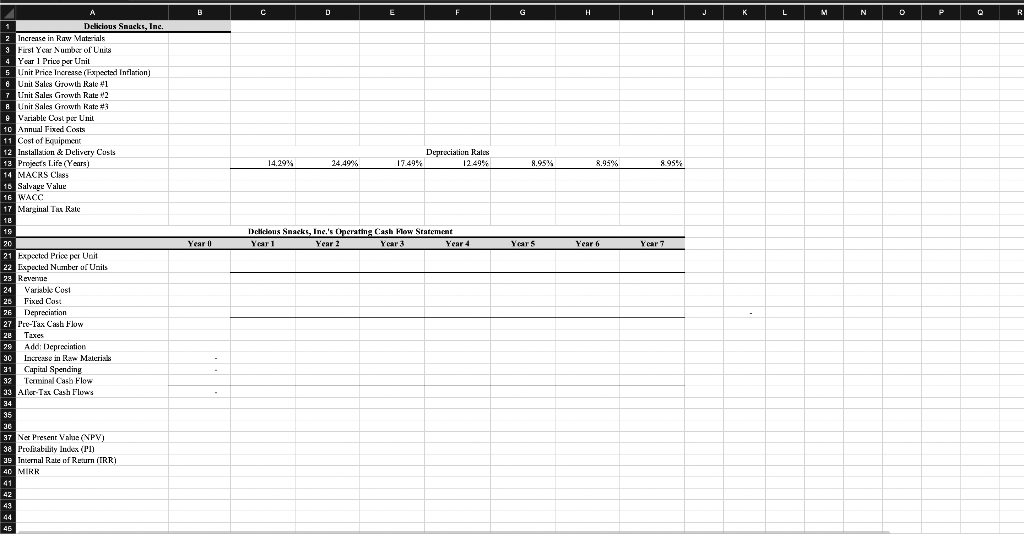

1. Delicious Snacks, Inc. is considering adding a new line of candies to its current product line. The company already paid $300,000 for a marketing research study that provided evidence about the demand for this product at this time. The new line will require an additional investment of $70,000 in raw materials to produce the candies. The project's life is 7 years and the firm estimates sales of 1,600,000 packages at a price of $1.22 per unit the first year; but this volume is expected to grow at 17% for the next two years, 13% for the following two years, and finally at 7% for the last two years of the project. The price per unit is expected to grow at the historical average rate of inflation of 3%. The variable costs will be 60% of sales and the fixed costs, which increase annually at the rate of inflation, will be $500,000. The equipment required to produce the candies will cost $600,000, and will require an additional $30,000 to have it delivered and installed. This equipment has an expected useful life of 7 years and will be depreciated using 7 Year MACRS depreciation - percentages on the spreadsheet. After 7 years, the equipment can be sold at a price of $200,000. The cost of capital is 9% and the firm's marginal tax rate is 35%. a) Calculate the initial investment, annual after-tax cash flows for each year, and the terminal cash flow. b) Determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR of the new line of candies. Should the firm accept or reject the project? c) The firm is considering three scenarios for the new line of cookies and bars. Under the best, base, and worst-case scenario the firm will sell 1,700,000, 1,500,000, and 1,100,000 packages the first year with the same expected growth rates in units and price described in the problem. Re-examine the decision criteria in part (a) under each of these scenarios. D H I L M N D R Depreciation Rules 17.49% 12.49% 14.29% 24.49% 8.95% 8.95% Delicious Snacks, Inc.'s Cperating Cash Flow Statement Year 1 Year 2 Year 3 Year 4 Years Year 6 Year Delicious Snacks, Inc. 2 Increase in Raw Materials 3 First Year Number of its Your 1 Price per Unit Unit Price Increase (Expected Inflation) 6 Unil Sales Growth Rale 1 7 Unit Sales Growth Rate 2 Unit Sales Growth Rate e Variable Cost pe Unit 10 Annual Fixed Costs 11 Cost of Equipment 12 Installation & Delivery Custs 13 Projects Life (Years 14 MACKS Chis 10 Salvave Value 16 WACC 17 Marginal Thu Rale 18 19 20 21 Expated Price per Uit 22 Expected Number of Unils 23 Revers 24 Variable Cost 20 Fixed Cost 26 Depreciation 27 Pro-Tax Casa Flow 2e Taxes 29 Add: Depreciation 30 laceras in Raw Materials 21 Capital Spending 32 Tamminal Cash Flow 33 All Tax Cash Flow's 34 35 36 37 Ner Present Vaha (NPV) 38 Profitability Index (PI) 39 Internal Rate of Return (IRR) 40 MIRR 41 42 43 44 45 1. Delicious Snacks, Inc. is considering adding a new line of candies to its current product line. The company already paid $300,000 for a marketing research study that provided evidence about the demand for this product at this time. The new line will require an additional investment of $70,000 in raw materials to produce the candies. The project's life is 7 years and the firm estimates sales of 1,600,000 packages at a price of $1.22 per unit the first year; but this volume is expected to grow at 17% for the next two years, 13% for the following two years, and finally at 7% for the last two years of the project. The price per unit is expected to grow at the historical average rate of inflation of 3%. The variable costs will be 60% of sales and the fixed costs, which increase annually at the rate of inflation, will be $500,000. The equipment required to produce the candies will cost $600,000, and will require an additional $30,000 to have it delivered and installed. This equipment has an expected useful life of 7 years and will be depreciated using 7 Year MACRS depreciation - percentages on the spreadsheet. After 7 years, the equipment can be sold at a price of $200,000. The cost of capital is 9% and the firm's marginal tax rate is 35%. a) Calculate the initial investment, annual after-tax cash flows for each year, and the terminal cash flow. b) Determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR of the new line of candies. Should the firm accept or reject the project? c) The firm is considering three scenarios for the new line of cookies and bars. Under the best, base, and worst-case scenario the firm will sell 1,700,000, 1,500,000, and 1,100,000 packages the first year with the same expected growth rates in units and price described in the problem. Re-examine the decision criteria in part (a) under each of these scenarios. D H I L M N D R Depreciation Rules 17.49% 12.49% 14.29% 24.49% 8.95% 8.95% Delicious Snacks, Inc.'s Cperating Cash Flow Statement Year 1 Year 2 Year 3 Year 4 Years Year 6 Year Delicious Snacks, Inc. 2 Increase in Raw Materials 3 First Year Number of its Your 1 Price per Unit Unit Price Increase (Expected Inflation) 6 Unil Sales Growth Rale 1 7 Unit Sales Growth Rate 2 Unit Sales Growth Rate e Variable Cost pe Unit 10 Annual Fixed Costs 11 Cost of Equipment 12 Installation & Delivery Custs 13 Projects Life (Years 14 MACKS Chis 10 Salvave Value 16 WACC 17 Marginal Thu Rale 18 19 20 21 Expated Price per Uit 22 Expected Number of Unils 23 Revers 24 Variable Cost 20 Fixed Cost 26 Depreciation 27 Pro-Tax Casa Flow 2e Taxes 29 Add: Depreciation 30 laceras in Raw Materials 21 Capital Spending 32 Tamminal Cash Flow 33 All Tax Cash Flow's 34 35 36 37 Ner Present Vaha (NPV) 38 Profitability Index (PI) 39 Internal Rate of Return (IRR) 40 MIRR 41 42 43 44 45

SHOW WORK PLEASE

SHOW WORK PLEASE