show work please

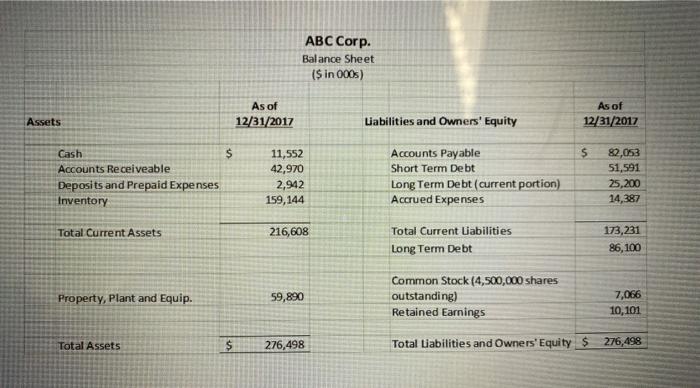

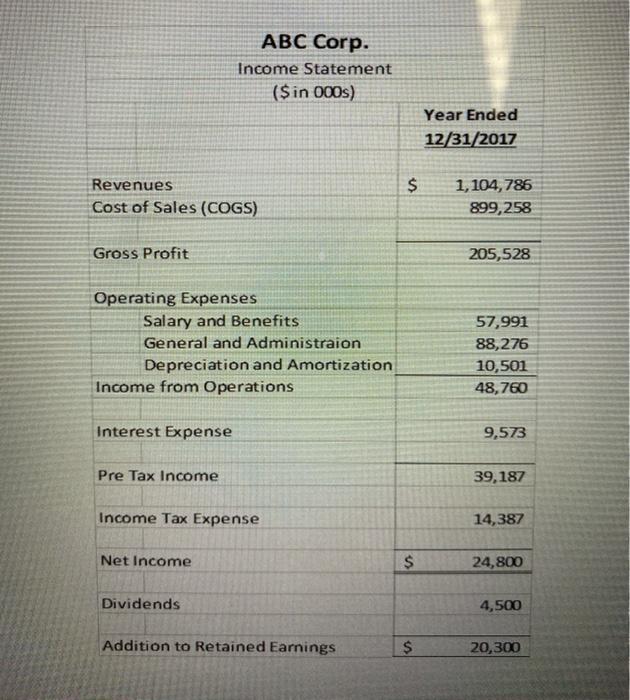

5. Calculate the Enterprise Value and EBITDA Ratios for ABC Corp. 6. What is the Earnings per Share (EPS) for ABC Corp.? Assuming the market price for ABC Corp. is $50/share what is the P/E ratio for ABC Corp.? (15 points) 7. What are the Debt-Equity and the Times Interest Earned ratios for ABC Corp.? Any observation or comment? 8. Companies Y and Z are both in the same industry and have no debt. Company Y has shown a return on assets (ROA) of 10% and pays out 10% of its earnings as dividends to shareholders. Company Z shows a ROA of 12% and pays out 50% of its earnings to shareholders as dividends. Assume that both companies continue to perform as they have in the past. Which company do you think has the ability to fund a higher growth rate with retained earnings? Why? ABC Corp. Balance Sheet ($ in 000) As of 12/31/2017 As of 12/31/2017 Assets Liabilities and Owners' Equity $ Cash $ Accounts Receiveable Deposits and Prepaid Expenses Inventory 11,552 42,970 2,942 159,144 Accounts Payable Short Term Debt Long Term Debt (current portion) Accrued Expenses 82,053 51,591 25,200 14,387 Total Current Assets 216,608 Total Current Liabilities Long Term Debt 173,231 86,100 Property, Plant and Equip. 59,890 Common Stock (4,500,000 shares outstanding) Retained Earnings 7,066 10,101 Total Assets $ 276,498 Total Liabilities and Owners' Equity $276,498 ABC Corp. Income Statement ($ in 000s) Year Ended 12/31/2017 $ Revenues Cost of Sales (COGS) 1,104,786 899,258 Gross Profit 205,528 Operating Expenses Salary and Benefits General and Administraion Depreciation and Amortization Income from Operations 57,991 88,276 10,501 48,760 Interest Expense 9,573 Pre Tax Income 39,187 Income Tax Expense 14,387 Net Income $ 24,800 Dividends 4,500 Addition to Retained Earnings $ 20,300 5. Calculate the Enterprise Value and EBITDA Ratios for ABC Corp. 6. What is the Earnings per Share (EPS) for ABC Corp.? Assuming the market price for ABC Corp. is $50/share what is the P/E ratio for ABC Corp.? (15 points) 7. What are the Debt-Equity and the Times Interest Earned ratios for ABC Corp.? Any observation or comment? 8. Companies Y and Z are both in the same industry and have no debt. Company Y has shown a return on assets (ROA) of 10% and pays out 10% of its earnings as dividends to shareholders. Company Z shows a ROA of 12% and pays out 50% of its earnings to shareholders as dividends. Assume that both companies continue to perform as they have in the past. Which company do you think has the ability to fund a higher growth rate with retained earnings? Why? ABC Corp. Balance Sheet ($ in 000) As of 12/31/2017 As of 12/31/2017 Assets Liabilities and Owners' Equity $ Cash $ Accounts Receiveable Deposits and Prepaid Expenses Inventory 11,552 42,970 2,942 159,144 Accounts Payable Short Term Debt Long Term Debt (current portion) Accrued Expenses 82,053 51,591 25,200 14,387 Total Current Assets 216,608 Total Current Liabilities Long Term Debt 173,231 86,100 Property, Plant and Equip. 59,890 Common Stock (4,500,000 shares outstanding) Retained Earnings 7,066 10,101 Total Assets $ 276,498 Total Liabilities and Owners' Equity $276,498 ABC Corp. Income Statement ($ in 000s) Year Ended 12/31/2017 $ Revenues Cost of Sales (COGS) 1,104,786 899,258 Gross Profit 205,528 Operating Expenses Salary and Benefits General and Administraion Depreciation and Amortization Income from Operations 57,991 88,276 10,501 48,760 Interest Expense 9,573 Pre Tax Income 39,187 Income Tax Expense 14,387 Net Income $ 24,800 Dividends 4,500 Addition to Retained Earnings $ 20,300